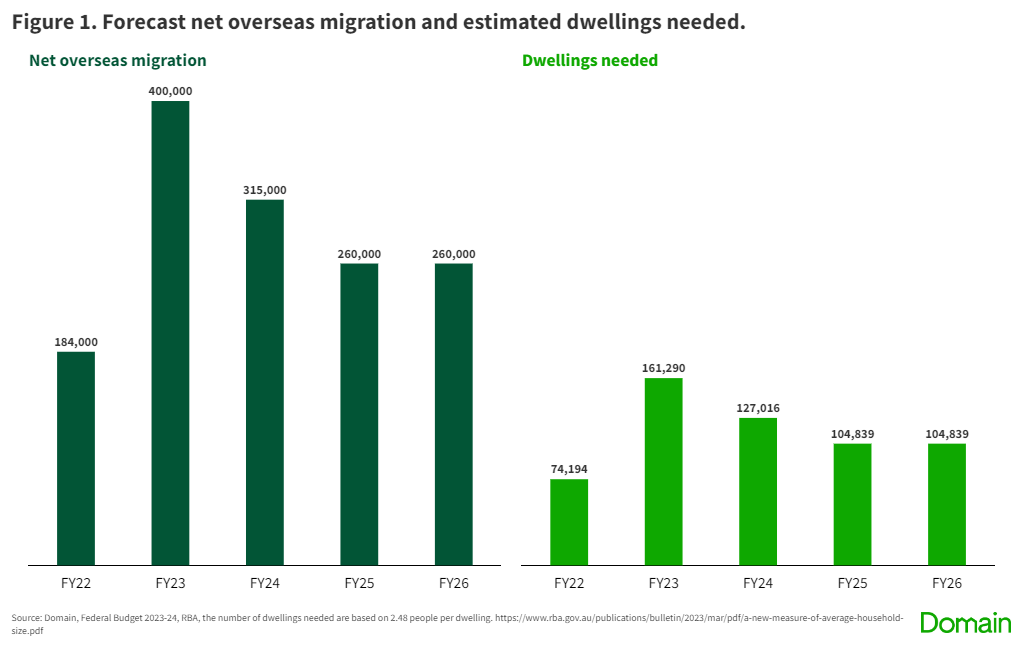

Australia is experiencing rapid population growth, as evident from the recent budget papers, which projected an influx of more than 1.2 million migrants in the next four years. To accommodate this expected surge, approximately half a million new homes need to be built by 2025-26, according to Domain. While this population boom brings notable challenges, it also offers a promising opportunity for investors and current renters who want to escape the rental crisis. Let’s delve into how you can capitalise on this situation.

Table of Contents

High Demand

Budget papers reveal that the projected net overseas migration in Australia is expected to reach 400,000 by the end of this year, surpassing the previous record of 316,000 in 2018. To make this easier to illustrate, the Australian Bureau of Statistics (ABS) population clock reveals that the country adds one person to its population every 47 seconds. Property Council of Australia Chief Executive Mike Zorbas said the budget papers showed the strength of migration but also the extent of the housing supply crisis in Australia, with dwelling investment levels predicted to drop significantly.

“Skilled migrants have been central to Australia’s economic success story for generations, filling critical job vacancies in important sectors, and making valuable contributions both economically and socially,” he said. “The population growth outlined in this budget highlights the need for faster and better housing delivery and planning across our cities.”

Based on the estimation of population growth, Australia is faced with the task of constructing an additional 497,984 homes in the next four years (until 2025-26) to accommodate the expected arrival of 1,235,000 net overseas migrants. Therefore, keeping up with this substantial population growth has become a growing challenge for Australia.

Source: Domain

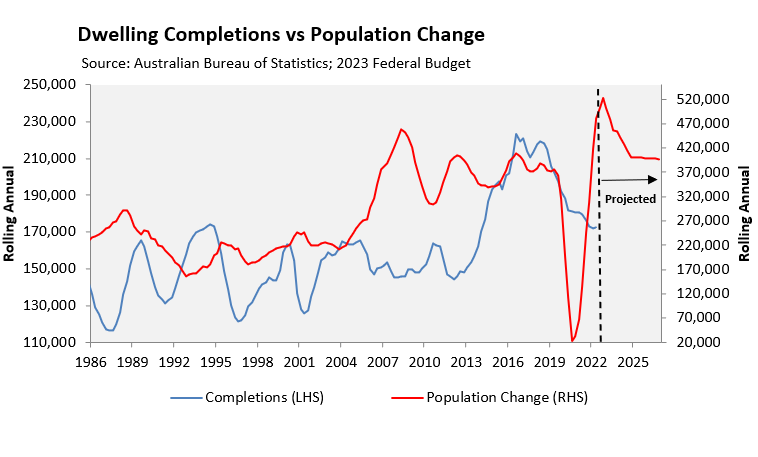

Low Supply

During a recent Senate Estimates hearing, the Treasury Secretary revealed that building approvals will continue declining until 2025. Investments in new homes are projected to decrease by 2.5% this year, followed by declines of 3.5% in 2023-24 and 1.5% in 2024-25.

Source: Macrobusiness

These numbers indicate a worrying trend and point to a challenging environment for the construction industry. It becomes clear that there’s a significant gap between the demand for housing and the available supply.

“The concerning thing is that record-low approvals right now only really show the full extent of the problem about 3 years from now, given the lag between approvals and completions,” Urban Development Institute of Australia national president Max Shifman described the decline as “particularly worrying” amid a housing and rental crisis. “This will only lead to one thing – continued growth in rental prices.

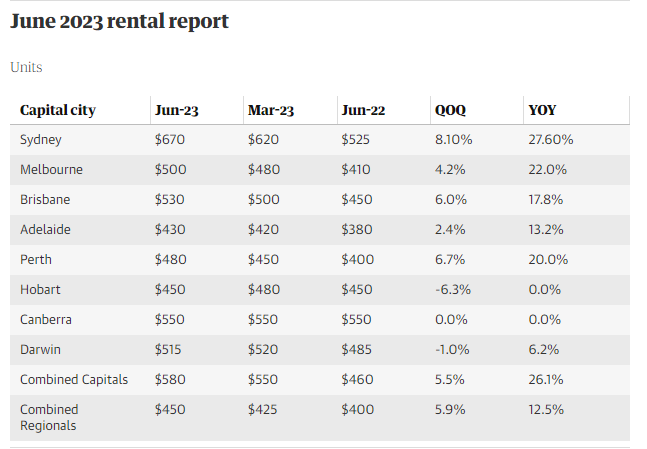

Rental Crisis and the Rise of Unit

With construction levels declining and the population growing at an unprecedented rate, the supply and demand issue in Australia is predicted to deteriorate. This could result in a challenging situation for renters who may face difficulties in securing housing.

The latest report from PropTrack reveals that advertised rents have risen by 2% in the June quarter, reaching a median price of $520 per week. This represents an 11.8% increase compared to June last year, when the median price was $465 weekly.

It is no surprise that New South Wales (NSW), particularly Sydney, is the most expensive location for renting a property due to its notorious high home prices. In Sydney, renters expect to pay a median price of $620 per week, reflecting a 13.8% increase over the past year.

Although housing rental increases have been relatively moderate compared to units, Sydney still leads the way regarding rental price growth in the past quarter. Median house rents in Sydney reached $700 in the April-June period, a 6.1% increase from the previous three months and a 12.9% increase compared to a year ago.

On the other hand, apartments are only slightly cheaper, with a median weekly rent of $595 after a staggering 19% increase over the past 12 months.

Domain’s data shows that rents continued to rise across Australia, particularly in major cities, with Sydney having higher median unit rents than the median house rents in all other state capitals. In the past year, the median weekly rent in Sydney has grown by 27.6%, reaching $670.

Source: The median weekly rent in Sydney has grown 27.6% to $670 in the past year. (The Guardian)

Kaytlin Ezzy, an economist at property data firm CoreLogic, said Australians have been increasingly turning to units amid sky-rocketing rents.

“Units are the affordable option for many; new migrants, students, service workers and many other tenant types,” Ezzy said. “But the increase in demand and low availability is forcing rents increasingly higher and causing the affordability gap between houses and units close rapidly.”

Units continue to experience a record-long period of increasing rents, marking the eighth consecutive quarter of growth and resulting in the fastest quarterly and annual rise ever recorded. Unit rental growth has surpassed the increase in house rents since mid-2022, narrowing the price difference between these two property types to a three-year low. Moreover, this sustained upward trend in unit rents has also contributed to gross rental yields reaching a nine-year high. This presents an exceptional opportunity for investors seeking to capitalise on the rental market.

How do investors and first-home buyers benefit from this?

For Savvy Investors

The booming migration and rental market in Australia presents several benefits for property investors.

- The influx of migrants contributes to increased demand for rental properties, leading to a rise in rental prices and potential rental income. This can result in higher rental yields and improved cash flow for investors.

- The continuous growth in the rental market provides a favourable environment for property investors to secure long-term tenancies and minimises periods of property vacancy.

- The narrowing price difference between units and houses in the rental market creates opportunities for investors to diversify their portfolios. With unit rental growth outpacing house rental growth, investors can consider investing in units that may offer relatively more affordable entry points and higher potential for rental returns.

For First Home Buyers

It is crucial for those currently in the rental market to consider the upsides of transitioning to home ownership. By taking advantage of opportunities available in the property market, such as affordable housing initiatives and favourable financing options, individuals can embark on the journey towards homeownership.

“Typically, overseas migrants rent on arrival, but, with a tight rental market Australia-wide, we may see some arrivals transition to home ownership sooner as they seek more stable housing alternatives” Domain notes in its report.

The Government has recently extended several schemes to help first-time home buyers make their homeownership dream come true:

- First Home Buyer Assistance Scheme: Eligible buyers can apply for exemption or concession on transfer duty charges, providing financial relief.

- First Home Owner’s Grant: a $10,000 grant when FHB purchase their first home, including houses, townhouses, or apartments off the plan.

- Shared Equity Home Buyer Helper: Eligible home buyers can purchase their own home with a deposit as low as 2%, making homeownership more accessible.

These schemes aim to support individuals in their journey towards homeownership by offering financial incentives and assistance. There are several schemes that you may be eligible to apply for. You can explore more here.

Is now a good time to buy?

Overall, the combination of booming migration and a thriving rental market in Australia can provide property investors with increased rental demand, higher rental yields, reduced vacancy rates, and opportunities for portfolio diversification. For First Home Buyer, this is also a good chance to escape the rental rush, start home ownership and potentially invest in the long-term financial future. For many first time buyers, leaving the rental market may seem like a huge hurdle that may feel impossible. Alex, one of our clients, felt the stress of being in the rental market but took the right steps, with the right team on his side, to get out of the rental market and work towards building up his own property portfolio.

“Once you get in, and you’ve settled, the property market just seems to open up to you. As soon you got a foot in the door, you got it” – Alex

At St Trinity, we understand the importance of homeownership and its journey. Our dedicated team is here to support and guide you every step of the way, just as we did for Alex. With our unwavering commitment, we strive to help you achieve your dream of becoming a property owner. Contact our St Trinity team at (02) 9099 3412 today and let us help you embark on your path to homeownership.