The Australian property market is experiencing a notable rebound in home values, recovering from a recent short-term decline. As highlighted in the April 2025 CoreLogic Home Value Index (HVI) report, national home values rose by 0.4% in March 2025, signalling a renewed strength in the Australian housing sector despite earlier softening.

Following a brief downturn, this upward movement may mark a critical turning point for both investors and homebuyers. With rental yields reaching their highest levels since 2019 and property values beginning to climb once again, this period could present strategic opportunities for those looking to enter the market or expand their existing portfolio.

In today’s competitive real estate landscape, understanding these trends is essential—whether you’re selling, investing, or purchasing your first home. After its meeting on 1 April 2025, the Reserve Bank of Australia (RBA) confirmed that the official cash rate would remain steady at 4.10%.

Table of Contents

Key Property Market Trends & Performance on March 2025

Making informed property investment choices requires a solid grasp of current market movements. Below is a summary of the key insights from CoreLogic’s March 2025 Home Value Index report:

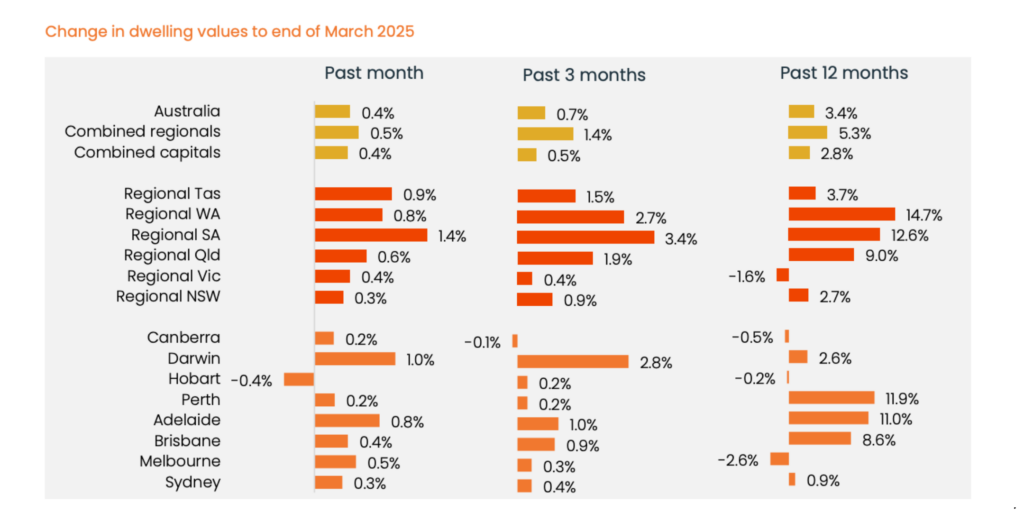

- Home values increased by 0.4%, signalling a rebound in demand and a recovery from the recent decline.

- While the performance gap is narrowing, regional housing markets (+0.5%) continued to outperform capital cities (+0.4%).

- This upward shift highlights a revival of confidence in the housing sector, supported by a stable economic backdrop. Even though the cash rate remains on hold, demand is expected to strengthen, as stability encourages investor confidence. The decision to maintain the current rate—even after a prior decrease—adds a sense of certainty for potential buyers.

- The rebound in values also reflects improved buyer sentiment, largely influenced by the cash rate reduction in February. The Reserve Bank of Australia’s choice to keep rates steady is likely to further support ongoing price growth, as a stable monetary environment promotes market consistency.

Capital City Performance in Australian Property Market 2025

- Sydney: Home values increased by 0.3% in March, factoring to a 0.4% rise over the quarter and an annual growth of 0.9%. The median dwelling value stands at $1,190,616 as of 31st March, 2025.

- Melbourne: Dwelling values saw a rise of 0.5% in March, with a 0.3% quarterly rise. However, the annual change remains negative at -2.6%, with the median dwelling value of $781,318.

- Brisbane: The city saw a rise of 0.4% in March, a 0.9% rise over the quarter, and a solid 8.6% annual growth, bringing the median dwelling value to $899,824.

- Adelaide: Second on the leader board, Adelaide recorded a 0.8% rise in March, and 1.0% quarterly increase, and an impressive 11.0% annual growth, with the median dwelling value of $827,675.

- Perth: Home values increased by 0.2% in March and quarterly, with a strong 11.9% annual growth, with a median value of $806,205.

- Hobart: The only capital to experience a decline during this shift, with home value seeing a downturn by 0.4% in March and 0.2% decline through the quarter. The annual change in the dwelling values stands at a -0.2% with a median value of $657,059.

- Darwin: The city recorded the highest growth amongst the capital regions with 1.0% increase in March and 2.8% quarterly rise. Its annual change stands at 2.6% bringing its median dwelling value to $519,287.

- Canberra: The home values saw an increase of 0.2% in March, and a slight quarterly downturn of -0.1% and an annual decrease of -0.5%, resulting in a median value of $854,398.

Source: CoreLogic

Regional vs Capital Cities

Regional markets have once again outpaced capital cities, with the combined regional index recording a 0.5% increase, compared to a 0.4% rise in the combined capital city index. However, the performance gap is gradually closing, as capital city markets begin to regain momentum. While regional affordability continues to appeal to buyers, the normalisation of post-pandemic migration trends will lead to stronger price growth in major metropolitan areas moving forward.

Source: CoreLogic

Profound Opportunity for Investors because of Stronger Rental Yields

- National rent values hit record highs, rising 0.6% in March. One of the key contributors to this has been the migration trends. As more and more people move to Australia, the demand and supply of properties is at an impasse causing increases in rent and dwelling values.

- Increase in rental yields: Gross rental yields of combined capitals now stands at 3.53%, the highest level since 2019, making rental properties increasingly attractive for investors.

- Slower rental growth: The pace of the rental growth is slower compared to that of 2020-2021 which was 9.7%, with the current annual rental growth over the past 12 months standing at 3.8%

With the vacancy rates at historical lows, the property owners are garnering huge profits from their rental properties. With increasing rental yields, the current market is highly favorable for property investors.

Source: CoreLogic

Read More: How to Effectively Evaluate House and Land Packages: Building Your Future, One Decision at a Time

Factors Influencing Market Growth

A combination of economic changes and policy adjustments is currently driving shifts in property trends and overall market sentiment:

Monetary Policy Easing: The recent improvement in buyer confidence can largely be attributed to the February cash rate cut, which has contributed to a recovery in home values. This, coupled with slightly improved borrowing capacity and mortgage serviceability, has offered buyers more flexibility.

Cost of Living & Income Growth: Rising disposable income levels are likely boosting confidence among buyers—particularly in affordable market segments. As household purchasing power improves, more people are able to take steps toward home ownership.

Changing Market Sentiment: A noticeable renewed interest from both investors and first-home buyers is influencing demand levels—particularly in growth-driven urban centres where property prices are beginning to climb once again.

Potential Challenges Ahead in the Australian Property Market

Although the overall outlook for the market appears positive, several headwinds could temper future price growth:

Affordability Pressures: As dwelling values continue to recover, affordability remains a significant concern. Rising property prices can lead to higher mortgage repayments and borrowing costs, making home ownership less accessible for many Australians. While government schemes and first-home buyer support programs help ease the burden to some degree, the affordability crisis is likely to persist, especially across the capital city markets.

Slower Population Growth: Population growth has historically been a key driver of housing demand and value appreciation. However, with migration rates stabilising post-COVID and growing economic uncertainties impacting relocation decisions, housing demand may cool compared to recent years. This could place downward pressure on rental demand and moderate the pace of price gains, particularly in some capital cities.

Restrictive Lending Policies: Despite steady interest rates—and the possibility of a cut later in the year—the lending environment remains cautious. Banks continue to enforce strict lending criteria, which can hinder access to credit, especially for investors. The Australian Prudential Regulation Authority (APRA) remains vigilant in its supervision of lending standards, and its actions may limit future borrowing capacity and place a ceiling on property demand.

Why This Matters for Buyers & Investors

For buyers, the current market conditions present a timely opportunity to act before further price escalations. The recent uptick in home values signals renewed market confidence, and with potential interest rate cuts on the horizon, borrowing may become more affordable in the coming months.

First-home buyers may find it advantageous to enter the market now, as ongoing price growth could make housing less affordable in the near future. Regional areas still offer better value for money compared to metropolitan markets, making them attractive for those seeking more space and lifestyle appeal without the high price tags.

For investors, the combination of record-high rental yields and strong rental demand—particularly across capital cities—makes this an opportune time to invest. With tight rental supply and historically low vacancy rates, investors are well-positioned to benefit from rising rents and consistent returns. Those looking to grow their property portfolios should consider emerging growth corridors and suburbs slated for infrastructure upgrades. Ultimately, staying informed about these trends will allow both buyers and investors to leverage current market dynamics to their advantage.

The Australian property market finds itself at a pivotal moment, with home values rebounding and rental yields reaching multi-year highs. While affordability remains a pressing concern, the anticipated cash rate reductions could offer some relief to investors by enhancing borrowing capacity. Although the Reserve Bank of Australia maintained the cash rate at 4.10% during the 1st April 2025 meeting, the next review set for 20th May 2025 may bring potential changes.

Regardless of whether you’re a buyer, investor, or seller, staying informed and up to date with current data and market shifts is vital to making the right decisions at the right time.

At St Trinity, we’re committed to providing you with the expert guidance and personalised support you need to thrive in today’s dynamic market. Whether you’re hunting for prime investment properties or simply navigating your next move, our team is here to support you every step of the way.

Book a call with St Trinity today and let’s take the next step in your property journey—together.