“Can I use my super to buy a house?” is one of the most commonly asked questions by potential first-home buyers in Australia.

Given the significant rise in property prices, many are looking for alternative ways to fund their dream home. This article addresses this question and provides comprehensive information for first-home buyers considering dipping into their superannuation funds.

Table of Contents

1. What is Super?

Superannuation, often called ‘super’, is a government-supported means of saving money for retirement in Australia. Throughout your work, your employer makes compulsory contributions to your super account. This money is then invested on your behalf to grow your nest egg for your retirement years.

2. Can I Use My Super To Buy A House?

The short answer is yes but with some conditions.

- First Home Super Saver Scheme (FHSSS): Introduced in the 2017-18 Federal Budget, the FHSSS allows Australians to save money for their first home within their super fund. The scheme permits voluntary contributions of up to $15,000 per financial year and $30,000 in total. Once ready to buy, you can withdraw these voluntary contributions and their associated earnings to help purchase your first home.

- Self-Managed Super Funds (SMSFs): Some people establish a Self-Managed Super Fund and use it to buy a property. However, this is complex and comes with strict regulations. You can’t live in the property, and it should be solely for the purpose of achieving a return on investment. Therefore, it’s not a direct way for first-home buyers to live in the homes they purchase.

3. First Home Super Saver Scheme (FHSSS)

What is the First Home Buyers Super Saver Scheme, and How Does It Work?

The First Home Super Saver Scheme, introduced in 2017, permits Australians to save for their first home within their super fund. They can make voluntary contributions and later withdraw them and their earnings for a home purchase.

You can voluntarily contribute up to $15,000 per financial year (capping at $30,000 in total) to your super. Later, you can withdraw these funds, along with the earnings, to assist in purchasing your first home.

What are the benefits of the FHSS scheme?

The First Home Super Saver Scheme (FHSSS) was designed to assist first-home buyers in their journey to homeownership. The benefits are multifaceted and tailored to offer financial relief and encouragement:

- Tax Advantages: One of the standout benefits of the FHSSS is its tax incentives. Contributions made under this scheme are taxed at a concessional rate, often much lower than an individual’s marginal tax rate. This can result in significant tax savings over time.

- Streamlined Withdrawal Process: Recognizing the urgency and excitement of buying a first home, the government has made the withdrawal process under the FHSS scheme efficient and user-friendly. This ensures that accessing your savings is a hassle-free experience when you’re ready to buy.

- Compound Growth Potential: Funds contributed to the FHSSS are invested, which means they can benefit from compound growth over time. This could result in a larger amount available for withdrawal than just the contributions made.

- Flexibility in Contributions: While there are caps on how much one can contribute yearly and in total, the FHSSS offers flexibility. You can decide how much you want to contribute based on your financial situation, allowing for personalised savings strategies.

- Encourages Saving: The very existence of the FHSSS serves as a motivation for potential home buyers to save more diligently, given the benefits they stand to gain.

Check out our comprehensive article about the First Home Super Saver Scheme to determine if you are eligible for this scheme.

Source: Mozo

Am I still a first-time home buyer if my partner has owned property before?

If you’ve personally never owned property, you’re deemed a first-time home buyer. However, when buying jointly with a partner who has owned before, things can get more complex:

- Individual vs. Joint Status: You remain a first-time buyer on your own. However, many incentive schemes, like the First Home Super Saver Scheme (FHSSS), consider the combined status of both partners.

- State-specific Rules: Different Australian states and territories have varying rules for grants and concessions. Some might reduce benefits if one partner has owned property before.

- Financial Implications: Banks may evaluate loan applications differently when one partner isn’t a first-time buyer, potentially impacting borrowing terms and rates.

It’s wise to consult a financial or legal expert to understand the nuances of your specific situation when purchasing jointly.

Important Things to Consider

- Taxes and Fees: While the FHSSS offers tax advantages, there will be some tax to pay upon withdrawal, albeit at a concessional rate. Moreover, there are administrative charges associated with the withdrawal process.

- Eligibility Criteria: To take advantage of the FHSSS, you must reside in the property as soon as possible after purchase and live there for at least six months within the first year of ownership.

- Limitations: The FHSSS doesn’t allow for withdrawals of your employer’s contributions or the mandatory 9.5% Superannuation Guarantee.

- Market Fluctuations: Your super is an investment, and its value can go up or down. Using it to buy property adds another layer of investment risk.

Is the First Home Super Saver Scheme a worthwhile investment?

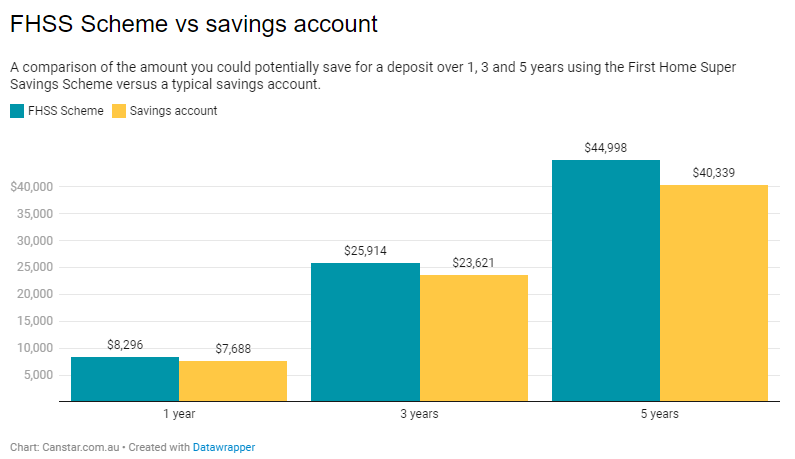

As per government estimates, the First Home Super Saver Scheme has the potential to enhance individuals’ savings by approximately 30% when compared to traditional savings accounts.

Canstar conducted a comprehensive analysis to illustrate the comparative savings outcomes between the scheme and a standard savings account.

In a hypothetical scenario, we examined the impact of salary sacrificing $10,000 annually into the scheme versus depositing an equivalent after-tax amount into a savings account. Our evaluation considered potential savings after one year, three years, and five years.

The marginal tax rate used in this comparison is derived from the average adult full-time earnings of $92,030 per year, based on the latest figures from the Australian Bureau of Statistics’ Average Weekly Earnings data.

4. Self-Managed Super Fund (SMSF)

In the realm of self-directed investment strategies, self-managed super funds (SMSFs) have emerged as a popular choice for individuals seeking to take control of their retirement savings and potentially diversify their portfolios with real estate investments. While SMSFs offer a degree of flexibility and control, understanding the complexities and considerations involved is crucial before embarking on this investment path.

What is a Self-Managed Super Fund?

An SMSF is a superannuation fund managed by its members rather than a financial institution. This means that members have direct control over the investment decisions made within the fund, allowing them to tailor their portfolio to their specific objectives and risk tolerance.

Benefits of Using an SMSF for Property Investment

Investing in real estate through an SMSF can offer several potential benefits, including:

-

Diversification: Real estate can provide diversification benefits within an SMSF portfolio, potentially mitigating risks associated with other asset classes.

-

Potential for capital growth: Real estate has historically demonstrated the potential for capital appreciation over the long term.

-

Rental income: Property investments can generate rental income, providing a steady cash flow stream for the SMSF.

-

Tax benefits: SMSFs are generally taxed at a concessional rate of 15%, potentially offering tax advantages compared to personal investment in property.

Considerations and Potential Drawbacks

Despite the potential benefits, there are also important considerations before using an SMSF for property investment:

-

Complexity: SMSFs are subject to complex regulations and require ongoing administration, which may involve seeking professional assistance.

-

Limited liquidity: Real estate investments can be illiquid, meaning it may take time to sell the property and access the funds.

-

Risk of loss: Real estate investments carry the risk of loss due to factors such as market fluctuations, tenant issues, and property maintenance costs.

-

Potential for conflicts of interest: If members of the SMSF are involved in the management or purchase of the property, potential conflicts of interest may arise.

Restrictions on SMSF Property Investments

Knowing some rules is important before using your SMSF to purchase a property. First, you can’t live in the property or use it for business. Even though you can buy a residential property, members of the fund or anyone related to them can’t live in it. Keep these rules in mind when considering property investments through your SMSF

Will I pay CGT if I sell my property as a part of a self-managed super fund?

Yes, properties that are part of Self-Managed Super Funds (SMSFs) are indeed subject to Capital Gains Tax (CGT) when sold. However, if the property within the SMSF was owned for over a year, a concessional rate may apply, potentially reducing the amount of tax payable. It’s essential to be aware that the specifics of how CGT is calculated and the applicable discounts can vary based on the circumstances of the fund and any legislative changes.

Furthermore, the strategic timing of the property sale and understanding the nuances of CGT within an SMSF context can have significant financial implications. For these reasons, consulting with a tax professional or financial advisor is highly recommended before making any sale decisions within an SMSF.

5. Seeking Professional Guidance

1. Financial Advisors and SMSF Specialists:

Due to complexities and potential risks, consult with qualified professionals before investing. Assess your circumstances, risk tolerance, and financial goals to determine if an SMSF aligns with your strategy.

2. Before Making Decisions:

Before selling properties within SMSFs, consult tax professionals or financial advisors to understand CGT implications and potential discounts.

Bottom Line

“Can I use my super to buy a house?” The answer is a resounding “YES!”—but it’s not as simple as tapping into your savings. Navigating the intricacies of superannuation-backed homeownership requires expert guidance. That’s where we come in.

Don’t let the complexities of super and property stand between you and your dream home. Contact us today for a personalised consultation.

We’ll help you unlock the potential of your superannuation, ensuring you make informed decisions that align with your financial goals and pave the way toward homeownership.

Ready to make your super work for you? Let’s get started!