Throughout this financial year, the property market has seen many positive news. Firstly, the RBA cash rate has remained unchanged since July, instilling stability and confidence. Furthermore, Sydney House Prices are projected to experience a substantial 6.9% increase, indicating a promising outlook for property investors.

In addition to these promising indicators, the market is witnessing a notable influx of new property listings, further enhancing its dynamism and offering many options to potential buyers and investors.

Let’s take a closer look.

Table of Contents

RBA Holds Cash Rate Steady at 4.1%

On one hand, the decision to hold rates is supported by a lower-than-expected inflation outcome for the June quarter, with headline inflation at 0.8%, the lowest quarterly change since Q3 2021. Additionally, retail sales declined by 0.8% in June, and economic conditions weakened, with Q1 GDP growth at just 0.2%.

On the other hand, there are persistent tight labour market conditions, with unemployment at a low 3.5% and strong job growth. Wages are rising well above the decade average, and services inflation remains “sticky,” with the highest annual growth rate since 2001.

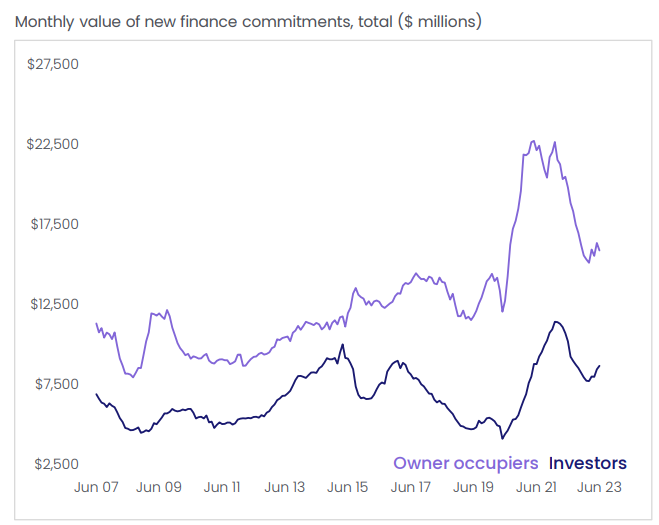

For the housing sector, there is evidence that buyers have become more active despite the highest interest rates since 2012. Housing finance data for May showed the number of home loan commitments was the highest since August last year, and the lending value has been trending upward since March, aligning with the rise in home values.

Source: CoreLogic

CoreLogic’s data shows sales over the past three months slightly exceeded the average of the previous five years. Moreover, the present pause in the RBA cash rate has led to a robust 5.4% surge in the combined value of secured housing finance in May. Notably, lending to first-time home buyers saw a rise of 4.3%, while investment finance experienced a growth of 2.6%.

New Listings Surge, Yet Demand Outpaces Supply

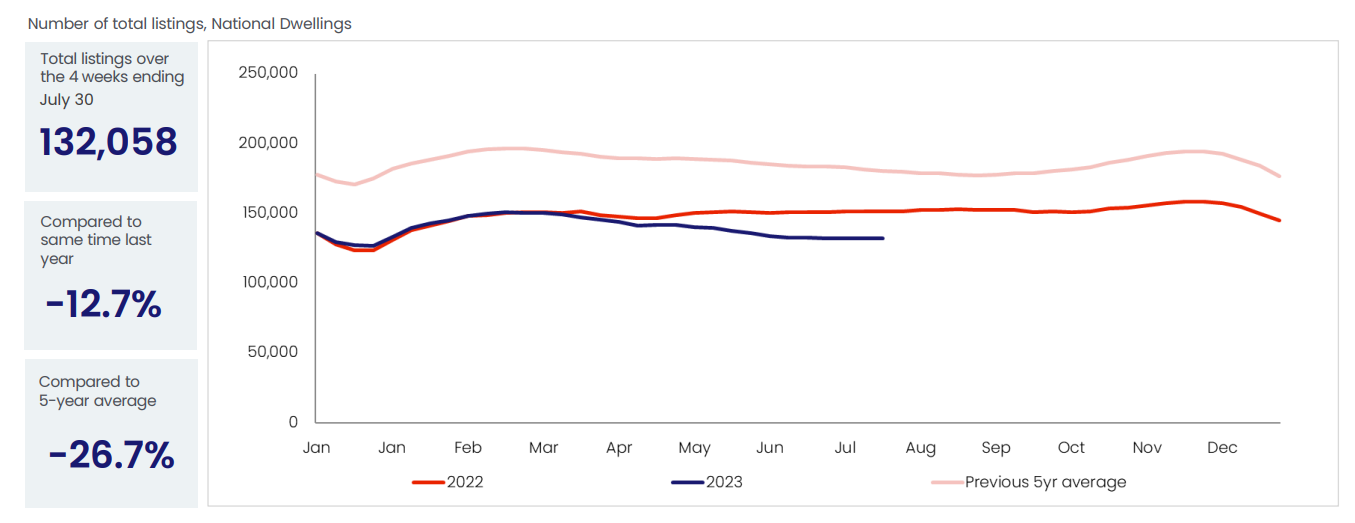

In four weeks up to July 30, the total count of new listings across the country was 33,616. Interestingly, there was a slight upward trend in new listings during July, which is typical for this season.

Particularly noteworthy is the significant rise in newly added property listings in Sydney. This surge in listings has shown a 9.9% increase compared to the same period last year and a remarkable 18.0% surge above the previous five-year average.

However, the total number of listings currently falls below the average of the past five years, primarily due to robust sales activity. Additionally, it’s important to highlight that the overall levels of available properties remain limited, indicating a decrease of 18.3% from the previous year’s figures and a notable 23.3% decline from the last five-year average.

Source: CoreLogic

Tim Lawless, the Research Director at CoreLogic, stated, “The ongoing decrease in total stock levels indicates that the demand is matching the growing influx of new listings entering the market.”

While it’s positive to see an increase in new property listings, it’s essential to note that the number of buyers is also rising. This indicates that the demand is keeping up with the pace of supply.

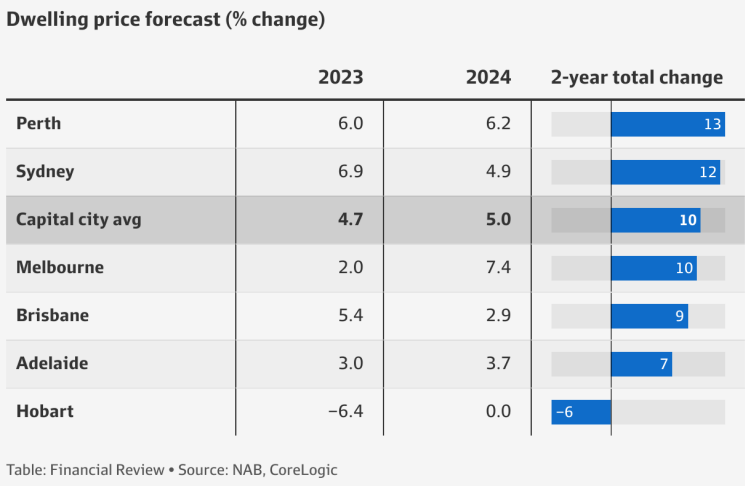

Sydney Property Prices Expected to Increase by 12% in Two-Year Period

Despite several economic challenges, the Australian property market is impressively resilient, defying earlier downturn predictions. In this ever-changing environment, the National Australia Bank (NAB) has adjusted its house price forecast due to the market’s unexpected strength, despite possible rate hikes and economic fragility.

Source: NAB, CoreLogic

Similarly, Westpac has revised its forecasts, anticipating stability in dwelling values for 2023 (projected initially a 7% decline), followed by a 5% increase in 2024.

According to NAB Group Chief Economist Alan Oster, the substantial increase in housing demand has played a significant role, as population growth bounced back considerably after international borders reopened in early 2022.

“We have adjusted our dwelling price expectation due to the recent resilience and the anticipation of robust housing demand shortly, all while supply growth remains constrained by higher rates and supply-side pressures,” he said.

Rising Apartment Rents: 13% Surge Expected Amidst Supply Shortfall

Across the combined capitals, data shows rent values have increased in more than 90% of Australian markets in the past year.

The unit sector continues to exhibit the most robust rental conditions, with rents increasing by 2.9% over the three months leading up to July on a national scale. This compares to a 1.9% rise in house rents.

From January 2022 onwards, the unit sector within the capital cities has consistently demonstrated a greater rate of appreciation in comparison to houses. This trend can be attributed to various factors, including more economical unit rents, heightened demand for medium to high-density housing, and limitations in supply due to approvals remaining below the decade’s average since 2018.

According to CoreLogic, the average rent for units in the inner west is currently sitting at $694 after rising by 21.5% in the past 12 months or $123 per week. The vacancy rate tightened to 1.3% from 1.9% a year ago.

Tim Lawless, CoreLogic research director, said rental growth seemed to have peaked in most inner-city areas, despite vacancy rates remaining below average.

“It’s fair to say demand for rental housing is likely to remain high as overseas migration, foreign students and domestic renters compete for scarce rental supply, and we are yet to see any material uplift in rental supply,” Mr Lawless said.

“The rise in first home buyer lending could point to more renters fast-tracking their home purchasing decision if they have the financial ability to do so.”

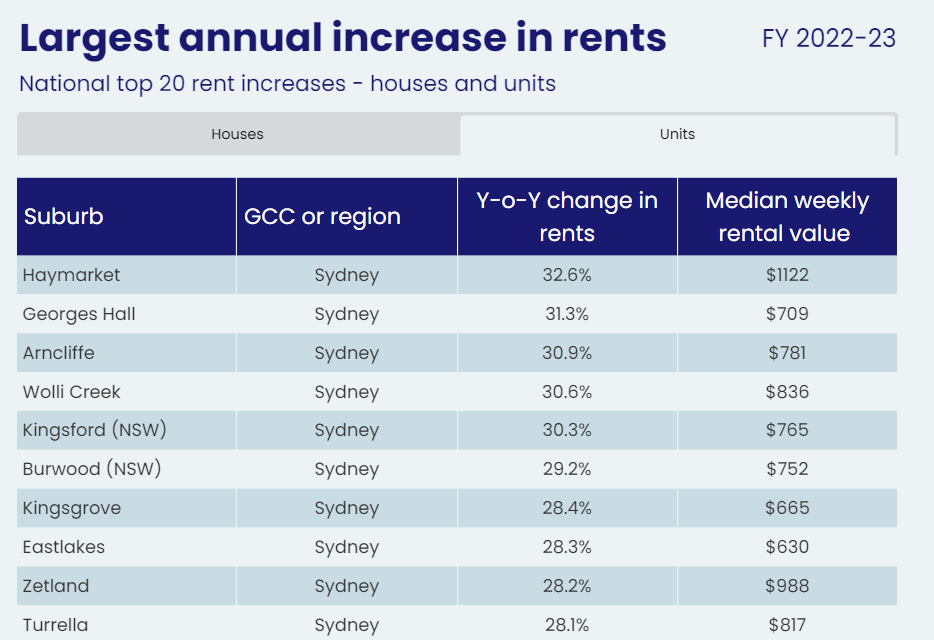

Within the list of the top 10 unit rental markets with the highest annual growth, all are concentrated in Sydney. Remarkable surges of over 30% have been observed in Sydney’s Kingsford and Haymarket regions.

Top 10 most significant annual increases in rents (Source: CoreLogic)

These areas are expected to attract many international students due to their proximity to major universities. Additionally, these leading unit rental markets boast excellent transportation facilities, proximity to the CBD, and a wealth of amenities. As a result, they are likely experiencing high demand from both international and interstate migrants, as well as young professionals.

What’s next?

Amidst the positive news in the property market and the RBA cash rate remaining on pause, potential buyers are pondering whether now is the optimal time to enter the property market. It’s important to note that there is no one-size-fits-all answer for everyone. However, one certainty remains: property prices tend to rise and appreciate over time.

Supported by CoreLogic’s data, the housing market experiences cycles of growth and decline, but the overall long-term trend is undoubtedly upward. On a national scale, dwelling values have soared by 382% over the past 30 years, translating to an average annual increase of 5.4% since July 1992.

Moreover, based on projections for dwelling prices in the upcoming 2023 and 2024 calendar years from PropTrack, Sydney is among the regions predicted to experience an increase ranging from 3% to 6%.

While this is a projection, it’s worth considering a more comprehensive and long-term approach rather than attempting to align your property purchase with market cycles. If your income remains stable and the circumstances align, the current market could present an advantageous opportunity to secure your position in the property market.

To maximise your time in the market, don’t hesitate to contact our team at St Trinity now at (02) 9099 3412.