Have you ever wondered how much wealth you are building through your property investment? Or exactly how much profit are you yielding relative to your investment?

Rental yield is the answer to all questions for property investors and a guide to getting a high return. Rental yield can help you estimate the worth and possibilities of a property, whether it’s residential or commercial.

Continue reading to see if your current investment property or an investment property you are interested in purchasing has a strong rental yield.

Table of Contents

What is rental yield?

Rental yield is the profit generated by your investment as a percentage of its value. Rental yield is used by investors to determine how much wealth they can create from their investments and to compare properties equally. A high rental yield equates to greater cash flow.

There are two forms of rental yields, gross yield and net yield. There are also 2 ways to calculate the rental yield based on these two forms. Gross yield is calculated through annual rental income and property value, whereas net yield is calculated by including all expenses involved.

What is gross rental yield?

Understanding gross rental yield helps you determine if there is cash flow potential in your property or if you should invest elsewhere. The equation for calculating gross rental yield is to divide the annual rental income of a property by the purchase price or the property value.

Gross rental yield = (Annual rental income/Property value) x 100

Let’s say, you receive $20,000 each year in rent, and the property is worth $500,000. Your gross rental yield is equal to ($20,000 / $500,000) X 100 = 4%.

As mentioned, calculating your gross rental yield is useful when determining if your money can be invested better elsewhere. From the example above, you might have invested in an apartment with a gross rental yield of 4% but because the property value has increased and the rent has not risen proportionately, your gross rental income can be a bit lower.

This figure provides insight into whether you should consider selling your property, attempting to raise your weekly rental income or purchasing another property with a higher gross rental yield so you have more cash flow.

Hence, the primary function is to draw comparisons between various properties to make the best choice for you.

What is net rental yield?

Net rental yield will provide you with the attributes of your property, the suburb, potential growth or the reasons for investing in an investment property. Moreover, a net rental yield figure will take into account additional costs such as fees, council rates, insurance, and other expenses related to property maintenance.

To calculate the net yield on your property, you will need to factor in your expenses for the property, which might include strata fees, maintenance fees and other legal fees. This will then provide you with a clearer understanding of the actual income return on your investment.

Net rental yield = [(Annual rental income – Annual expenses) / Total property cost] x 100

Let’s say, you receive $20,000 each year in rent. You pay $10,000 each year in property-related expenses, and the property is worth $500,000.

Your net rental yield is equal to (($20,000 – $10,000) / $500,000 ) X 100 = 2%

What is a good rental yield?

There is, in fact, no set ‘good rental yield’ percentage; it all depends on the unique characteristics of each property. In most cases, a higher rental yield equates to a bigger return, but this isn’t always the case.

High rental yields are preferable for investors since they produce a consistent cash flow. Generally speaking, investors should look for a property with a stable or growing rental yield.

Looking at median rental yields around the country might assist potential homeowners in figuring out what their interests and ideal results are.

What should you consider when thinking about rental yield?

Having a high property price doesn’t guarantee a high rental income, which can lead to a low rental yield, commonly known as negative gearing. Despite its name, negative gearing has a positive side. The primary advantage is that any losses you incur each fiscal year from your property can be used to reduce the income you earn, thereby lowering your taxable income and the amount of tax you owe.

Negative gearing is suitable for investors more interested in the long-term growth of property value than immediate cash income. However, if you’re aiming to supplement your regular income with rental earnings and positive cash flow, especially if you’re a retiree, properties with a high rental yield might be a more suitable choice.

Australia Property Rental Yield Performance

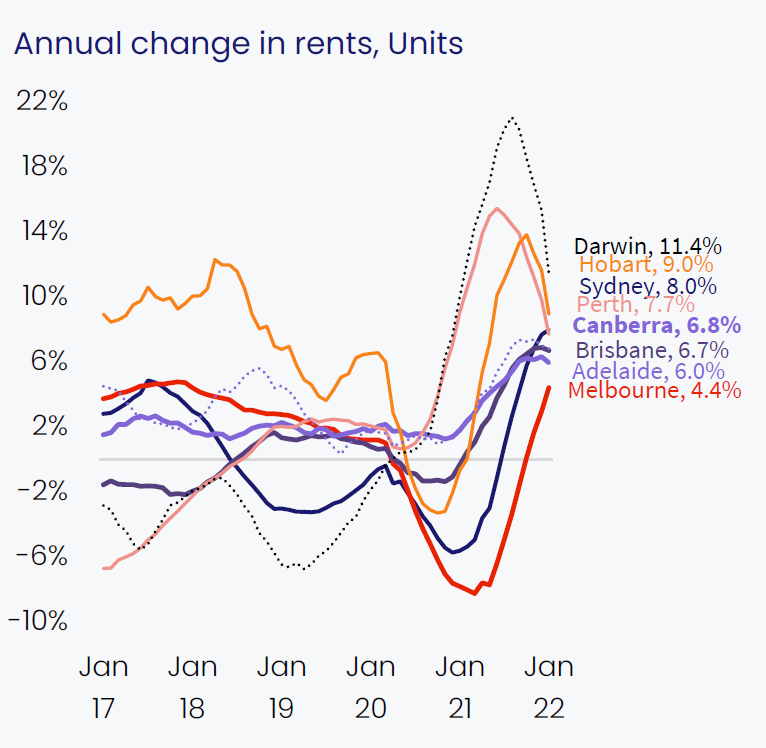

According to the latest CoreLogic Home Value Index, the quarterly pace of growth in Australian rents has been easing since moving through a peak of 3.2% in March last year.

Source: Gross rental yield across states – CoreLogic Home Value Index released 1 February 2022

There was a broad decrease in the annual rental growth in some states, most notable in Darwin, Perth and Hobart, with a more than 10% decrease in rent. On the other hand, the opposite rental trends are observed in other states, with Brisbane and Canberra now recording the fastest rise in rents, both up 2.3% over the three months ending January.

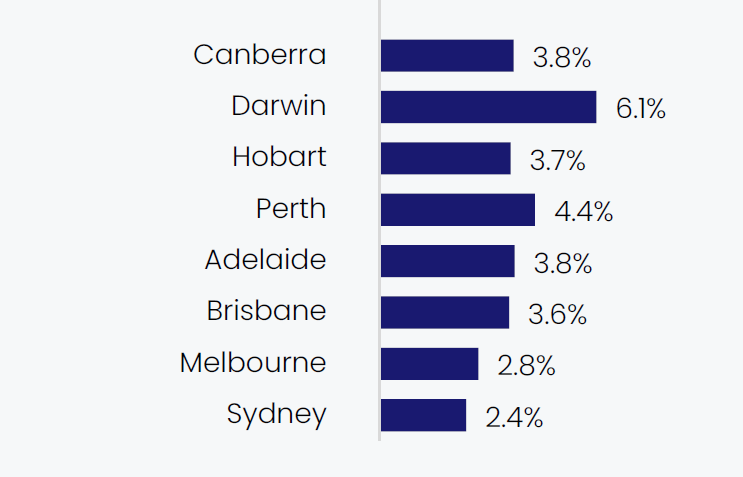

Although rents have been rising, property value has also risen at an above-average pace, pushing the rental yield in most cities to the lowest level on record. Sydney and Melbourne now remain as the only capitals where gross rental yields are lower than 3%.

Source: Gross rental yield across states – CoreLogic Home Value Index released 1 February 2022

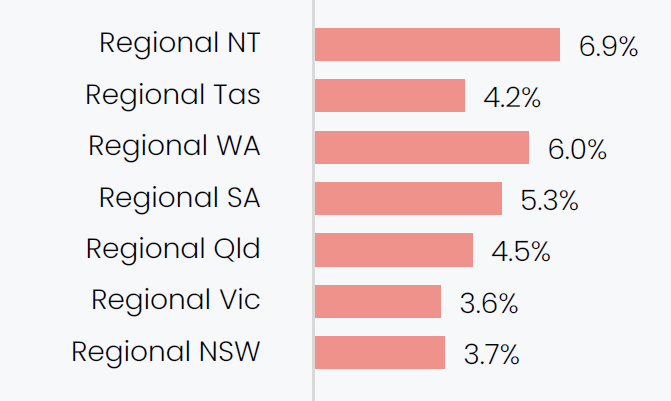

However, while the capital city trend slows, Australia’s regional markets remain high due to the increasing popularity of sea change and tree change trends.

Source: Gross rental yield across states – CoreLogic Home Value Index released 1 February 2022

Property markets with lifestyle characteristics such as Kiama and Wollongong in the Illawarra region, NSW are performing well, with both strong rental yields of 3.3% and 3.4%, respectively, according to the latest SQM Research figures and record high in growth rates.

St Trinity’s top-performing & above average rental yields

The key to locating high-yield rental properties is to look for suburbs with both low property prices and relatively high rental returns.

Here we list out our top suburbs with high rental yields from NSW and ACT (All figures are provided by SQM Research).

New South Wales – Sydney

- Fairfield, NSW 2165 – 4.3%

- Granville, NSW 2142 – 4.1%

- Villawood, NSW 2163 – 4.1%

- Arncliffe, NSW 2205 – 3.9%

- Wolli Creek, NSW 2205 – 5.61%

New South Wales – Regional

- Kiama, NSW 2533 – 3.3%

- Wollongong, NSW 2500 – 3.4%

All in all…

Gaining an understanding of what rental yield is and how it is calculated can help you determine potential profits and losses on a property you already own or on the one you’re looking to invest in.

Evaluating property values and their respective rental yields can be useful to invest your money wisely and dig your pockets deeper in return.

We at St Trinity work towards helping you find the right property to suit your needs and requests. Simply call us at 02 9099 3412 or contact us today by clicking on the button below!

*Disclaimer: All figures and statistics mentioned in this article are based on data available as of the time of writing. Real estate market conditions and financial data can change over time, so it’s advisable to verify the latest figures and consult with relevant professionals or authorities for the most current and accurate information when making financial decisions.