The Australian property market is off to a hot start into 2023. Kicking into gear, our team is seeing strong numbers of buyers inspecting and inquiring about new properties a bit earlier this year than expected.

Strong demand has come back to apartments and “lifestyle living” as the affordable option, paired with the January 16th rollout of The First Home Buyer Choice (NSW), home buyers now have more opportunities than ever before.

Let’s take a deeper look at what is currently happening in the market.

Table of Contents

Interest Rate Rises

On the first Tuesday of February, the Reserve Bank of Australia (RBA) announced the first interest rate rise in 2023. The official cash rate was lifted by 25 points to 3.35 per cent for the ninth time in the recent round of rate hikes, driven by an inflation rate of 7.85%.

It’s still unlikely that this will be the final increase in 2023, as RBA Governor Philip Lowe has signalled additional hikes to the official interest rate this year in an effort to reduce inflation.

“The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary,” he said in a statement.

As a result, economist experts from some of the biggest banks have updated their predictions, but all seem to be in agreement that there will be one or two more cash rate increases before things stabilise.

- Westpac: 3.85% in March 2023 then drop to 2.85% Nov 2023

- NAB: 3.6% March 2023 and remain steady until 2024

- CBA: 3.85% April 2023 then drop to 2.6% Dec 2023

- ANZ: 3.85% by May 2023 then drop to 3.6% by Nov 2024

*Please note that these are simply forecasts and that the big 4 banks may update them. Figures are correct at time of publishing.

What the media didn’t tell you – The REAL truth

For homebuyers, increasing interest rates mean that over the next 12 months, you will be experiencing higher repayments on your home or investment property. However, this would be offset by a massive increase in rent and tax refunds because of the rising interest rates.

Many forecasts say that property prices will fall because of the rising interest rates. However, considering the current state of the economy, our financial health and property markets, there’s no credible reason to suggest a crash in the property market.

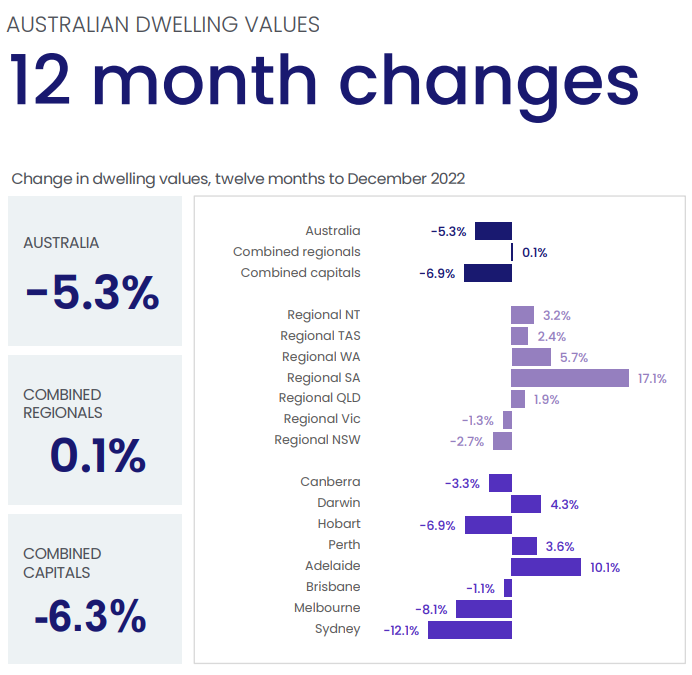

In fact, after 9 straight interest rate increases, the market only fell by 5.3%, much smaller than the previous growth we experienced in 2020 – 2021.

Source: CoreLogic Home Value Index

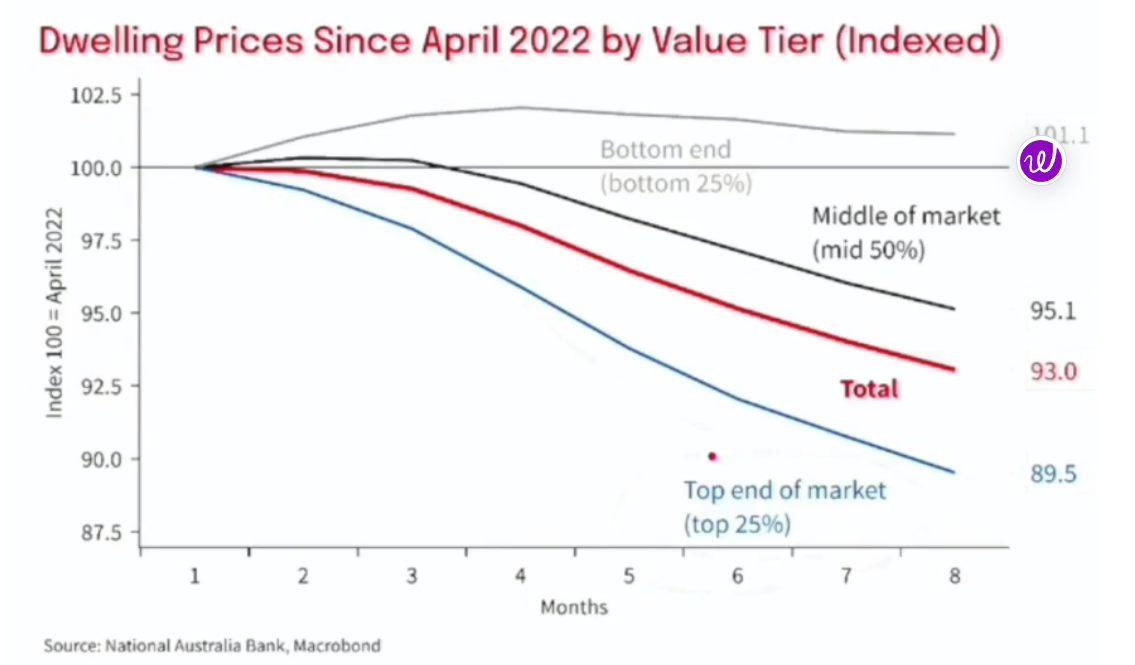

Additionally, the most expensive properties—including luxury homes and land—are those whose prices have fallen the most. The more affordable sector of apartments, towards the bottom end is very resistant in price.

So if you have the capacity to buy or invest, now is the right time!

In Australia, a variety of discounts on stamp duty and other purchase incentives are offered. The First Home Buyer Choice initiative, which was launched in NSW earlier this year, is one new incentive that has replaced lockdown-era subsidies like the HomeBuilder grant.

It gives first-time home buyers the option of paying stamp duty or a land tax based on the property’s value.

Alastair Mairs, a buyer’s advocate at The Property Bureau, suggested that for some buyers, waiting for ideal conditions was a waste of time.

“If you’re buying [a house] at $1.5 million it’s a lot different, but if you’re buying in the apartment market it hasn’t really moved in the past decade,” he said. “If they’re waiting for the apartment market to crash, it won’t.”

As soon as the RBA stops raising rates, according to Waters, fear of losing out would start to drive up prices.

“My anticipation is, once we get through this rate increase cycle, which has been vicious, but once rates top out that will give a degree of confidence to buyers.”

Our Current Property Market

CoreLogic’s National Home Value Index (HVI) decreased by 1.0% in January, which is the smallest month-on-month decrease since June of last year and a slight improvement over the 1.1% fall seen in December.

The reduction in the rate of decline was evident across most capital cities, except for Adelaide (0.8%) and Perth (0.3%), where property values have remained firmer since interest rates began to rise in May 2022.

CoreLogic Research Director Tim Lawless said although the housing downturn remains geographically broad-based, there are signs some momentum has left the housing downturn.

Sydney’s median dwelling value dropped below $1 million for the first time since March 2021, falling 1.2% in January, an improvement on December’s 1.4% decline.

Despite the current figure, Mr Lawless stressed the importance of understanding this downturn in context.

“Record declines in home values follow a record upswing in magnitude and speed. The national HVI was up a stunning 28.6% in the space of just 19 months,” he said.

“Despite the recent sharp drop in values, every capital city and rest of state region is still recording home values above pre-pandemic levels, although Melbourne’s index would only need to fall a further 0.4% before equaling the March 2020 reading.”

As we touched on in our last ‘market update,’ we have seen the following:

- A further price decrease across Australian property markets.

- RBA Interest rate hikes this month and potentially in the upcoming months.

- Strong demand in the rental market pushes more renters to purchase.

- Immigration levels are the highest they’ve ever been, even pre-pandemic.

- Building approvals take up to twice as long.

- Supply Vs Demand issues in the building sectors, seeing demand outweigh supply.

This perfect storm coupled with a split in the housing vs apartment market has certainly seen strong demand come back to apartments.

What Will February bring?

As we look ahead to the remainder of 2023, there are a few key trends to keep an eye on. Firstly, rental demand is expected to stay strong, due to an increasing number of renters staying in the market rather than buying property.

Many agents & developers have been launching post “Holiday Period”, with the properties they held until 2023 officially kicked into gear. The 31st of Jan officially brings to a close the stigma of ‘holidays’, and now the beginning of Feb beings “Business as usual”.

As many are predicting, we will likely see Interest rates continuing to rise for one or two more months, then will begin to stabilise. A higher cash rate would mean higher interest rates for home loans and business loans, which would be expected to lead to lower spending, which in turn should put downward pressure on inflation.

In conclusion, the Australian property market is in a very strong position heading into 2023 and beyond. With low vacancy rates & high rental yield, strong population growth, and increased demand for property, the market is expected to remain robust and continue to provide strong returns to investors.

With the right research and knowledge, investors can take advantage of the market’s positive outlook and make smart investment decisions.

Have any questions? Or interested in purchasing property?

Chat with our team at St Trinity today for all your property needs at (02) 9099 3412 or enquire below.