Over the past year, a distinct pattern of supply and demand has begun to emerge within the property market. With the population experiencing a sharp increase from the return of migration after COVID, the supply of properties available is no longer able to keep up with the demand for housing in Australia.

Like other assets such as stocks and bonds, the prices of properties depend heavily on the concept of supply and demand. For example, if there is a large group of people interested in purchasing properties in a certain area, house prices in the suburb tend to rise due to the competition of buyers driving the prices up. On the other hand, if there are numerous available properties in a suburb and not much demand for them, the prices of the properties tend to fall.

But how exactly does this supply shortage in the market affect you?

Table of Contents

Increasing demand from population growth

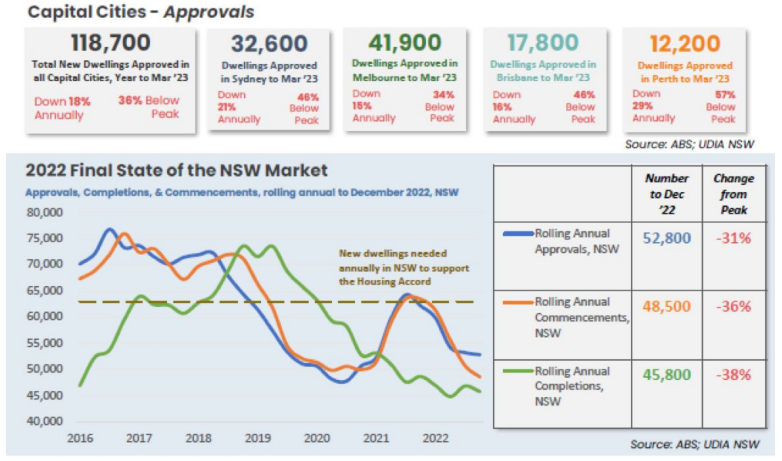

According to the National Housing Finance and Investment Corporation (NHFIC), net additions of apartments and medium-density dwellings such as townhouses until 2027 are projected to be around 40% less than the levels seen in the late 2010s. The report also suggests that the lack of supply caused by these lowered levels will cause a 79,300 home deficit across Australia. For Sydney, the Property Council of Australia predicts that the city will face a shortfall of over 10,000 homes by 2027, which could mean tight competition for the property market in Sydney.

Property Council Chief Executive Mike Zorbas expressed his concern regarding this growing housing shortage.

“We need to urgently move the housing needle by creating the right investment conditions for new build-to-rent housing, purpose-built student accommodation and retirement living communities.”

“We need this for our existing population and to continue to attract the skilled migrants and students who support our education sector and bridge the huge gaps in our mining, construction, agricultural and retail workforces nationally,” he said.

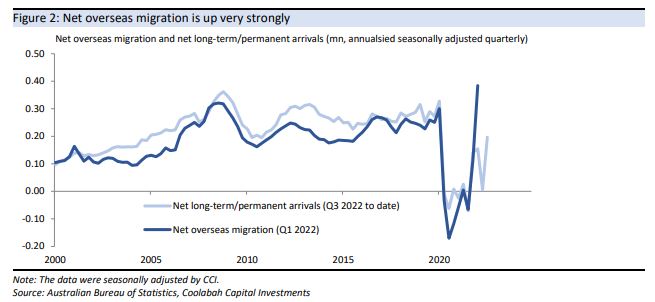

Source: The Australian Bureau of Statistics

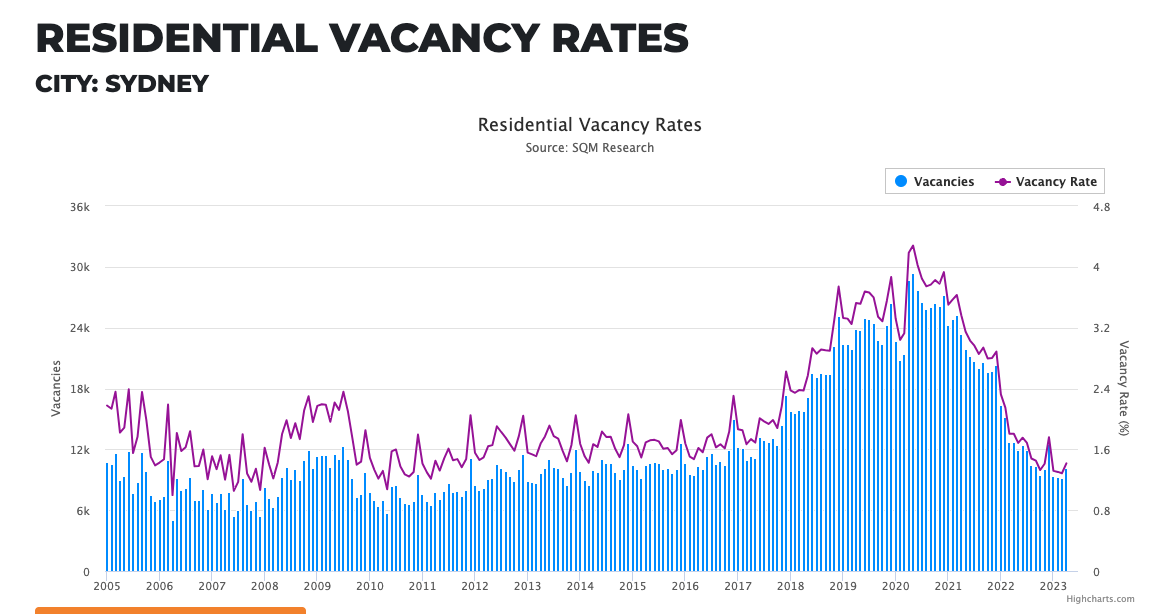

Over the 2021-22 financial year, 170,900 migrants settled in Australia. This is a 50.3% increase from the 2020-21 financial year, which reflects the resumption of international travel and migration as COVID restrictions were eased in late 2021. Sydney alone has taken in 36% of these new migrants, with most of whom are looking to rent a property. And with a rental vacancy rate of just 1.4% in Sydney (according to SQM Research data), it’s quite clear that rental prices will continue to rapidly increase because the limited rental properties cannot keep up with this population boom, making it even more difficult for renters to find affordable places to live.

Reduced building approvals

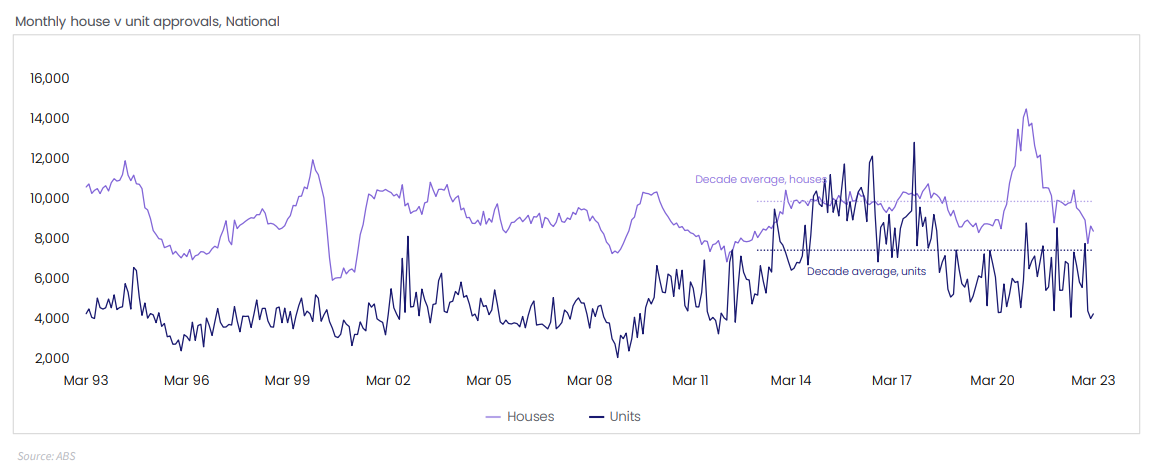

Source: CoreLogic

Additionally, only 48,900 total new dwellings were approved in NSW in the past financial year, according to data from the Urban Development Institute of Australia. This means residential building approvals were down by 18% annually. Sydney in particular had only 32,600 dwellings approved, which is 21% lower than last year.

Australian Bureau of Statistics (ABS) Head of Construction Statistics Daniel Rossi said that dwelling approvals have continued their downward trend since September 2022 following the conclusion of government stimulus and rising interest rates.

Source: The Urban Development Institute of Australia

Residential building approvals depend on numerous factors that vary with the state of the economy including interest rates, availability of mortgage funds, government spending, and business investment. The current residential building approval figures reflect how the construction industry in Australia is still struggling from COVID fallout, which leads to a severe shortage of housing market supply.

Shortage effects

Source: SQM Research

To put it simply, a supply shortage in the property market looks like this: a sharp increase in property prices due to a limited supply of available properties, rental vacancy rates significantly dropping because of the increased population, and skyrocketing rental prices to reflect this competitive market. Data from CoreLogic’s national Home Value Index suggests that the price of Sydney properties are currently 3% higher than the prices recorded in January. According to SQM Research, rental vacancy rates have dropped by 0.4% since December 2022, and the average weekly rent for a unit has increased by $67 in the same timeframe.

As established, the demand for rental properties far exceeds the supply of homes available for tenants, meaning that market competition pushing prices up will make it more challenging for households to find affordable housing. As demand increases, this will only get worse.

Furthermore, successive interest rate hikes would contribute to the rising rental prices, because investors need to pass on the cost of rising interest rates to their tenants. A combination of interest rate increases, increased rental property demand from a larger population and the low supply of rental properties is what’s making rental prices increase further – to the point where purchasing a property in some areas of Sydney could even be a cheaper option than renting.

What’s the positive among this?

There is one upside to the housing crisis, and it’s that it presents a fantastic opportunity for investors to invest in real estate. Because of increased demand and low housing supply, the property market continues to remain extremely competitive.

PropTrack director of economic research and report author Cameron Kusher predicts that the demand for rental properties will continue to rise — and so will rental prices.

“Rents in Sydney are now the highest they’ve ever been and we’re expecting them to continue to increase over the next quarter if the trend continues.”

“It’s being driven by both domestic and international workers seeing job opportunities in Sydney and Melbourne, but also the scarcity of new supply on the market.”

In these circumstances, as demand grows, property investment could be a great opportunity for you to build wealth. It is important to be smart about the properties that you choose to invest in by ensuring that you are selecting high-quality properties by trustworthy developers so that you can reap the benefits of your investment property in the long run.

Our dedicated team at St Trinity safeguards the long-term market position of our clients by partnering with trusted developers, who go through our own due diligence before we offer each and every property to our clients. Chat with us today at (02) 9099 3412 or enquire below.