Table of Contents

Interest Rate on Hold

At Tuesday’s meeting, the Reserve Bank of Australia (RBA) paused the cash rate hike for the first time after 10 consecutive rises, keeping the current cash rate at 3.6%.

“The decision to hold interest rates steady this month provides the Board with more time to assess the state of the economy and the outlook, in an environment of considerable uncertainty.” The RBA governor, Philip Lowe, said in the official RBA release.

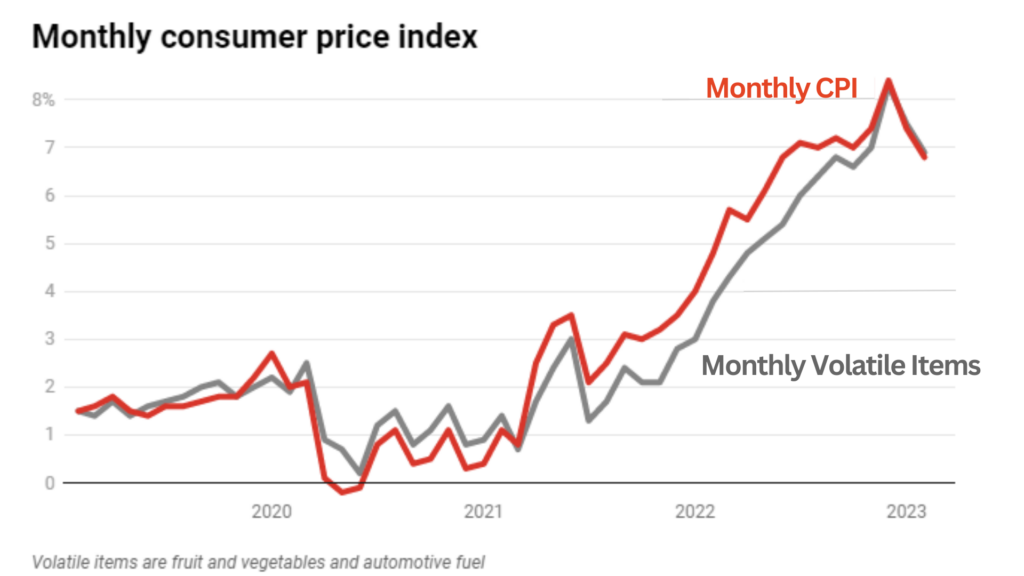

According to the board, several indicators suggest that inflation has already reached its highest point. In December, the inflation rate was at its peak of 8.4%, but it has since declined to 7.4% in January and 6.8% in February.

Source: ABS data, ABC News

Finance Minister, Katy Gallagher, speaking on behalf of Treasurer Jim Chalmers, said that this pause is welcomed news for households and businesses, and it follows an early sign that inflation has peaked.

Even though Commonwealth Bank is still expecting one more rate rise next month, the Head of Australian Economics, Gareth Aird, believes that there is now a strong possibility that the rise will not happen.

“We continue to expect 50 basis points of rate cuts in the fourth quarter of 2023 and a further 50 basis points of easing in the first half of 2024.”

Our current property market

Tim Lawless, CoreLogic’s research director, said the end of the rate hikes by May was likely to spark a property market recovery as consumer sentiment improved.

“Although interest rates are high and there is an expectation the economy will slow through the year, it’s clear other factors are now placing upwards pressure on home prices,” Mr Lawless said.

According to their latest Home Value Index Report, national property prices rose by 0.6 per cent in March despite the previous rate rises, putting an end to a 10-month decline. The residential property values went up in the four largest capital cities, with Sydney leading the way with a 1.4% increase.

Source: CoreLogic Home Value Index Released 3 April 2023

Since September of last year, the number of new property listings being added to the market has been consistently below average, compared to the previous year.

However, there has been an increase in purchasing activity during March, with a 10.4% rise over the month. At the same time, estimated sales during the month were also the highest they’ve been since May last year.

The Current Rental Market

The current rental market continues to be extremely tight across most regions.

CoreLogic reports that the predominant trend in the largest capitals is a rise in rental growth, particularly in the unit sector, while the growth rate is slowing down in the smaller capitals and for houses.

Source: CoreLogic Home Value Index Released 3 April 2023

The unit sector in Sydney is experiencing an annual growth rate of 18.1%, which is almost double the growth rate recorded for houses, which is at 9.4%. This trend is observed in all major cities, where the rate of rent increase is much faster for units compared to houses. As a result, unit investors are enjoying higher profits.

Dr. Lawless (CoreLogic) attributes this trend to the fact that an increasing number of tenants are searching for reasonably-priced housing options in medium to high-density areas.

“Additionally, the surge in overseas migrants and students is likely to be funnelling demand in inner city areas and precincts close to universities, transport and amenity hubs,” He said.

He also added that international migration has a greater impact on rental demand rather than home purchasing demand, and this trend is expected to continue.

However, due to the current vacancy rates in most cities being around 1%, it’s likely that the high influx of migration will lead to a faster increase in home purchasing demand compared to previous years, and the housing market is looking increasingly positive.

It’s been 3 years since the COVID-19 pandemic began, how is the housing market going?

Given the positive indication of a property market recovery, it’s a good time to reflect on how the housing market has transformed over the past three years since the onset of the Covid pandemic.

Source: CoreLogic

- Despite some ups and downs, national home values have soared by a whopping 14.8% since March 2020, evidence of the resilience of the property market.

- The regional dwelling market has experienced a surge in value, increasing by 30.7% since the pandemic began, thanks to the popular trend of sea-change and tree-change movements. However, with current migration figures, the trend may shift back to pre-pandemic patterns in favour of capital cities.

- National rent values dropped during the pandemic, but have been on a steady rise to a remarkable 23.1% as of March 2023, with no signs of slowing down.

- In a fascinating twist, the unit market has emerged as a top pick for purchasers, especially investors, due to the enticing combination of affordability, higher rental yields, and surging demand from renters.

Next Steps in the Housing Market

All in all, what we can report in the property market this month are:

- Interest rate hikes paused for the first time in 10 months

- Buyer sentiment is still strong amidst the economic uncertainty.

- National property prices rose by 0.6 per cent in March

- 71% Auction Clearance Rates (nationally)

- The housing market is looking increasingly positive for both home buyers and investors

Despite ongoing market volatility and the possibility of rising interest rates, the Reserve Bank of Australia (RBA) appears to be shifting its focus towards addressing banking instability rather than just fighting inflation.

Another key factor is Australia’s growing population, which is now expanding at a faster rate than ever before. This increased population growth means that more homes will need to be built to meet the growing demand. If the supply of housing fails to keep up with demand, property prices are likely to significantly increase.

Interested to get into the property market? Get in touch with our property consultant experts at (02) 9099 3412 or enquire below.