There has been much discussion in the media recently about the future of the property market, specifically regarding inflation and interest rates. It is crucial for individuals involved in the property market to comprehend the effects that inflation can have on the real estate industry.

Generating passive income through investments is always the ultimate goal, and the property market has always been the go-to destination for savvy investors. However, amidst the uncertain times of increasing inflation, it’s easy to feel hesitant about investing in real estate.

Therefore, it’s important to understand the definition of inflation, how it works, and its true effects on the property market before making any decisions. So, let’s go into the details!

Table of Contents

INFLATION EXPLAINED

What is inflation?

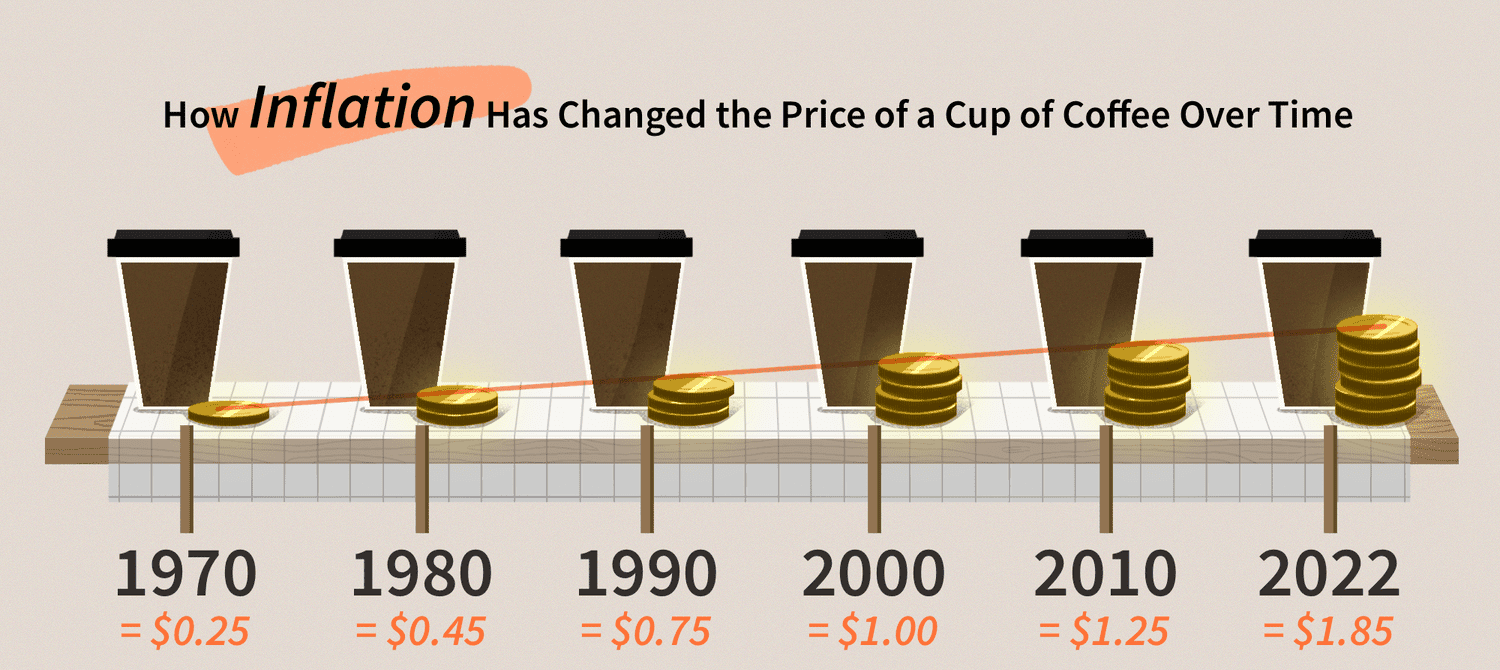

In simple terms, Inflation refers to the general increase in prices of goods and services over time, which reduces the purchasing power of a currency. In other words, as inflation rises, each unit of currency buys fewer goods or services than before. Inflation can be caused by various factors, such as an increase in the money supply, a rise in production costs, or a decrease in the supply of goods and services.

For instance, if the inflation rate is 6.8%, the same basket of groceries that cost $100 last year will now cost $106.8 this year, despite containing the exact same items.

Source: Investopedia

Inflation can have several implications on the real estate market. For one, it can affect the affordability of properties and mortgages, leading to a decline in demand for real estate. However, on the flip side, inflation can also result in rising property prices, leading to increased returns for property owners and investors. We will discuss this in more detail in the next section.

Is inflation the same as appreciation?

The answer is no, these are not the same thing.

Unlike inflation, appreciation refers to the increase in the value of a property over time, which can occur due to various factors such as market demand, upgrades, and renovations, among others. When a property’s value appreciates, it increases in response to market demand, not the power of the dollar.

While both inflation and appreciation can lead to an increase in prices, they are fundamentally different concepts. Inflation is a general increase in prices across the economy, while appreciation is a specific increase in the value of an asset or currency relative to another.

Therefore, while real estate & property can appreciate at a rate higher than inflation, it can also depreciate despite an inflationary economy, depending on various factors affecting the market.

HOW INFLATION AFFECTS PROPERTY?

Affordability

While inflation and interest rates can impact property prices to some extent, their relationship with property prices is not always straightforward or direct.

In some cases, rising interest rates can actually help to control inflation, which can stabilise property prices. Additionally, high inflation rates and interest rates can lead to increased borrowing costs for homebuyers, which can reduce their purchasing power and limit their ability to afford higher-priced properties.

However, this does not necessarily mean that demand for property is decreasing; it can simply mean that buyers may shift their preferences toward more affordable properties or alternative financing options.

As a result, the demand for properties in more affordable sectors, such as units, increases with inflation, leading to an increase in property prices.

Rising rental prices

During periods of high inflation, the cost of living increases. So landlords may need to increase rent to cover the rising costs of maintenance, utilities, and taxes and even their rising interest rates, which can make renting more expensive to tenants.

As a result, buying property is becoming more attractive for not only investors but home buyers that want to get out of the rental rush, which can increase demand for property and cause prices to rise.

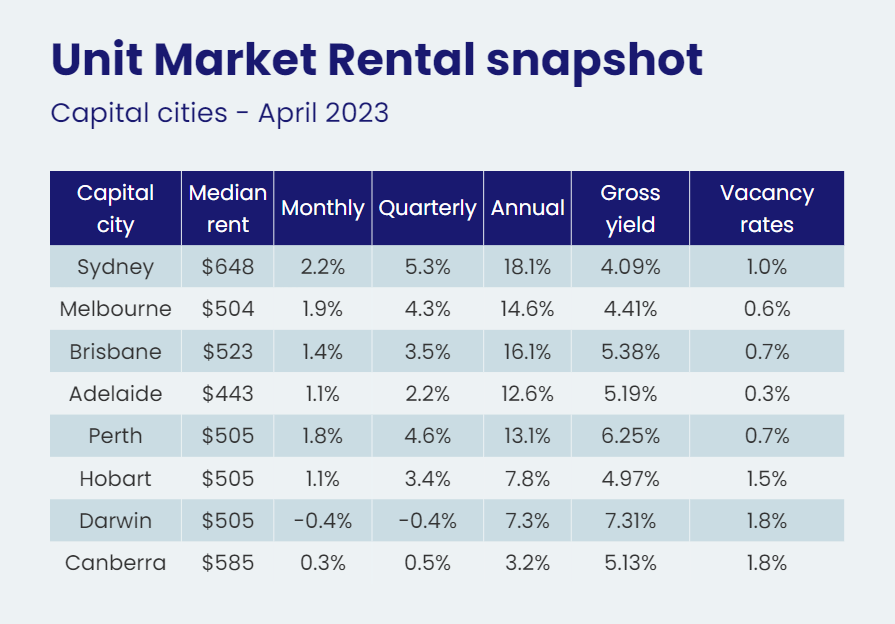

According to CoreLogic’s recent report on Australian Unit Market Update, national rents in the country’s capital cities have increased 14.3 percent, with Sydney leading the trend with 18.1%

Source: CoreLogic

At the same time, across Australia, the vacancy rate remains at its lowest point on record in March 2023 at 0.8%. This demonstrates how fiercely competitive Australia’s rental market is. A renter’s nightmare but an investor’s dream!

Supply and Demand

The property market can be impacted by inflation, leading to a surplus of properties and reduced demand, causing a drop in prices.

However, in Australia we are seeing the opposite is happen due to a significant increase in migrant arrivals.

The Australian Bureau of Statistics reports a 171 percent increase in arrivals, including international students, skilled migrants, and working holidaymakers. As a result, there is now extreme demand for properties in Australian capital cities.

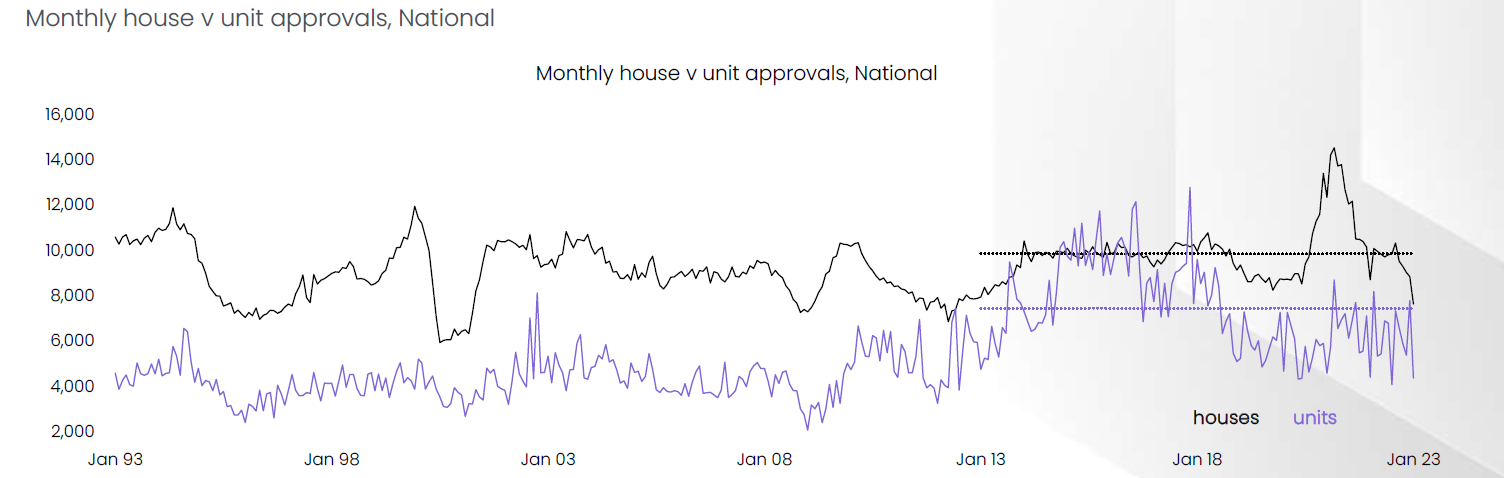

Nevertheless, inflation increases the costs of building materials and labor, which makes it more expensive for property developers to construct new buildings or undertake renovations. This has resulted in a severe decline in construction commencements, such as the completion of only 7,100 apartments in Sydney in 2022 compared to 28,000–30,500 apartments completed in 2017.

Source: CoreLogic

As this situation is likely to continue, especially with the pressure from tourism, overseas migration, and foreign students putting more pressure on the limited supply of residential properties. This can lead to a reduction in the supply of properties, which can contribute to an increase in property prices.

Property Appreciation

According to CoreLogic, in the past few weeks, several data sets have pointed to stronger demand for property, as advertised supply remains low.

Home values are starting to trend higher, as seen in CoreLogic latest report, which has lifted 0.9% since early March.

Looking ahead, the proportion of suburbs recording a rise in values could start to trend higher. If this cycle mirrors historical ones, the higher-tier markets of Sydney and Melbourne are likely to show more suburbs on the upswing over the coming months.

PROPERTY OVER TIME

Over the last few years, our projects have achieved remarkable capital growth. There are multiple regions across Sydney showcasing growth during this period, making them hotspots in the market (All figures are collected from SQM research)

- Sydney CBD: 13.3%

- South Coast NSW: 12.6%

- Liverpool: 10%

- Inner West: 7.9%

- St George: 3.5%

- South West Sydney: 2.5%

According to our Head of Sales, Bianca Anton, our clients are enjoying a strong return on their investment.

- A 3 bed, 2 bath, and 1 car space apartment in Wollongong sold for $735,000 in 2021 and is now valued at approximately $1 million, representing a capital growth of $235,000.

- A 2 bed, 2 bath, and 1 car space apartment in Villawood has experienced a $90,000 growth in value after only 9 months of settlement, representing an 18% increase.

- A 1 bed, 1 bath apartment at Kogarah has seen capital growth of $40,000 in 18 months, after settling in July 2021.

The examples highlighted above provide compelling evidence that real estate is a valuable asset that appreciates over time, even in the face of inflation. By investing in property, you can leverage the long-term growth potential of the market and enjoy the financial benefits that come with it.

ALL IN ALL

The rising rate of inflation can impact the property market in different ways, depending on various factors such as the state of the economy, supply and demand and interest rates. However, by making strategic investments, you can reap the rewards of being in the market and enjoy significant returns over time.

At St Trinity, we specialise in identifying lucrative investment opportunities and helping our clients navigate the complex world of real estate. With our expert guidance, you can make informed decisions about your future and achieve your financial (& property) goals.

To learn more about our services and how we can assist you with your property investments, please do not hesitate to reach out to us by clicking on the enquiry button below. Our team of experienced professionals is ready to help you unlock the potential of your property portfolio.