The Australian Tax Cuts of 2024 are poised to reshape the financial landscape, offering relief to taxpayers and sparking potential opportunities, particularly in the property sector. As part of the government’s comprehensive three-stage financial policy, the Stage 3 tax cuts, scheduled for implementation on 1 July 2024, promise equitable benefits across various income brackets.

In this article, we delve into the details of these tax adjustments, exploring their implications for individuals and shedding light on their potential influence on the property market. Let’s navigate through the stages, understand the proposed changes, and analyse the broader impact, especially on property investments.

Table of Contents

Effects of Stage 1, Stage 2 and Stage 3 Tax Rates

Stage 1 and Stage 2 have brought many benefits and tax relief to Australian taxpayers nationwide since its effect commencing in 2018.

For all three stages, the main objective has been to provide relief to taxpayers and stimulate economic growth. The government is working to boost consumer spending, enhance household budgets, mitigate the impact of tax bracket creep, and promote economic activity.

The initially proposed Stage 3 plan had started quite the conversation with lower income earners, as their bracket was being provided the least relief.

In response, the government recently published a redesigned Stage 3 plan that aims to deliver equitable tax benefits across all average income brackets while levelling the grounds for positive economic stability and increasing investment opportunities in Australia.

If the proposed changes are accepted, we can look forward to the forthcoming tax adjustments stated to take effect from 1 July 2024.

As such, understanding adjustments to tax brackets, offsets, rates and thresholds is a primary force that can maximise your investment returns and financial freedom.

Tax Rates in Financial Year 2018 – 2020: Stage 1 and Stage 2 Rundown

Stage 1:

Implemented in Financial Year 2018 – 2019, Stage 1 aimed to provide tax relief by adjusting tax brackets and introducing a Low and Middle Income Tax Offset (LMITO). The LMITO was designed to benefit low and middle-income earners, providing a maximum offset of $1,080 for those earning between $48,000 and $90,000.

Stage 2:

Succeeding in the Financial Year 2022, Stage 2 involved further adjustments to tax brackets, leading to additional tax relief for middle-income earners. The plan raised the income threshold for the 32.5% tax bracket, lifting the higher threshold from $87,000 to $90,000.

Tax Rates from 1st July 2024: Stage 3 in Discussion

Stage 3 is proposed for implementation in the Financial Year 2024 – 2025, as per the newly structured plan that comes with tax bracket adjustments to ensure fairer tax relief across different income groups.

The redesign sets the tax threshold at the median income of $146, 486, with lower-income earners getting the better end of the bargain while those earning above this threshold having to pay higher than what was outlined in the original plan.

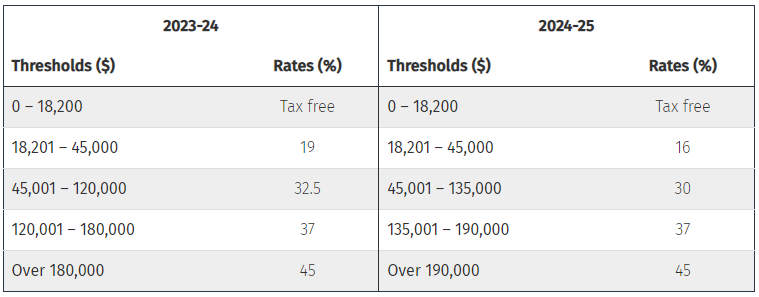

The redesign brings the 32.5% tax bracket down to 30%, whilst extending the top threshold of this bracket to $135,000, extending benefits to a broader range of taxpayers. Additionally, the plan increases the threshold for the 45% tax rate from $180,000 to $190,000, further contributing to fairer taxation.

These figures offer a fairer benefit to all income earners than the previous plan, which was notorious for skewing benefits in favour of higher-income groups.

Here’s a comparison table highlighting key changes:

Source: Treasury, Australian Government

Who Benefits from Stage 3 Tax Cuts

The revised tax cut plan benefits all taxpayers, emphasising larger cuts for those earning less than $150,000 annually. The government retains the 37% tax rate on a broader income bracket, ensuring a more equitable distribution of tax relief.

For instance, someone with an $80,000 annual salary receives a tax cut of $1679, compared to the original plan’s $875. In contrast, a person earning $200,000 annually now gets a tax cut of $4529, reduced from the initially envisaged $9075.

The redesigned stage three is estimated to provide relief to 13.6 million taxpayers, focusing on those facing higher living costs.

Additionally, demographic analysis suggests that factors affecting income brackets, such as your generation, job type, gender, and occupation impact tax cuts through Stage 3.

Here’s how:

Gen Z Comes Out on Top

Australia’s youngest workers, Generation Z (aged 24 and under), are expected to benefit the most from the proposed Stage 3 tax cuts.

Data from the Australian Tax Office reveals that about 99% of Gen Z’s 1.9 million workers had taxable incomes below the average of $146,485 in FY 2021.

Gen X Faces Limited Gains

In contrast, Generation X (aged 40-54 in 2021) has the smallest share of workers set to gain significantly from the changes, although it’s still notable.

Roughly 88% of Gen X’s 4.2 million workers are expected to receive a bigger tax cut under the new plan than under the original.

Impact on Gender:

The tax plan aims to ensure that 5.8 million women, constituting 90 per cent of female taxpayers, receive larger tax cuts, as per a media release by the Prime Minister.

Majority of Occupations to Benefit:

More than 99% of workers across various occupations are projected to benefit from the redesigned tax plan.

Jobs with median taxable incomes below $146,486, which constitute the majority, will witness most workers gaining from the proposed changes.

Winners Outnumber Losers:

Across Australia’s 2,600 postcodes, those expected to benefit from the tax cuts significantly outnumber those who may miss out, without exception.

A majority of postcodes where winners outnumber losers significantly are in regional and rural areas.

Data analysis suggests that over 10 million Australians will benefit from the tax cuts, with less than 2 million potentially facing reduced benefits compared to the original tax system.

Source: ABC, Ministers Treasury

Stage 3 – Australian Tax Cuts of 2024 & its Impact on Property Investment

The new Australian tax cuts of 2024 will heavily impact property investments as indicated by the increased disposable income per capita. This demand could contribute to a reduction in distressed property listings and improve market sentiment.

Increased demand

Individuals earning between $50,000 and $90,000 annually could see an average tax reduction of $1,080 per year, providing them with additional disposable income to potentially save or invest in property.

This additional disposable income is likely to increase property inquiries and purchase intentions, exerting an upward pressure on property prices that translates into favourable returns for existing property investors.

The injection of disposable income into the market is forecasted to stimulate housing market activity. Industry experts suggest a 25-30% increase in housing construction and development activities over the next financial year.

Increased Borrowing Capacity

As per insights from the AFR, the proposed tax cuts have the potential to bolster borrowing capacity for middle-income groups and higher-income groups by 6% and 5% respectively.

For instance, someone earning $100,000 annually could potentially borrow an additional $23,969, while someone earning $200,000 could potentially borrow an additional $49,819.

The surge in borrowing capacity can lead to higher property demands as individuals can afford larger mortgages.

Related

- Find out how you can get started in property by understanding the property buying process.

- Learn more about Australia’s property future and RBA’s February Market Update.

In summary, the Australian Tax Cuts of 2024 is going to mark a pivotal moment in fiscal policy, promising equitable relief and stimulating economic activity. With a focus on fairness and broad benefits, the redesigned Stage 3 plan ensures relief across income brackets, benefiting Generation Z, various occupations, and female workers. Geographical analysis reaffirms widespread benefits, particularly in regional areas.

The impact of this tax reform on property investment can provide increasing disposable income, thus fueling demand and expanding borrowing capacity. This surge is expected to reshape the property market, reducing distressed listings and fostering growth through 2024 – 2025.