There’s been a lot of activity in the Australian property market as residents slowly adjust to life after the COVID-19 pandemic. With international and domestic borders reopening, we have been welcoming international students, visitors and residents back into the country, watching rents skyrocket and vacancy rates drop.

Read on for full insight into Australia’s property market activity.

Table of Contents

Apartment Rentals On The Rise

Currently, renting an apartment is one of the most popular choices for many residents, particularly international students entering the country and young Australians who want to save for a home of their own in the future.

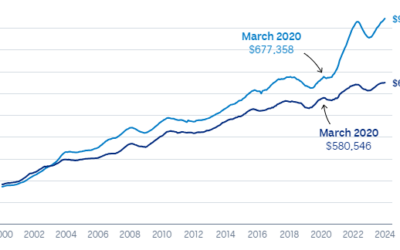

Rent values for apartments continue to rise above houses to an all-time high, with rents rising 9.5% over the 12 months to May. The rise is mostly propelled by low vacancy rates due to increased demand for rentals and a lack of property supply. With borders reopening and migrants returning from overseas, demand for rentals has spiked – leading to continued rent rises.

According to CoreLogic, the annual trend in unit rents (9.5%) outpaced growth in house rents (9.2%) for the first time since June 2018. Out of all capital cities, Sydney and Melbourne are experiencing the highest growth in rent, at 9.0% and 8.4%, respectively.

Source: CoreLogic

“Early in the pandemic rental demand for medium to high-density dwellings fell sharply due to a preference shift towards larger homes and a demand shock from closed international borders,” CoreLogic’s Research Director Tim Lawless said.

“As rental affordability pressures mount, demand for higher density rentals has steadily grown due to the unit sectors’ relative affordability advantage. More recently, demand has been boosted by international arrivals returning to the rental market.”

Record Low Vacancy Rates

Tenants are struggling to find rentals across the nation, with Australia’s vacancy rate rising fractionally to 1.1% after hitting its lowest level in 16 years! In April, the vacancy rate for Sydney was 1.6%, 1,9% in Melbourne and just 0.7% in Canberra.

“Vacancy rates are dropping like a stone in both Sydney and Melbourne and that’s driving rental growth,” ANZ senior economist Felicity Emmett said.

Another factor for this vacancy drop is the recent shortage of rental supply.

According to CoreLogic, the number of unit rental listings was -30.2 per cent lower than the previous five-year average in the four weeks ending May 29, tightening from -29.7 per cent lower in the four weeks ending May 1.

Rental Yields On The Rise

Since rental growth continues to outpace capital gains, rental yields are recording some upwards momentum, boosting higher returns for investors, especially in Sydney and Melbourne.

Sydney’s gross rental yields are up from a record low of 2.42% in December last year to 2.59%, while Melbourne’s yields have increased from a record low of 2.74% in December to 2.86%.

“Despite the upwards trajectory, yields remain remarkably low in both cities, but a recovery back to average levels may be relatively quick if housing values continue to fall while rents maintain this growth trajectory,” said Mr Lawless.

Moving forward, the rental market is expected to continue being tight.

“With strong demand, limited supply, properties are renting quickly and rental rates rising – and it looks unlikely that there is any significant relief on its way,” Cameron Kusher, director of economic research at PropTrack, realestate.com.au warned.

Indeed, with international borders reopened and migration expected to grow, particularly in the foreign student sector, rental supply is expected to tighten even further. This will almost certainly put more pressure on rental prices.

So if you are stressing over renting, we’re here to help. At St Trinity Property Group, we have a range of professionals who are happy to help you with your finance and kickstart your property journey.

Contact us below or call (02) 9099 3412 for more information and property insights.