The NSW Government, led by Premier Dominic Perrottet, has recently introduced a new scheme with the aim to reduce the deposit required for first home buyers and assist Sydney’s current affordability crisis.

Under this new scheme, first home buyers in NSW can now use a state government contribution for their home deposit (which is often 20% of the purchase price). In exchange, you will hand over a part of your properties equity to the government.

Table of Contents

THE NSW GOVERNMENT’S NEW “SHARED EQUITY” SCHEME

Put it simply, equity is the difference between the value of your home and how much you still have left to pay on your mortgage. And under the new proposed scheme, the NSW government would hold a share or proportional interest of your property.

When the property is sold or through repayments, this equity would then be repaid.

The scheme will include equity against a new or existing home, land in which a home buyer builds a home or equity against the home of a guarantor.

Parents of first home buyers may also transfer equity in their homes to the state government to assist their children in purchasing a new home.

In his speech ahead of voting in four NSW byelections, NSW Premier Dominic Perrottet said the NSW government had a responsibility to develop better ways to help young people enter the property market.

NSW Premier Dominic Perrottet. Picture: NCA NewsWire/Damian Shaw

“Increasingly younger generations think being able to buy their first home is unachievable, and for me, that’s unacceptable,” the Premier said,

“As a parent, I would happily sacrifice some equity in my home if I knew it would give my kids a foot in the door to our state’s property market.”

According to the Sydney Morning Herald, the final details of this new scheme are still being worked out, including whether there will be a cap on the amount that government will contribute or the price of the property or land.

The government is also considering increasing the stock of social, affordable and Aboriginal housing, as well as a program to transition low-income earners from renting to property ownership.

“By supporting industry, we can also enable them to increase housing supply, which will help unlock new ways of providing social and affordable housing, meaning more keys in doors for our state’s most vulnerable people,” Minister for Homes Anthony Roberts said.

The new plan is expected to be a key component of the premier’s commitment to addressing homeownership and affordability ahead of the 2023 state election in NSW.

SYDNEY’S CURRENT HOUSING MARKET

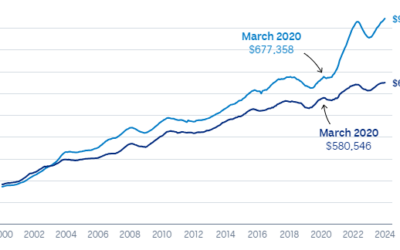

According to Domain latest House Price report, the median house price in Sydney in early 2022 is $1.6 million, with an annual growth rate of 33.1%.

At a slightly lower stage of growth, the median price for an apartment in Sydney is just over $800,000.

Dr Nicola Powell, Domain’s chief of research and economics, commented on the gap between the unit and housing affordability.

“We’ve seen record low-interest rates support buyer activity.” Said Dr Powell. “House prices in Sydney have grown four times faster than units, and this is something we’ve seen across most of our capital city markets,”

However, the good news for buyers is that the NSW market could finally be losing some of its relentless momentum.

An increase in housing stock across the city is likely to take the steam out of demand, and a potential interest rate hike could slow growth.

Now, It is expected that the NSW Government’s efforts through new “shared equity” schemes will make it easier for people to buy their own homes.

For first home buyers looking to purchase your first property, St Trinity Property Group is here to help. Get in touch with us on (02) 9099 3412 to find out more about getting into the Sydney property market, or take a look at the current projects available here.