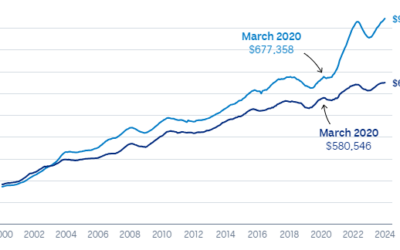

According to Domain’s latest report, house prices continue to surge in regional hot spots across NSW, with many entering the ‘million-dollar club’.

As more people continue to work from home, seek new lifestyles, and downsize, Domain’s Alice Stolz said that “regional house growth has gone bananas”, soaring by $500,000 in some popular coastal areas.

Table of Contents

The rise of the regional areas – The Million-dollar Club!

Over the year to March, most regional NSW areas jumped 20% in median house price.

The Southern Highlands, Ballina and Wollongong are some of the most recent regional hot spots to join the million-dollar club. The annual changes in price rise by around 30%.

Wollongong’s median house prices climbed $215,000 to a whopping $1.02 million – a 45.7% increase in the last 5 years.

These regions join the coastal town of Kiama, where prices climbed more than 45% over the year to a median of $1.6 million, high than Greater Sydney’s median of $1.59 million.

Source: Domain 2022 Q1 House Price Report

This price growth is fuelled by low supply and low-interest rates, as well as the ongoing demand from the sea- and tree-changers “who want an alternative life”, said Alice Stolz.

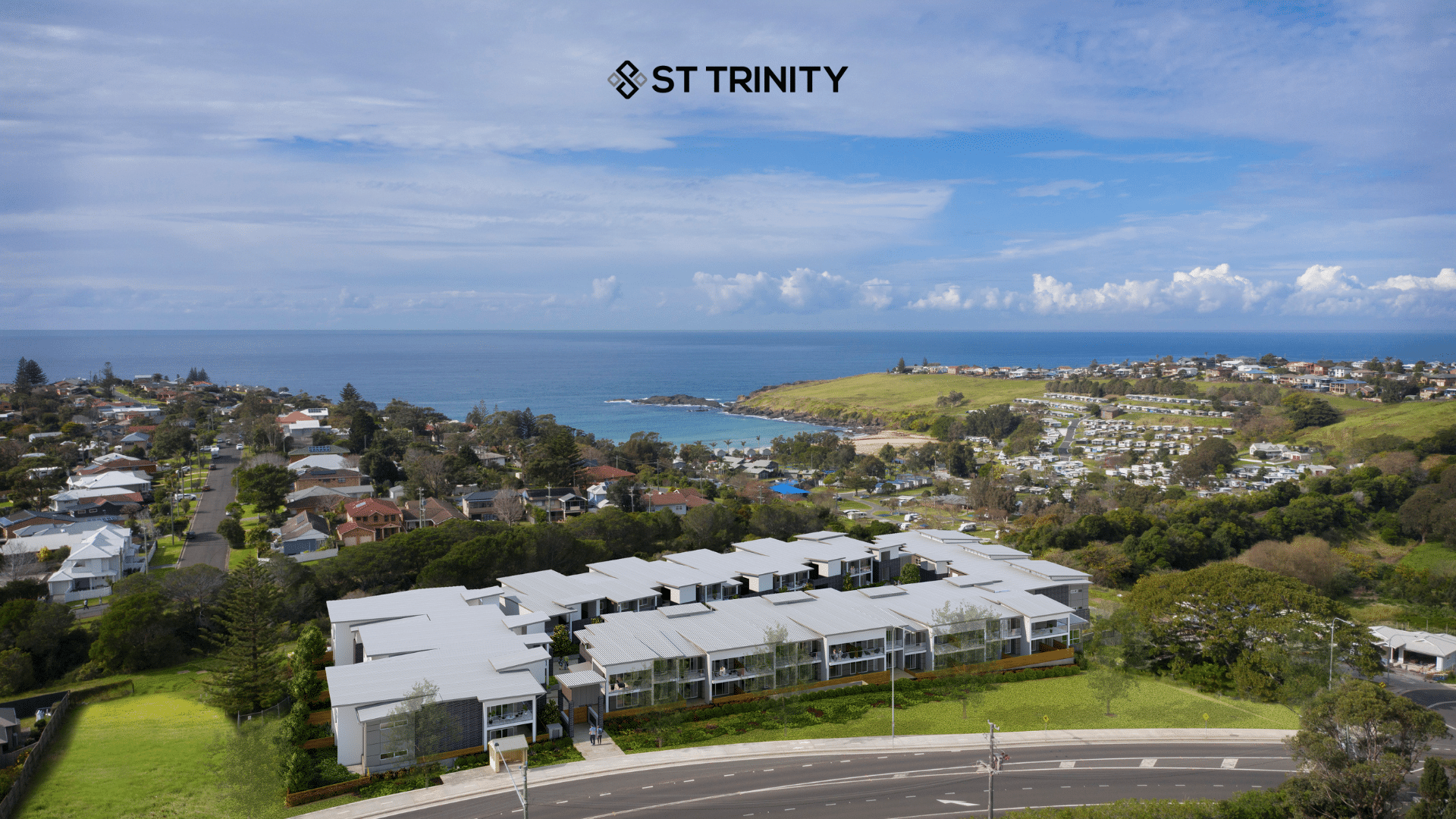

Image: Midtown Wollongong

CoreLogic’s latest Pain & Gain report also shows that regional Australia saw nominal gains for 94.0% of sales, compared with 93.7% of capital cities.

These areas also had a higher rate of profit than Australia’s combined capital at 94.0% versus 93.7%, respectively.

“Extraordinary” surge in Kiama’s property prices

Kiama was one of six regional council areas where median house prices increased by more than 40% year on year.

Just five years earlier, median prices in Kiama were only $825,000. Now, Kiama’s median price is sitting at $1.6 million, almost doubling with a 94% increase.

And despite more people returning to offices, we are still seeing strong demand from Sydneysiders due to the lifestyle this coastal town has to offer and its proximity to Sydney.

Source: Domain 2022 Q1 House Price Report

According to Dr Nicola Powell, during the pandemic, demand from sea and tree changers, as well as those looking for secondary homes, drove up prices and drove out local buyers in some areas.

“These rates of price growth are unsustainable long term and are particularly painful for local buyers who can’t compete with somebody with deeper pockets coming from Sydney,” Powell said.

She noted that such out-of-area demand was easing as more workers returned to CBD offices, resulting in a slowing of price growth in some markets.

However, she predicted that areas near cities and regional centres would continue to be popular among buyers.

Image: Dmitry Osipenko

A healthier property market

Some heat has come out of Kiama’s market in recent months, and there was a more even balance between the sellers and buyers.

“The craziness, where we had 40 or 50 groups at any open home, is over; now we might get a calmer 10 to 15 [groups], which is still extremely healthy,” according to a local real estate agent in Kiama.

Will Wehbe, Sales Director of St Trinity Property Group, said Kiama was “such a beautiful coastal town”.

“More and more people are wanting to escape the hustle and bustle of the cities,” he said.

“But we’re also seeing that the market is starting to open up a little bit, with more properties on the market, which is encouraging people to upsize and downsize.

“Interest rates are still low, and money is still cheap, so people are still willing to buy.”

Looking at 2022, Mr Wehbe said he believed the market in the Kiama area was going to “continue along this same path, and there’s definitely still a lot of confidence in the market.”

Is now the time to buy?

The rising interest rates are expected to impact the housing market, as lower borrowing power and higher mortgage repayments are putting weight on buyer demand – should you wait to buy?

We all know how quickly our market has sped up since June 2019. Every prediction at the time expected a massive drop with COVID-19 in 2020 and only a slight rise in 2021 – none of which really happened.

Property investment is always a long-term decision. Nobody knows what the future will look like, but residential property markets have increased in value from decade to decade.

So if you buy the right asset for you, finance it effectively and hold it for the long term, you are heading in the right direction.

Don’t know where to start? Contact us below to book an appointment with our investment strategy team!