NSW Stamp duty is one of the most significant upfront fees when purchasing a home and is always a top-of-the-list question for property buyers, specifically first-home buyers.

Table of Contents

WHAT IS STAMP DUTY?

Stamp duty, or commonly referred to as land “transfer duty”, represents a single tax payment made when acquiring property in New South Wales. This levy is calculated based on the property’s market value and follows a progressive scale that escalates with the property’s worth.

Sometimes, NSW stamp duty can “slip under the radar” for new investors or those buying interstate, according to real estate experts, and become a nasty surprise when it’s time to pay. So acknowledging this tax and budgeting for it will save you a lot of stress when it comes time to purchase your next property.

The rates of stamp duty may vary between state and property types and are affected by a number of factors. These include:

- If it is your primary residence or an investment property

- If it is an existing property, newly constructed or vacant land

- If you are a first-home buyer

Your NSW stamp duty is used to support a variety of state-funded public services, including education, health, roads, transportation, and emergency services.

HOW MUCH IS NSW STAMP DUTY GOING TO COST ME?

In NSW, the amount of NSW stamp duty is calculated based on the property’s sale price or its current market value, whichever is higher. The more expensive the property, the higher the NSW stamp duty you will need to pay. Each year the threshold amounts for standard transfer duty and premium duty rates are adjusted in accordance with the Consumer Price Index (CPI).

For off-the-plan purchases, the NSW stamp duty is often calculated based on the value of the land and the building at the date when contracts are signed, and the deposit is paid. As a result, if you buy a property that is still under construction, you may pay a lot less in NSW stamp duty than when you buy an established home.

The good news is there are NSW Stamp Duty calculators online to get an estimate on the fees you’ll be required to pay.

WHEN AM I EXPECTED TO PAY STAMP DUTY?

According to the NSW Government, stamp duty must be paid within three months of signing a contract for sale or transfer. Another advantage for off-the-plan purchasers is if you intend to live in the property, you may be able to postpone your transfer duty obligation for up to a year.

If payment is made after the due date (i.e. 3 months after the liability date), interest and penalty tax may be imposed, and interest will accrue.

ARE THERE ANY STAMP DUTY CONCESSIONS?

Stamp duty exemptions are offered by state governments when the property is transferred between family members or after a death or divorce.

As part of the First Home Buyers Assistance Scheme from 1 August 2020, NSW first home buyers purchasing newly built, off-the-plan properties or vacant land continue to get a complete exemption under the following circumstances:

- New homes valued up to $800,000*

- Established property valued up to $650,000*

- Vacant land worth up to $400,000*

For existing homes valued between $800,000 and $1,000,000*, partial stamp duty concessions are available for first-home buyers.

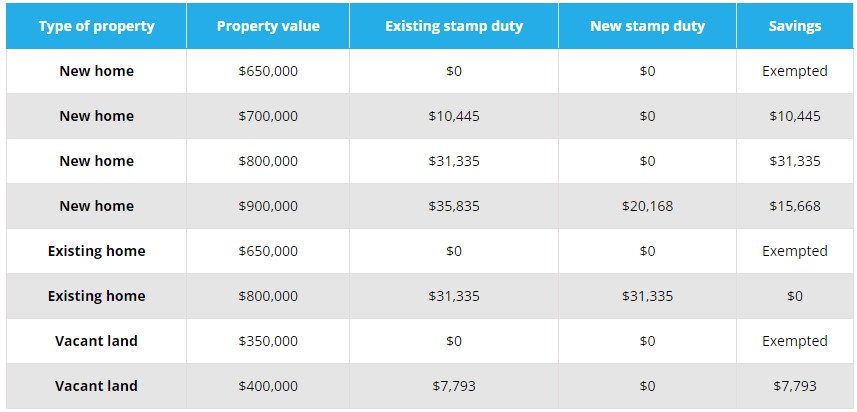

NSW Premier, Gladys Berejiklian, has indicated that this boost to stamp duty exemptions and concessions will last until around August 2021. And the following table shows the amount of savings you will get if you purchase new and off-the-plan properties.

Source: Home Loan Experts

HOW DO I PAY STAMP DUTY?

The NSW State government accepts payment online via credit/debit card, bank transfer and also payment via cheque.

To sum up, stamp duty is considered as part of funds to complete for all property purchasers. Therefore, if you are thinking about entering the property market, don’t forget to factor stamp duty into your budget. As soon as you work out how much needs to be paid from the offset, it will financially save you from a lump sum liability.

To find out more about the latest concessions and eligibility criteria, speak with St Trinity Property Group about your next property purchase by enquiring below.

Source: Realestate.com.au

Note: This information is as of July 2023 and is subject to change in the future.