Buying your first home is an exciting and significant milestone, but it can also be a daunting and complex process, especially when it comes to securing the right mortgage. Fortunately, Australia offers a variety of mortgage options for first-time home buyers. In this article, we will explore some of the best mortgage options available to help you navigate the path to homeownership with confidence.

Table of Contents

Getting to Know Mortgage Basics

To get started, let’s break down the fundamentals:

- Principal: This is the money you borrow to purchase your property.

- Interest: When you borrow money, the lender charges you an interest rate percentage based on the amount you owe. This interest is an additional part of what you need to repay.

- Term: It’s the length of time you’ll spend repaying your loan, which can span 15, 25, or 30 years in Australia.

What are the Available Mortgage Options For First-Time Home Buyers in Australia?

To get you started, here are the basic interest rate options available to you:

- Standard Variable Loans: These loans have interest rates that can fluctuate based on the official cash rate set by the Reserve Bank of Australia and the lender’s decisions. They often come with flexible features like offset accounts or the ability to make extra repayments.

- Fixed Interest Rate: An interest rate set for a fixed period. These mortgages lock in an interest rate for a set period (typically 1 to 5 years). Once this period ends, you usually have the choice to either fix the rate again at the current rates or switch to your lender’s standard variable rate.

- Split Loans: A combination of both variable and fixed rates. There are advantages to both fixed and variable-rate home loans. Split loans offer the advantages of both fixed and variable-rate home loans. With this option, you can enjoy the features and benefits that matter most to you.

Selecting a Mortgage: Comparing Mortgage Options for First-Time Home Buyers

When seeking a favourable home loan, the interest rate is of paramount importance. Home loans are long-term commitments, and even a slight variation in interest rates can accumulate significantly over time. As a first-time home buyer, here are five essential steps to help you compare all mortgage options and secure the best possible deal:

1. Determine Loan Type:

Understanding the type of home loan you need is the first step. There are two primary categories to consider:

- Principal and Interest Loans: This is the most common type of home loan. You make regular repayments that cover both the borrowed amount (principal) and the interest on that amount. The loan is paid off over a specific period, such as 25 or 30 years.

- Interest-Only Loans: These loans involve repayments that, for an initial period (e.g., five years), only cover the interest on the borrowed amount. During this time, you’re not reducing the principal debt. Be cautious, as repayments will increase once the interest-only period ends.

2. Choose the Right Loan Term:

The loan term is the duration you have to repay the loan. It significantly influences your monthly mortgage repayments and the overall interest you’ll pay.

- Shorter Loan Term: Opting for a shorter loan term (e.g., 20 years) leads to higher monthly repayments but reduces your interest payments over the loan’s lifetime.

- Longer Loan Term: A longer loan term (e.g., 30 years) results in lower monthly repayments but may lead to higher overall interest costs. Consider your financial capacity when choosing a loan term.

3. Prioritise the Lowest Interest Rate:

Securing a competitive interest rate is key. Even a 0.5% reduction in interest can save you thousands over time. You can check the average interest rate for home loans in your category and repayment type using data from multiple sources such as the Reserve Bank of Australia or comparison tools.

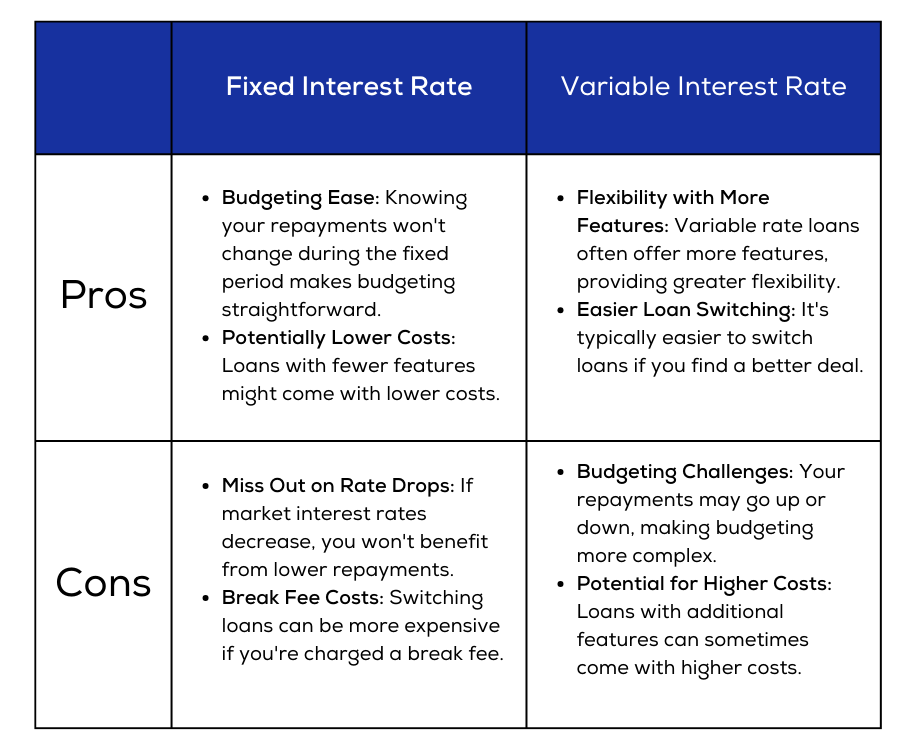

4. Compare Fixed vs. Variable Rates:

Choose between fixed and variable interest rates based on your preference. Here is the comparison table of the pros and cons of each type of interest rate:

5. Consider Partially-Fixed Rates:

If you’re uncertain about choosing fixed or variable rates, a partially fixed-rate (split loan) could be an option. With this, a portion of your loan has a fixed rate, while the rest has a variable rate. You can determine the split that suits your preferences, like 50/50 or 20/80.

#Final Tips

Be mindful of extra features and their costs. Not all features are necessary, and you should evaluate if they are worth the added expense. For instance, an offset account can save you interest if you maintain a substantial balance.

When comparing mortgage options for first-time home buyers, consider what features you genuinely need and what you can do without. Don’t pay extra for “nice-to-have” options if they won’t significantly benefit you.

Calculate a realistic borrowing capacity. With rising mortgage interest rates, give yourself some financial breathing room to ensure you can comfortably meet repayments.

In summary, compare different lenders and their home loan offerings, focusing on interest rates, fees, and repayment features. Utilise tools like mortgage calculators to assess repayments and choose a loan that aligns with your financial goals. If you’re unsure about where to start, consulting a mortgage broker can provide valuable insights and guidance to find the ideal loan for your circumstances.

The Value of Mortgage Brokers

Engaging with a mortgage broker can be invaluable if you’re looking for mortgage options for first-time home buyers. These professionals, equipped with deep market understanding, can steer you towards deals that mirror your needs and also handle the cumbersome paperwork.

A helpful broker does the following:

- Understand what you need and what you want to achieve.

- Figure out how much you can borrow without overstretching.

- Finds mortgage loan options for first-time home buyers that match your situation.

- Explains how each loan works and what it costs, like interest rates and fees.

- It helps you apply for a loan and guides you through the whole process until it’s completed.

That’s where St Trinity comes in, ensuring you select the best mortgage options based on your financial situation and goals.

Bottom Line

Achieving the dream of owning your first home is a common aspiration for many Australians, but it can be a challenging journey, especially when there are many mortgage options to choose from. This is where diligent research plays a vital role. Take the time to conduct comprehensive research, consult with experts for guidance, and carefully weigh the pros and cons to make a decision that aligns perfectly with your unique situation.

Don’t hesitate to contact St Trinity today for personalised expert insights into your mortgage options as a first-time homebuyer.