Despite facing multiple economic challenges, the Australian property market is showing impressive resilience and defying earlier predictions of a downturn. With twelve interest rate rises, surging inflation rates, and new data indicating a slowdown in economic growth, many experts were expecting the property market to suffer.

However, halfway through the year, it has become evident that the market is experiencing a surprising surge instead.

Table of Contents

Current property market

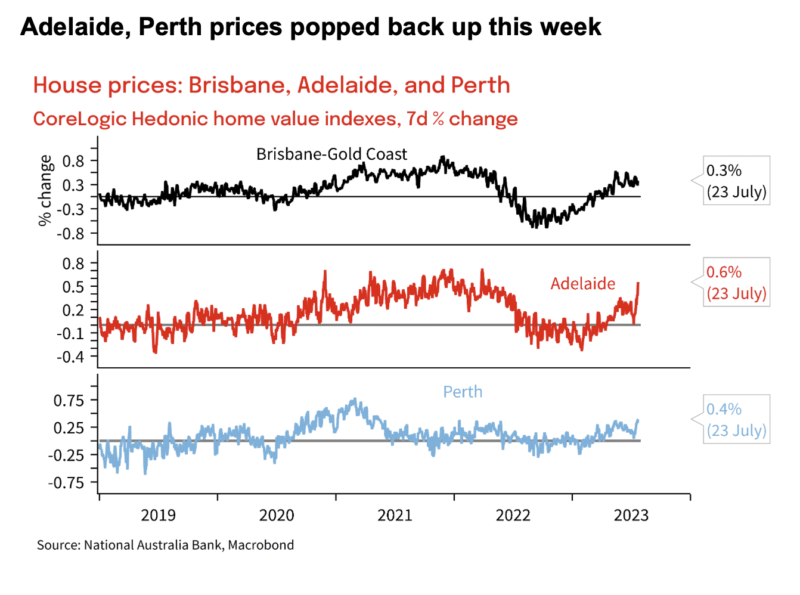

According to CoreLogic, combined capital cities have increased in value by 3.8% in the year to date. Sydney’s house prices have witnessed remarkable growth, surging by 6% over the last six months. While Melbourne is still experiencing modest growth, other cities such as Brisbane, Adelaide, and Perth have also maintained steady growth patterns in recent months.

Source: National Australia Bank, Macrobond

This week CoreLogic reports that…

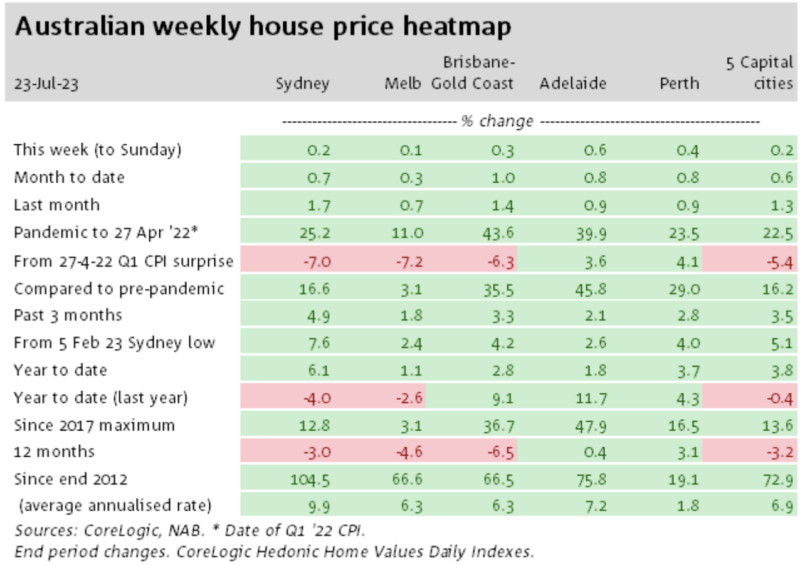

- Sydney property prices rose by 0.2% in the last week and by 1.7% in the last month, resulting in a year-to-date increase of 5.9%.

- Melbourne property prices increased by 0.1% in the last week and by 0.7% in the last month, with a year-to-date rise of 1.1%.

- Brisbane property prices saw a 0.3% increase in the last week, a 1.4% increase in the last month, and a year-to-date increase of 2.8%.

Source: CoreLogic, NAB.

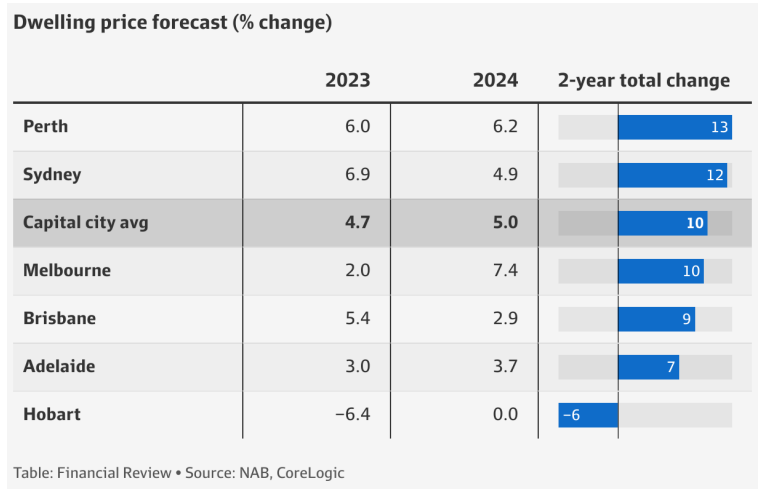

NAB Prediction: Sydney House Prices will rise 6.9% this year.

Amidst this dynamic landscape, the National Australia Bank (NAB) has revised its earlier prediction for Sydney’s house prices. Initially expecting a 2.2% decline, NAB now predicts a substantial 6.9% rise by the end of this year.

This shift in the forecast is based on the surprising resilience the housing market has shown since its previous bottom-out earlier in the year.

Source: NAB, CoreLogic.

The positive outlook for Sydney is mirrored in other cities as well. NAB predicts that Melbourne will witness a 2% rise in house prices, Brisbane a 5.4% increase, Adelaide a 3% gain, and Perth a significant 6% surge.

The bank predicts that by the end of 2024, Melbourne prices will climb by a larger 7.4% while Brisbane’s will increase by a smaller 2.9%. Adelaide and Perth are expected to add 3.7% and 6.2%, respectively, but Hobart is predicted to be flat.

The recent drop in Australia’s June quarter inflation rate to 6%, which was higher than expected by economists, has increased the likelihood that the Reserve Bank will extend its interest rate pause next week. Although NAB expects two more interest rate rises this year, the bank remains optimistic that interest rates will normalise in the following year, supporting further growth in dwelling prices.

Demand and Supply Imbalance

The underlying factors driving this surprising trend in the property market include a strong rise in housing demand due to a rebound in population growth since the reopening of international borders.

Additionally, the need for more living space during the pandemic has created sustained demand, which is expected to persist for some time. Simultaneously, new property completions have decreased despite a substantial pipeline of work, further boosting demand.

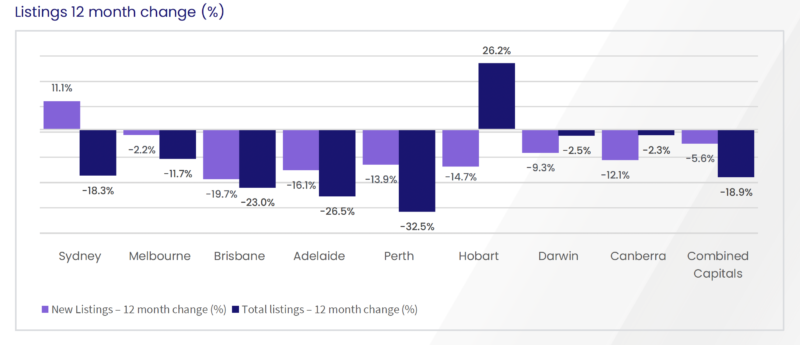

Source: CoreLogic

- New property listings in Sydney are 13.2% below the previous five-year average and nearly 23% lower than last year.

- Melbourne’s new listings are 12.3% below the previous five-year average and 23.4% lower than the previous year.

- Brisbane’s new listings are 17.8% lower than the previous five-year average and almost 20% lower than last year.

According to NAB, the ongoing demand and supply imbalance would offset the drag from reduced borrowing power and affordability as interest rates rise.

“We have revised up our expectation for dwelling prices based on the recent resilience and outlook for strong housing demand in the near term, while supply growth continues to be challenged by higher rates and supply side pressures,” NAB group chief economist Alan Oster wrote.

“A strong rise in housing demand appears to have been a key support, with population growth rebounding very strongly since international borders reopened in early 2022.

“This combined with the demand for additional floor space during the pandemic – which will likely take some time to unwind – has significantly added to demand while completions of new properties have fallen despite a large pipeline of work to be completed.”

Prices across the combined capitals are now up 16% from pre-COVID levels and have tracked above 1% month-on-month over the past two months.

Unanticipated resilience in the housing market

The Australian property market has shown remarkable resilience despite a challenging economic landscape. The surge in demand, coupled with limited supply, has created an upward trend in house prices, defying earlier predictions of a downturn.

With NAB revising its forecast for Sydney’s house prices to a 6.9% rise, it appears that Australia’s property market may indeed be entering a new cycle of growth. However, it is crucial to monitor economic developments closely to understand the market’s trajectory fully.

Should I Buy Property Now or Wait for the Right Time?

A question that any homebuyer would ask time and time again is – should I purchase property now? Or should I wait for the right time?

Pinpointing the current stage of the property cycle is challenging, and even experts can’t predict how long each market cycle will last. However, one thing is certain – property prices tend to rise and increase in value over time. This makes spending more time in the market a wiser choice than trying to guess the perfect entry point.

So instead of timing your property purchase based on the market cycle, consider taking a long-term perspective. If your income is stable and the timing feels right for you, now might be an opportune moment to secure a place in the current property market while others remain on the sidelines.

To find a perfect property for you, chat with our team at St Trinity today at (02) 9099 3412 to take full advantage of time in the market.