In response to a housing shortage, Australia’s real estate market has seen significant changes in recent years, with medium to high-density housing units assuming a vital role in addressing the country’s housing demands.CoreLogic Economist Kaytlin Ezzy delves into the dynamics of Australia’s unit market, highlighting the importance of unit supply and its impact on housing affordability and demand.

Table of Contents

The Rise of Medium to High-Density Housing

In August, CoreLogic reported that units comprised 25.9% of the national housing stock, a substantial increase from 19.6% at the beginning of the decade. In capital cities, this trend is even more pronounced, with units making up 30.4% of the housing stock, up from 22.9% in 2010.

This growing reliance on medium to high-density housing is particularly evident in major cities like Sydney, Melbourne, and the ACT, where limited land availability has made low-density development increasingly challenging.

The Shortfall in Unit Housing Stock

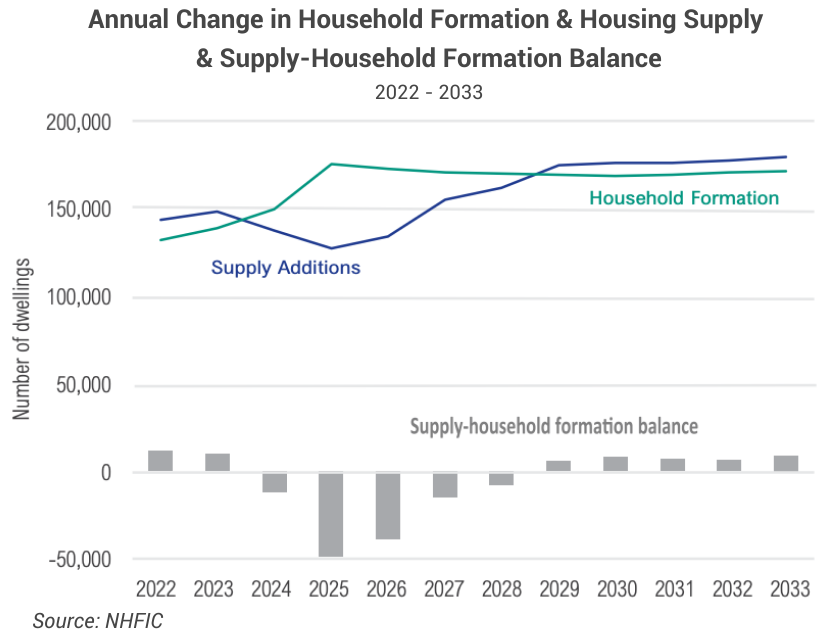

However, a looming challenge threatens to disrupt the balance in the unit market. The National Housing Finance and Investment Corporation (NHFIC) ‘State of the Nation’s Housing’ report has forecasted a national housing deficit, which was initially estimated at approximately 106,300 by 2027 and later upgraded to a staggering 175,000 units. Alarmingly, around 59% of this housing shortage is expected to affect the unit market.

NHFIC continues to anticipate a housing shortage of apartment housing shortage and medium-density dwellings over the coming years. Additions in this segment are expected to be 62,300 below new household formation cumulatively over the five years to 2027.

Decline in Approvals and Completions

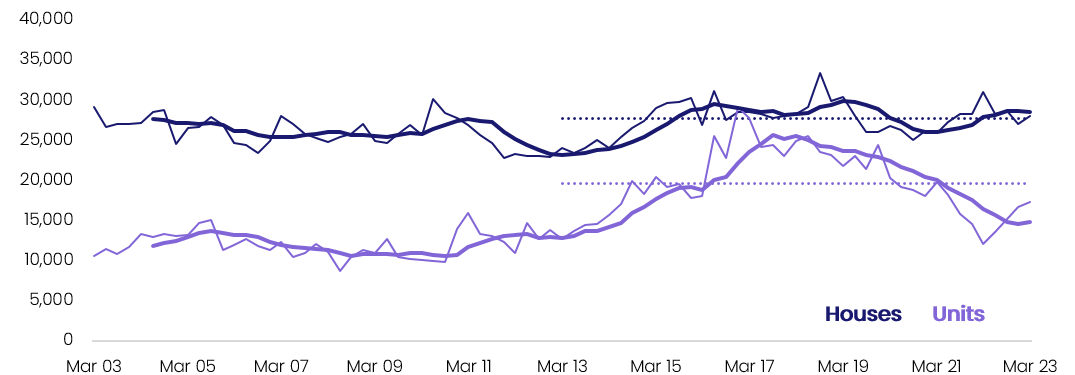

The Australian Bureau of Statistics (ABS) data reveals a concerning decline in unit approvals and completions. Unit approvals dropped by 19.9% from the previous month in July and were nearly 40% below the decade average.

This trend has persisted since mid-2018, with unit approvals consistently falling below the decade average, while house approvals have remained relatively stable.

National monthly housing approval by property type

Source: CoreLogic

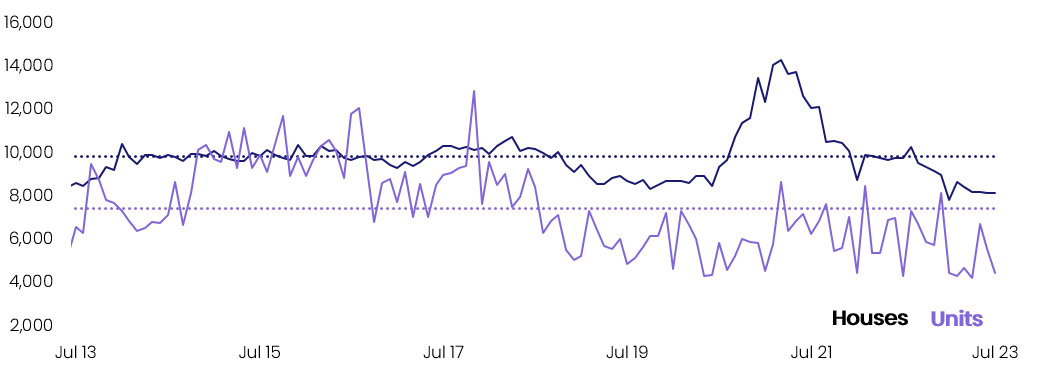

Similarly, ABS building activity data indicates a decline in unit completions, with units making up just 37.1% of total completions in the first quarter of 2023, which is approximately 27.1% below the decade average. This decline contrasts the historical average, where units accounted for about 41.7% of new housing completions.

National quarterly housing completion – by property type

Source: CoreLogic

Despite a surge in demand, developers are taking a cautious approach due to uncertain economic conditions, rising construction costs and a tight construction labour market. While a considerable pipeline of unit projects is yet to be completed, it remains below the highs seen in the mid-2010s. As a result, it is likely that unit completions will continue to decrease, further exacerbating the housing shortage issue.

What is Causing Australia’s Rental Housing Crisis?

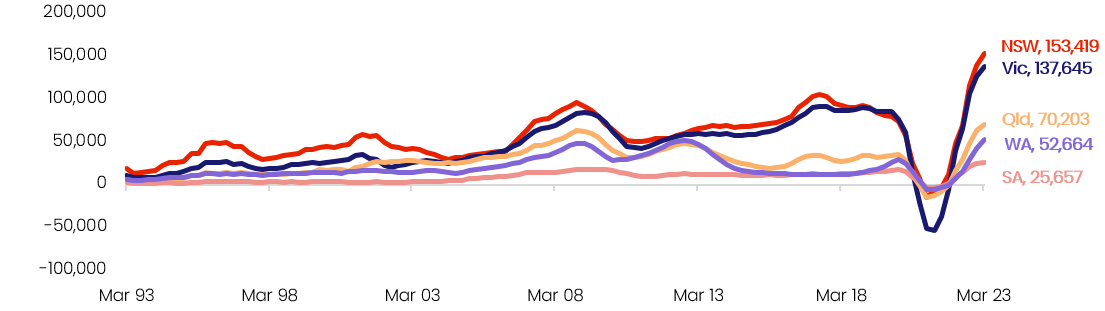

The surge in net overseas migration is causing a significant increase in housing demand in Australia. More people are coming to the country, and fewer are leaving, leading to a record high in net migration. In the year ending March 2023, a staggering 454,400 individuals were added to Australia’s population. Simply put, this influx of people is equivalent to creating approximately 181,723 new households, considering the average household size.

Annual count of net overseas migration

Source: CoreLogic

Historically, the Australian Bureau of Statistics (ABS) data shows that significant cities with high-density housing have experienced greater increases in net overseas migration. When we look at the numbers from 2016 onwards, regions like Sydney’s Inner South West, Parramatta, Melbourne’s South East and Melbourne Inner have consistently had the highest levels of net overseas migration.

Notably, a significant portion of recent long-term migrant arrivals initially choose to rent rather than buy. This surge in demand for rental properties has already been observed in the rental market, particularly in capital cities. Unit rents in these cities experienced a remarkable annual growth rate, reaching a peak of 16.5% in the year leading up to May.

Although rental affordability has become more challenging in recent months, unit rents are expected to remain high for a considerable period, especially with the anticipation that net overseas migration will continue to be substantial throughout 2023 and 2024.

Rental Crisis Amidst a Unit Housing Shortage

Australia’s housing market is facing a severe rental crisis due to a construction slowdown coinciding with a population growth surge. This situation presents significant difficulties for renters in their quest for housing.

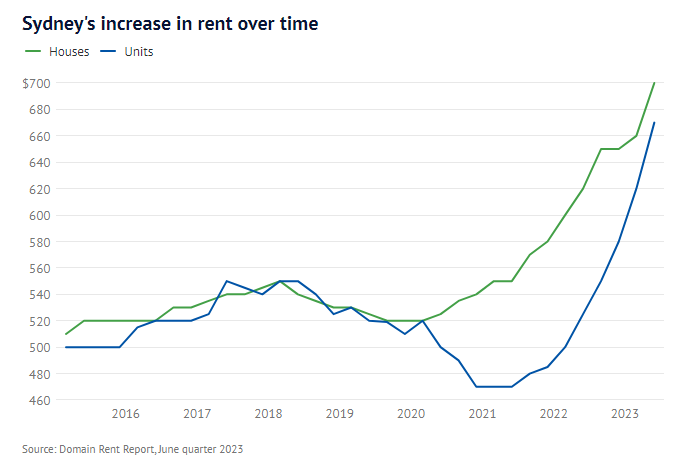

According to a report from Domain, in Sydney, apartment rents have surged by 27.6%, reaching a median of $670, while house rents have risen by 12.9%, reaching $700 per week.

Dr Nicola Powell, the Chief of Research and Economics at Domain, attributes this robust rental demand to factors such as substantial migration, the return of international students, and a decline in household sizes. This increased demand is alongside sluggish growth in new housing supply and investor activity.

Kaytlin Ezzy (CoreLogic) notes that Australians increasingly turn to units due to soaring rents. Units are considered the more affordable option for tenants, including new migrants, students, and service workers.

However, the surge in demand and limited availability is pushing rents higher, rapidly closing the affordability gap between houses and units.

Units are amid a record-long period of rent increases, marking the eighth consecutive quarter of growth and the fastest quarterly and annual rise. Unit rental growth has outpaced houses since mid-2022, narrowing the price difference between these two property types to a three-year low.

Additionally, this sustained upward trend in unit rents has boosted gross rental yields to a nine-year high, presenting an attractive opportunity for investors in the rental market.

KPMG Report Forecasts Australian Unit Prices to Soar by 9.1%

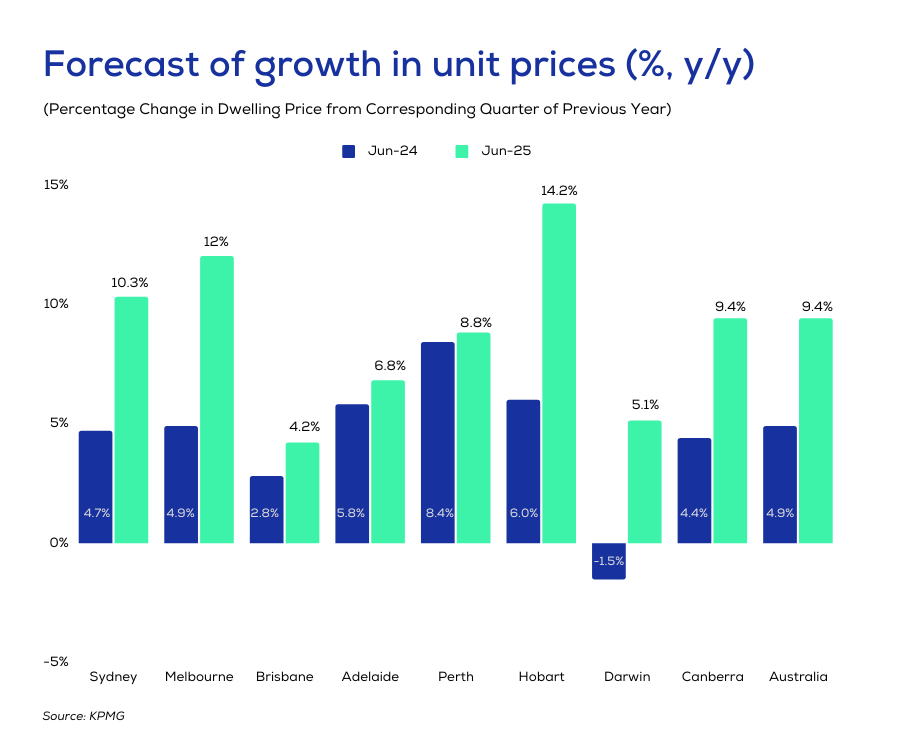

KPMG’s latest property report, which focuses on Australia’s capital cities, predicts a national increase in house prices of 4.9% over the next nine months, followed by a substantial surge of 9.4% in the year leading up to June 2025. Additionally, the report forecasts that apartment prices across the country will witness an average rise of 3.1% by next June, with a subsequent 6% increase in the following 12 months.

Dr Brendan Rynne, KPMG Chief Economist, said: “Despite high-interest rates, constrained supply will likely dominate the factors influencing property prices in the short term and result in continued price gains in most markets during FY24.

As the housing market recovers from consecutive rate increases, mortgage owners may be relieved to hear KPMG have predicted rate cuts by the next financial year.

“The supply issue will combine with several other factors to push asset prices up – higher demand due to heavier migration, anticipated rate cuts moving into financial year 2025 and potentially relaxed lending conditions,” Dr Rynne said.

High rental costs and low vacancy rates may make owning a home more appealing to Australians, according to KPMG.

“When the cost of renting is comparable to the cost of buying and owning a similar property, households may opt for homeownership, potentially driving up house prices.” the report reveal.

In the coming two years, units in Melbourne and Hobart are poised to outpace the national average, with expected gains of 14.2% and 12% by June 2025. Following this trend is Sydney, projected to experience a 10.3% increase by June 2025, resulting in a cumulative 15% rise over the two-year period.

How do you Navigate the Unit Housing Shortage Crisis in Australia 2023?

Navigating the unit housing shortage crisis in Australia in 2023 requires a strategic approach, especially for first-home buyers and property investors. Here are some honest and factual tips to help you tackle this situation:

- Stay Informed: Keep up-to-date with the latest news and reports on the property market in Australia. Liviti’s commitment to thorough research can be a valuable resource for this.

- Location is Key: Choose your property location wisely. Look for suburbs that show potential for growth and have amenities like schools, transportation, and shopping centres nearby.

- Budget Wisely: Assess your budget realistically. It’s essential to know your financial limitations and seek expert guidance to determine what you can afford comfortably.

- Consider Off-Market Properties: Sometimes, properties are available off-market. Engage with our team of experts to explore such opportunities.

Act Now

“When the cost of renting is comparable to the cost of buying and owning a similar property, households may opt for homeownership, potentially driving up house prices.” – Dr Brendan Rynne, KPMG Chief Economist, said.

While there’s always an element of uncertainty in forecasts, now presents a favourable chance to secure a price with the current stable interest rates. The current market conditions, backed by stable interest rates, create an excellent opportunity for potential apartment buyers. This stability in interest rates means more favourable borrowing conditions, ultimately making property purchases more cost-effective.

It’s a good idea to buy an apartment now while interest rates are stable. We’re here to help you every step of the way with our expertise and commitment.

Whether you’re a first-time buyer, or investor, or looking for your dream home, we have the knowledge and resources to help you make informed decisions and achieve your homeownership goals.

Contact our St Trinity team at (02) 9099 3412 today, and let us assist you in securing your place in the property market. Your journey to homeownership begins here.