Exploring the cost of living in top Australian cities reveals a varied landscape of living expenses across Sydney, Melbourne, Brisbane, and Perth. This comprehensive cost of living comparison in Australian cities offers insights into housing, transportation, food, utilities, healthcare, and education expenses, providing a clear picture for those considering a move within Australia.

In Australia, there are many major cities where bustling urban centres offer diverse opportunities and lifestyles. Understanding the cost of living in top Australian cities is an absolute must before you plan a move to the land of opportunities.

Below we delve into the cost of living in some of Australia’s top cities – Sydney, Melbourne, Brisbane, and Perth – examining key factors that influence expenses and offering insights into managing finances effectively.

Table of Contents

6 Major Factors Influencing Cost of Living In Top Australian Cities

Let’s take a look into the key factors such as housing prices, healthcare expenses, and transportation costs that can primarily influence your move to Australia.

1. Housing

One of the big things that affect how much it costs to live somewhere is housing. Rent and property prices can be very different from city to city, with Sydney and Melbourne usually being more expensive than Brisbane and Perth. Housing affordability measures help us understand how much of our income goes towards paying for a place to live.

Housing remains a significant contributor to the average cost of living in Australian cities. Sydney and Melbourne present higher challenges in terms of affordability, pushing many towards alternative cities like Brisbane and Perth, where the housing market offers more accessible options. This comparative cost of living in Australian cities underscores the importance of housing in financial planning.

2. Transportation

The cost of living and wage growth in Australian cities are closely tied to transportation expenses. Cities with extensive public transport networks like Sydney and Melbourne can offer savings over car-dependent lifestyles, yet parking and toll costs must be considered. This aspect of cost of living comparison in major Australian cities emphasizes the role of transportation in daily expenses.

Getting around in capital cities comes with its expenses. Public transport fares, fuel prices, parking and vehicle maintenance costs impact overall monthly budgets.

While capital cities like Sydney and Melbourne boast extensive public transport networks, car ownership can be expensive due to parking fees, motorway tolls and even the extended delays that traffic may cause, leading to wasted time.

3. Food and Groceries

Another unavoidable expense is food. The cost of groceries and dining out can differ vastly between capital cities, influenced by factors like proximity to grocers, food markets and restaurants.

Understanding food affordability and setting budgets can help residents make informed choices about their eating and dining habits.

4. Utilities

Utilities, including electricity and internet, alongside healthcare costs, form critical components of the cost of living in different Australian cities. These expenses can vary widely, affecting the overall cost of living in major Australian cities and contributing to the Australian cost of living.

Essential services such as electricity, water, and internet add to the monthly bills. Prices for utilities can vary depending on the city’s infrastructure and climate conditions.

Residents in warmer regions often face higher energy costs for air conditioning and residents in cooler climates face the additional energy costs of heating.

5. Healthcare

Ensuring access to top-notch healthcare is essential for residents, but it does come at a cost.

Factors such as health insurance premiums, fees for doctor consultations, and expenses for prescription medications all play a role in determining the overall cost of living.

Affordability of healthcare is a prominent issue, particularly for families and individuals managing pre-existing conditions.

In Australia, Medicare frequently covers a substantial portion of medical expenses; however, many Australians prefer to supplement this with private health insurance for additional coverage.

6. Education

Education costs, from school fees to university tuition, play a significant role in the costs of living in Australia. This investment in the future significantly impacts families and individuals planning long-term residency.

For families with children or individuals aspiring to pursue advanced studies, educational costs are a key factor to bear in mind. The fees for schools, university tuition, and the expenses associated with educational resources fluctuate from city to city, exerting a substantial impact on household budgets.

Cost of Living Comparison Across Major Cities In Australia

Sydney

Sydney, Australia’s largest city, often tops the charts for one of the most expensive cities in the world.

The median house price in Sydney has soared to approximately $1.5 million, creating a real estate landscape that can be daunting for those on a budget. Additionally, the city’s transport and dining options come with a hefty price tag, contributing to the overall high cost of living.

Despite these financial challenges, Sydney remains a magnetic hub, drawing people from across the globe. Its vibrant cultural scene, diverse job opportunities, and a truly cosmopolitan metropolis. As of the 2023 June quarter, the unemployment rate in Greater Sydney was 3.4%, reflecting a relatively stable employment landscape amid the city’s economic dynamics.

Read more on Where To Find The Most Affordable Real Estate In Western Sydney: Top 5 Suburbs You Didn’t Know Of

Learn more about Why Western Sydney Is Home To Some Of The Best Suburbs To Invest In Sydney

Melbourne

Melbourne, renowned for its vibrant arts scene and bustling café culture, presents a relatively more affordable cost of living when compared to its counterpart, Sydney.

As of January 2024, the median property price in Melbourne is approximately $960,000. Melbourne’s demanding real estate landscape often features housing options that are more accessible than those in Sydney. The transportation costs are easier to manage. What truly distinguishes Melbourne is its eclectic culinary scene, where a multitude of eateries representing various cuisines cater to diverse tastes and preferences.

Melbourne’s job market is also thriving. Residents have ample opportunities for professional growth and economic stability. This, coupled with the city’s unique cultural identity and events, contributes to Melbourne’s appeal as a city with a balanced cost of living, providing both the essentials and the enriching experiences that residents value.

Brisbane

Nestled as a more affordable alternative to the bustling cities of Sydney and Melbourne, Brisbane offers a unique blend of a relaxed lifestyle and lower housing costs. Residents in Brisbane benefit from a more affordable housing market compared to their counterparts in Sydney and Melbourne, providing a conducive environment for those seeking cost-effective living solutions.

However, it’s important to note that Brisbane’s sprawling layout may result in residents spending more on transportation. The city’s expansive design can necessitate longer commuting distances, potentially impacting transport expenses for those navigating the metropolitan area.

Furthermore, the city is blessed with a subtropical climate, that encourages outdoor activities and a healthy lifestyle. The abundance of parks, riverside areas, and recreational opportunities under the sunny skies all enhance Brisbane’s appeal.

In summary, while Brisbane may present certain challenges in transportation costs due to its size, its overall cost of living remains relatively lower, offering residents a chance to enjoy the benefits of a relaxed lifestyle, a favourable housing market, and the allure of a subtropical climate.

Read more on Why The Future Looks Bright For Queensland Gold Coast

Perth

Perth, situated on the scenic west coast of Australia, boasts a distinctive lifestyle enriched by its proximity to pristine beaches and abundant outdoor activities. Despite fluctuations in housing costs influenced by economic factors in recent years, Perth is far more affordable than its eastern counterparts.

The city’s appeal lies not only in its affordability but also in the natural beauty that surrounds it. With a Mediterranean climate and numerous beaches along its coastline, Perth offers residents a relaxed and sun-soaked atmosphere. The outdoor-centric lifestyle is further enhanced by a plethora of parks, nature reserves, and recreational spaces, contributing to a sense of well-being.

While housing costs may have experienced shifts, Perth’s overall affordability often allows residents to enjoy a comfortable lifestyle without the same financial pressures experienced in other major Australian cities. The city’s economy is driven by sectors such as mining and resources, which provides stability to its cost of living.

In essence, Perth stands out as a city where the cost of living is generally more manageable, offering residents not only affordability but also the unique charm of a coastal lifestyle enriched by outdoor adventures and natural beauty.

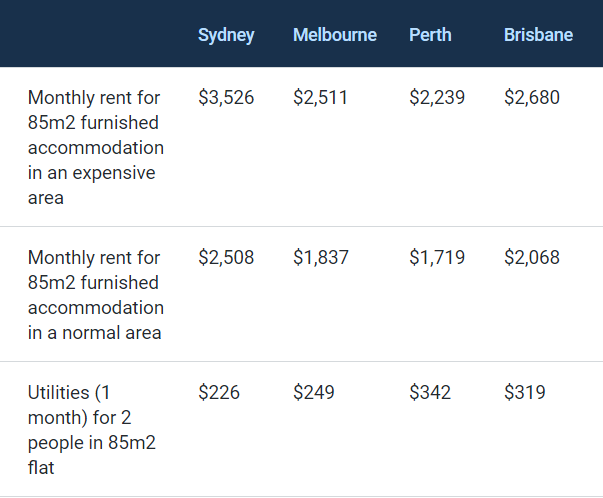

According to Finder, Sydney sits on top with accommodation and utilities both priced significantly higher than in other cities. On the other hand, Melbourne costs 36% less, Perth costs 45% less and Brisbane costs 25% less than Sydney.

The below chart compares the price difference across these different locations.

Source: Finder

Considerations About Quality of Life

When contemplating the quality of life in top Australian cities such as Sydney, Melbourne, Perth, and Brisbane, several factors contribute to the overall appeal. The standard quality of living in Australia, coupled with strategic financial management, can lead to a fulfilling life despite the high cost of living per month in Australia.

- Beyond Living Costs: It’s not just about living expenses; access to amenities, job opportunities, and the environment also matters.

- Balanced Trade-offs: Some cities with higher costs often have better infrastructure and services, improving overall quality of life.

- Outdoor Lifestyle: The favourable climate in these cities encourages residents to spend more time outdoors.

- Cultural Vibrancy: Each city offers diverse arts and entertainment options, from museums to theatres and music venues.

- City Perks: Big-city perks include vibrant restaurants, nightlife, and recreational amenities, contributing to a well-rounded living experience.

Strategies for Managing Cost of Living In Top Australian Cities

Navigating the cost of living in Australia requires strategic planning and savvy financial management. To ensure financial stability and comfort, getting a grasp on these strategies will effectively cut down on your daily expenses.

- Budgeting Tips: Creating a monthly budget and tracking expenses helps residents better manage their finances and identify areas where they can save money.

- Housing Alternatives: Exploring alternative housing options such as shared accommodation can significantly reduce the cost of housing.

- Transport Optimisation: Utilising public transport options or carpooling can help minimise commuting expenses.

Australia has well-developed public transportation networks, including trains, buses, ferries, and trams, to minimise commuting costs. Invest in an Opal card (Sydney), myki Pass (Brisbane), or SmartRider (Perth) for convenient payment options. - Prioritise Healthcare: Leverage Australia’s healthcare system by understanding the options available. Access tax-funded Medicare for free or low-cost healthcare services. Consider supplementing with private health insurance for coverage of extras like dental, specialist care, and ambulance services.

- Lifestyle Adjustments: Making small changes to lifestyle habits, such as cooking at home instead of dining out, can lead to significant savings over time.

Also, think about outdoor exercise instead of a costly gym membership. Australia’s weather is perfectly suitable for engaging in activities like walking, running, cycling, hiking and so on.

Conclusion

Navigating the cost of living in top Australian cities requires careful planning and budgeting.

While expenses may vary between cities, understanding the factors that influence costs and implementing strategies to manage them can help residents achieve financial stability and enjoy a high quality of life.

By being proactive and adaptable, individuals and families can thrive in Australia’s dynamic urban environments while keeping their expenses in check.

Frequently Asked Questions (FAQs):

Which city has the most affordable housing options?

Brisbane typically offers more affordable housing options compared to Sydney and Melbourne. Perth also stands out for its relatively lower housing costs, especially in recent years.

How much are typical grocery and transportation costs?

The cost of groceries and transportation can vary depending on factors such as location and lifestyle choices. However, in general, Sydney tends to have higher grocery and transportation costs compared to Melbourne, Brisbane, and Perth.

What are the average utility bills and energy costs?

Utility bills and energy costs can fluctuate based on factors like usage, climate, and local infrastructure. On average, residents in Sydney experience higher utility bills compared to other cities due to factors like higher electricity usage for cooling in the summer months.

What are the tax rates and government fees in each city?

Tax rates and government fees can vary depending on individual circumstances and income levels. However, Australia generally operates under a progressive tax system, with rates varying across different income brackets. Government fees may include property taxes, vehicle registration fees, and other administrative charges, which can vary slightly between cities.

How much should I budget for dining, entertainment, and leisure?

Budgeting for dining, entertainment, and leisure activities can vary greatly depending on personal preferences and lifestyle choices. As a rough estimate, residents may allocate a certain percentage of their monthly budget for discretionary spending on dining out, entertainment, and leisure activities, with costs varying between cities.

Which city offers the best value for salary vs. expenses?

While Sydney may offer higher salaries in certain industries, the cost of living, including housing and other expenses, tends to be higher compared to other cities like Melbourne, Brisbane, and Perth. Therefore, residents may need to carefully weigh factors such as salary, expenses, and overall quality of life when considering the best value for their circumstances.

Are there any hidden costs to consider like parking or tolls?

In addition to basic living expenses, residents should also consider potential hidden costs such as parking fees, motorway tolls, and other incidental expenses associated with transportation and daily living. These costs can vary depending on factors like location, lifestyle choices, and commuting habits.

How much does childcare cost in each city?

Childcare costs can vary significantly depending on factors such as the type of childcare (e.g., daycare, nanny, preschool), location, and quality of care. As a general guide, childcare costs in major cities like Sydney and Melbourne tend to be higher compared to Brisbane and Perth, although specific costs can vary widely depending on individual circumstances and preferences.

How does the cost of living compare to other major cities globally?

The cost of living in Australian cities like Sydney and Melbourne is high compared to many other major cities globally. However, factors such as quality of life, job opportunities, and cultural amenities also play a significant role in determining overall value for residents.

What are the long-term financial implications of living in each city?

The long-term financial implications of living in each city depend on factors such as housing market trends, employment opportunities, and economic stability. Residents need to consider factors such as property investment potential, career growth prospects, and retirement planning when assessing the long-term financial implications of living in a particular city.