Starting on a positive note, property prices have experienced a remarkable rebound, surging by an impressive 6.7% since January, according to CoreLogic.

Additionally, the RBA Board maintained interest rates at 4.1% in July, allowing for further evaluation of the economic outlook.

Meanwhile, the growing population and limited housing supply have exerted immense pressure on the rental market. As a result, unit rents have soared by 14.8%, while house rents have risen by 8.1%.

Let’s take a closer look.

Table of Contents

Interest Rate On Hold This Month

The Reserve Bank of Australia (RBA) has held interest rates at 4.1 per cent for the month of July but has warned that more hikes will be needed to fight inflation.

RBA Governor Philip Lowe cited falling inflation and lagging productivity as significant drivers of this month’s decision to hold the cash rate steady and a preference to see more economic data before changing the base rate.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve,” Lowe said.

“The decision to hold interest rates steady this month provides the Board with more time to assess the state of the economy and the economic outlook and associated risks.

Image: PETER BRAIG

The “Big 4” have once again weighed in on their forecasts regarding the future movement of the cash rate.

- CBA: foresees rates peaking at 4.35% By August 2023, followed by a drop to 3.35% by November 2024.

- Westpac: Anticipate the rate hitting 4.60% by August 2023 and descending to below 3% by the end of 2025.

- NAB: also anticipates a peak at 4.6% in August, decreased to 3.10% by November 2024.

- ANZ: we also expect an increase to 4.6% by August decline to 4.10% by the close of 2024.

*Please note that these are simply forecasts and that the Big 4 banks may update them. Figures are correct at the time of publishing.

Why are property values rising despite the rate hike?

Prices climb

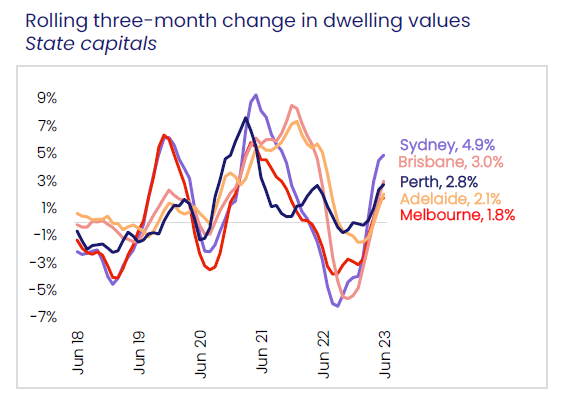

Australian housing values moved through a fourth month of recovery, with CoreLogic’s national Home Value Index (HVI) rising 1.1% in June.

Every capital city except Hobart (0.3%) saw dwelling values rise in June, with CoreLogic’s research director, Tim Lawless, noting that Sydney continues to lead the cycle.

“Sydney home values increased another 1.7% in June, taking the cumulative recovery since the January trough to 6.7%. In dollar terms, Sydney’s median housing values are rising by roughly $4,262 a week,” he said.

Source: Corelogic CoreLogic Home Value Index

Despite the expectation that higher interest rates would decrease housing affordability and lead to a decline in property prices, the opposite phenomenon has been observed in our property market. Over the past six months, the Reserve Bank of Australia (RBA) has raised interest rates four times in an attempt to curb inflation. Surprisingly, during this period, property prices have actually increased by 6.7%, according to CoreLogic.

One would assume that the elevated mortgage payments resulting from the interest rate hike would discourage potential buyers and consequently cause property values to decrease. However, this is not the case. So why would property values still increase despite the interest rate hike?

High Demand

The impact on housing prices extends beyond interest rates as numerous other factors come into play. These factors contribute to either heightened demand or reduced supply, directly influencing property prices in the market.

Source: Ian Cutmore

Despite the consecutive increases in interest rates, the housing market remains resilient and continues to strengthen. This can be attributed to the significant demand generated by a population boom.

By the end of this year, Australia is projected to experience a net overseas migration of 400,000 individuals, surpassing the previous record of 316,000 set in 2018. The Australian Bureau of Statistics (ABS) population clock indicates that the country adds one person to its population every 47 seconds.

Given the current rate of population growth, it is evident that property prices will continue to rise rapidly. This is primarily due to the limited supply of properties, which is unable to keep pace with the ongoing population boom. Data from PropTrack as of May 2023 reveals an impressive 7% increase in potential buyers per listing compared to the same period in 2022.

Limited Stock

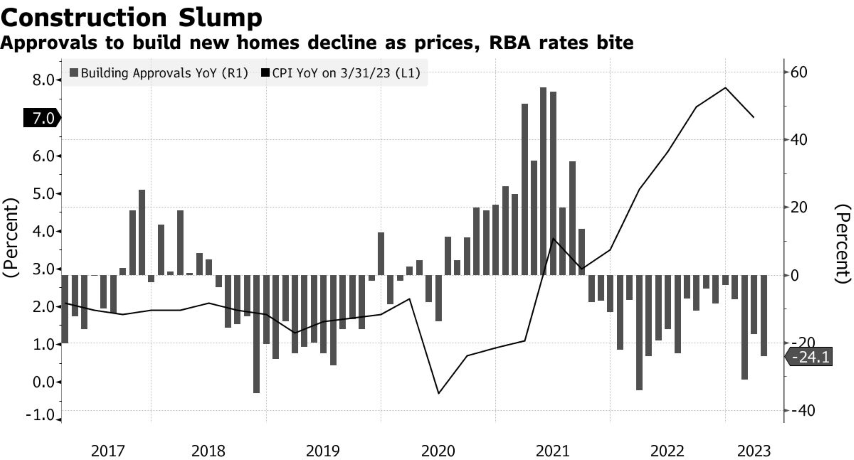

Recent data from the ABS indicates a significant decline in approvals for new home construction, reaching the lowest level in 11 years. This decline is primarily driven by a decrease in permits for apartment buildings.

In April, total dwelling approvals experienced an 8.1% decrease compared to the previous month, with permits for apartments plummeting by 16.5%. Although monthly data can be volatile, the overall trend has shown weakness over an extended period, with total approvals dropping by 24.1% compared to the same time last year.

“Total dwellings approved fell to the lowest level since April 2012,” said Daniel Rossi, ABS’ head of construction statistics. “Private sector house approvals also continued to decline.”

Source: RBA, Bloomberg

According to Hayden Groves, the president of The Real Estate Institute of Australia, the Australian property market has remained relatively unaffected by the continuous rise in interest rates due to the limited supply of properties available.

Groves believes that until there is an increase in property stock, the current low-supply environment will continue to exert upward pressure on prices, despite the efforts of the Reserve Bank of Australia (RBA) to control the market. He also expresses confidence in the strong recovery phase of the Australian property market and predicts that prices will continue to rise.

A Domain report supports this outlook, particularly in Sydney, where house prices are projected to increase by 6% to 9%. Similarly, unit prices in Sydney are expected to rise within a range of 2% to 5%.

A Rising Rental market

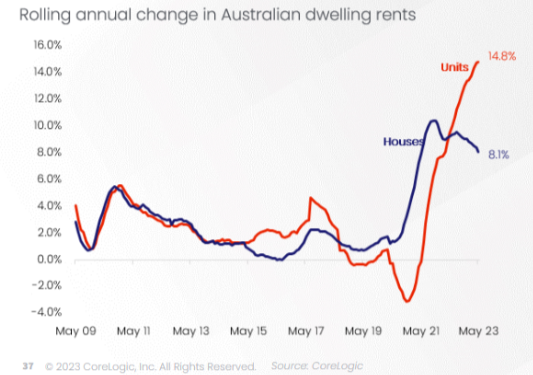

The rental crisis is a direct consequence of the increasing demand for rental properties coupled with the limited availability of housing stock. This situation has led to a sharp rise in property prices due to the scarcity of available properties. Additionally, the rental vacancy rates have significantly dropped as the population increases, further exacerbating the crisis. As a result, rental prices have skyrocketed to reflect the highly competitive rental market.

Furthermore, there is a strong demand for rental units in capital cities, and the shortage of available listings has led to a significant narrowing of the gap between median house and unit rents. Within the span of a year, this gap has decreased from $64 per week to $39 per week.

Several domestic factors contribute to this situation, including the return of Australian students to campuses, the rental demand from workers in inner city areas, and the attraction of lower rental rates for units. Additionally, the influx of overseas migrants and international students has played a role in this record-breaking rental market. Over the three months leading up to April, unit rents in the combined capital cities experienced a significant 4.9% increase, adding an average of $26 to weekly rental values, which now stand at $560 per week.

Source: Core Logic

What’s next

As we conclude the end of the financial year and enter July, the prevailing theme of limited housing supply and strong demand, as highlighted by CoreLogic, continues to resonate with consumers.

It’s not all doom and gloom for Sydney house prices. While the increase may be slower than initially projected, house prices are still expected to rise, potentially reaching 9% by June next year.

Additionally, CoreLogic research director Tim Lawless predicts the market won’t slow down anytime soon.

“Simply, there are more buyers active than fresh supply being added to the market. Total supply is now 26 per cent below average across the combined capital cities at a 10 per cent lower than a year ago.”

“I think there is still a potential for prices to rise at the same pace as we’ve seen over the past couple of months, but there’s also the risk that they could drift lower if there’s a rebalancing in the supply and demand over the next few months.”

The increasing rental prices for both houses and apartments may prompt more individuals to consider homeownership rather than renting. While buyers remain active in the market, they approach their decision-making process with caution.

With promising news from the Reserve Bank of Australia (RBA) and positive developments in the property market, the anticipation is that the spring selling season will be busier than usual. Experts believe that market conditions are improving, and inventory levels are gradually returning to normal.

Interested in getting into the property market? Get in touch with our property consultant experts at (02) 9099 3412 or enquire below.