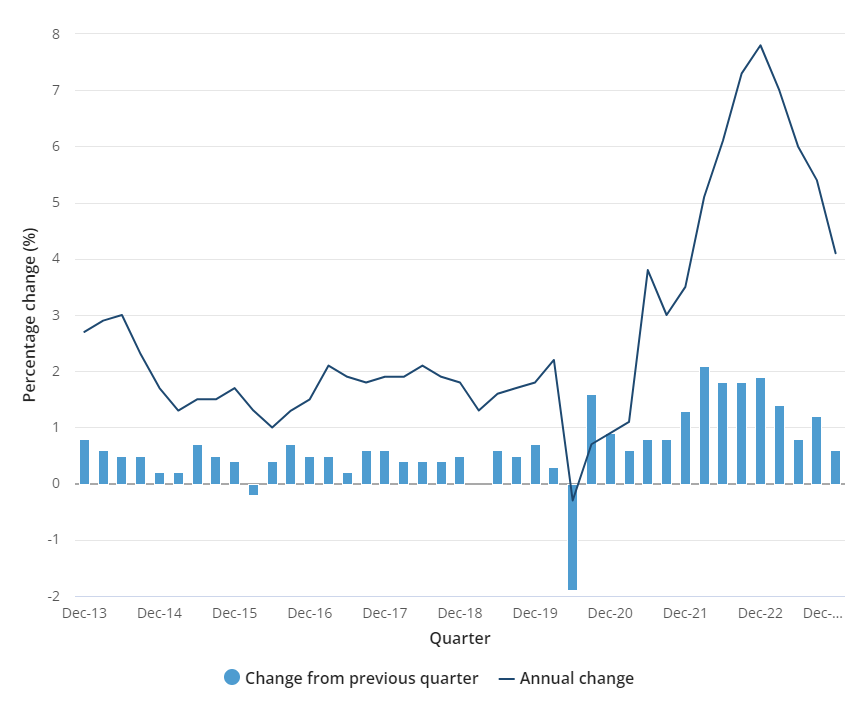

As the Reserve Bank of Australia’s (RBA) February announcement unfolds, new data on inflation emerges, influencing expectations in the property market. The Consumer Price Index (CPI) reveals a notable decline, prompting speculation about potential interest rate cuts and their impact on property prices and the housing market.

In addition to the RBA’s deliberations on the cash rate, the latest data from the Australian Bureau of Statistics (ABS) highlights a significant drop in annual inflation.

“While prices continued to rise for most goods and services, annual CPI inflation has fallen from a peak of 7.8 per cent in December 2022, to 4.1 per cent in December 2023.”, said ABS head of prices statistics Michelle Marquardt.

Due to high Christmas spending, financial markets were expecting December’s Inflation figure to come in higher. In the backdrop of the unexpected fall in annual inflation, this sparks hopes that the RBA will consider interest rate cuts over the coming months to stimulate economic activity, particularly in the housing sector.

Table of Contents

Inflation and Interest Rates

The faster-than-expected decline in inflation has bolstered expectations that the RBA may refrain from adjusting interest rates in it’s February meeting with potential rate cuts on the horizon.

Eliza Owen, CoreLogic’s head of research, suggests that lower interest rates are likely to boost housing demand, providing relief to potential homebuyers burdened by high interest costs.

“A reduction in interest rates is likely to boost housing demand. As seen in the rental market, fundamental demand for housing is very strong but demand for home purchases has been influenced by high interest costs and limited borrowing capacity,” she said.

Source: ABS

RBA Announcement – 6th February 2024

As the cash rate has remained at 4.35% for 2 months since December 2023, consumers have seen minimal reprieve. In the Reserve Banks February Statement it announced, “At its meeting today, the Board decided to leave the cash rate target unchanged at 4.35 per cent.”

“While recent data indicate that inflation is easing, it remains high.”

The Reserve Bank’s February statement emphasises that the Board anticipates it will take some time before inflation consistently falls within the target range. The path of interest rates, crucial for steering inflation back to the target, will be guided by ongoing data and assessments of risks. Importantly, the statement highlights that “a further increase in interest rates cannot be ruled out.”

This consistency can offer home buyers some relief by maintaining the current level of interest rates, preventing any immediate increases in the cost of borrowing.

As a home buyer, it’s crucial to stay informed about economic dynamics. Many industry professionals are predicting this is the peak of interest rates.

“This is the peak for the cash rate, and I actually think everyday Australians will assume that too,” says Domain chief of research and economics Dr Nicola Powell.

Overall, for home buyers, the steady cash rate signals a temporary respite from fluctuations, providing a window of opportunity to make informed decisions about property purchases with a clearer understanding of the current interest rate landscape.

Impact on the Housing Market

Lower interest rates over the coming months could make it easier for people to buy property, but there’s a concern that this might lead to too much excitement in the housing market.

Rental Market Insights

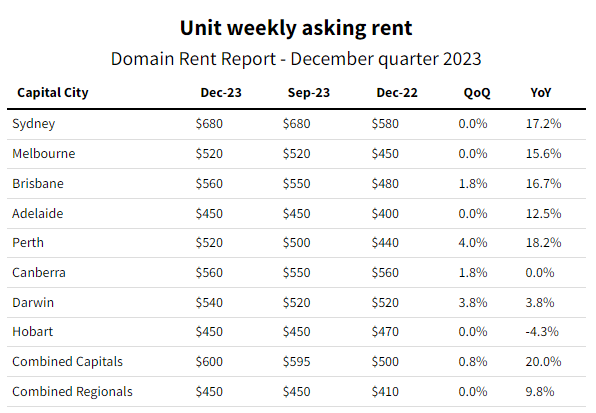

Source: Domain

Rental prices, despite a 0.9% rise in the December quarter, shows signs of moderation compared to the previous quarter. Changes to Commonwealth Rent Assistance have influenced this moderation. If you exclude these changes, rental prices would have increased by 2.2%, indicating the complexities in interpreting rental market trends.

In Sydney, the average asking or advertised weekly rent for units has experienced a significant surge of 17.2% over the past year, reaching $680, according to Domains recent report.

Simultaneously, vacancy rates across the country have remained fairly stable at 1.3% to December 2023.

Property Markets in Sydney & Brisbane fully recovered from downturn in 2022

House prices in Sydney and Brisbane are at record highs, along with Unit prices in Canberra, ending 2023 fully recovered from the 2022 downturn. An established recovery is well underway for Sydney and Melbourne unit prices – with Sydney likely to hit a new record in the first quarter of 2024.

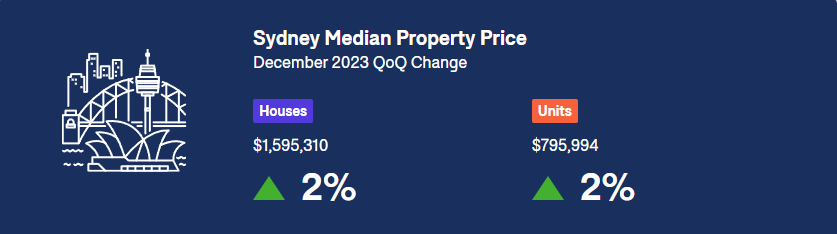

Source: Domain

Across several capital cities, there has been substantial growth in house prices with Adelaide taking the lead with an impressive 12.7% annual increase. Closely followed by Perth at 11.9%, and Sydney at 10.6%. Notably, record high property prices have been observed in capital cities, with Sydney averaging $1,595,310, Brisbane – $888,285, Adelaide – $875,034, and Perth – $742,390, according to Domain.

In Sydney, there is a significant price gap between houses and apartments. Currently, the average property price for a house stands at $1,595,310, while an apartment is priced at $795,994, translating to the cost of a house being twice that of an apartment.

Effect on Property Demand

Migration to Australia: The New Policy

Rental dynamics in Australia underwent a significant transformation as the government took measures to address the migration bottleneck accumulated during the COVID-19 years.

Over the 12 months leading up to September 2023, net migration to Australia surged to approximately 500,000, surpassing the Treasury’s projection of 400,000, with a predominant influx of international students, as reported by the ABS.

In response to this unprecedented influx, the government unveiled the new Migration policy for 2024, aiming to curtail Net Overseas Migration (NOM) to 375,000 in the next financial year (2023-2024) and further reducing it to 250,000 in 2024-2025.

The expectation is that these numbers will stabilise at the lower level from that point onward. The 2023-24 permanent Migration Program strategically addresses persistent and emerging skills shortages, targeting individuals with specific skill sets currently lacking in Australia.

The implications of this shift in migration policy are noteworthy. Some predictions indicate that rental prices are poised to experience an immediate decline in the next year and subsequent years, however with the focus on skilled migrants and the push for settlement in regional areas, there is still rental growth to come in certain regions of the country.

Migrant Trends: Renting to Owning over the long term

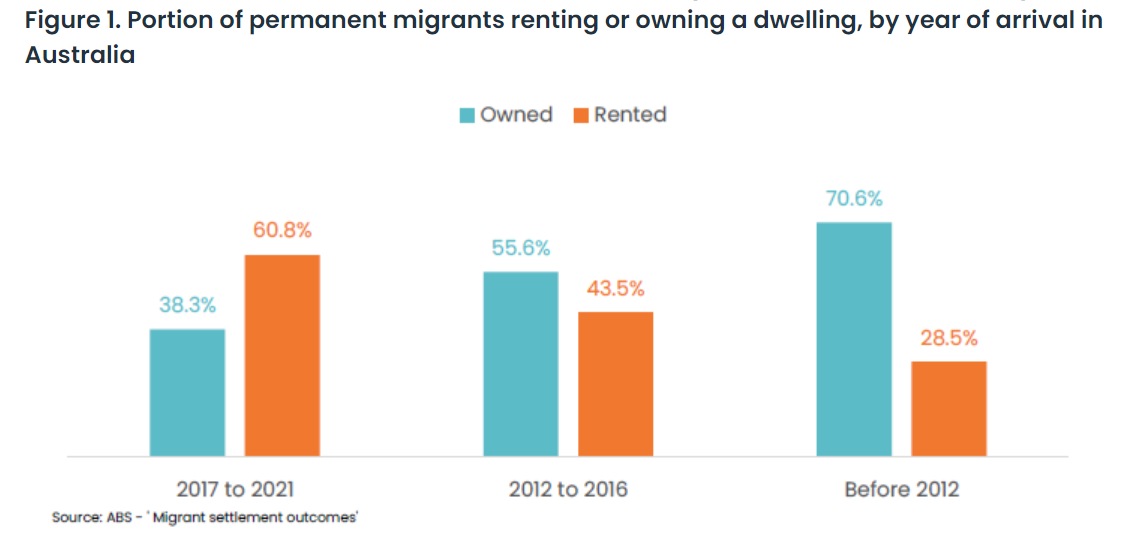

Source: ABS

The provided data on homeownership trends among migrants in Australia, as per the ABS, carries significant implications for the country’s property market. The statistics highlight a notable correlation between the length of time migrants have resided in Australia and their likelihood of becoming homeowners.

Analysing the migrant settlement data for different time periods when individuals moved to Australia, we observe distinct shifts in homeownership rates:

- 70.6% homeownership for those moving to Australia prior to 2012

- 55.6% homeownership for those moving to Australia between 2012 & 2016

- 38.3% homeownership for those moving to Australia between 2017 & 2021

The lower homeownership rate for more recent migrants has the potential to increase the demand for rental properties. This shift could influence rental market dynamics and investment opportunities for property owners and investors.

Supply-side Dynamics and Housing Challenges:

A significant factor contributing to the current surge in Net Overseas Migration is the temporary restriction imposed from March 2020 to March 2022. The sudden reopening of borders in 2023 resulted in a substantial population influx, creating a strain on housing supply.

Addressing this challenge, the national cabinet aims to construct 1.2 million new homes over the next five years starting from July 1, 2024. The strategy involves collaboration with private developers, leveraging relaxed planning and zoning rules to encourage higher-density constructions.

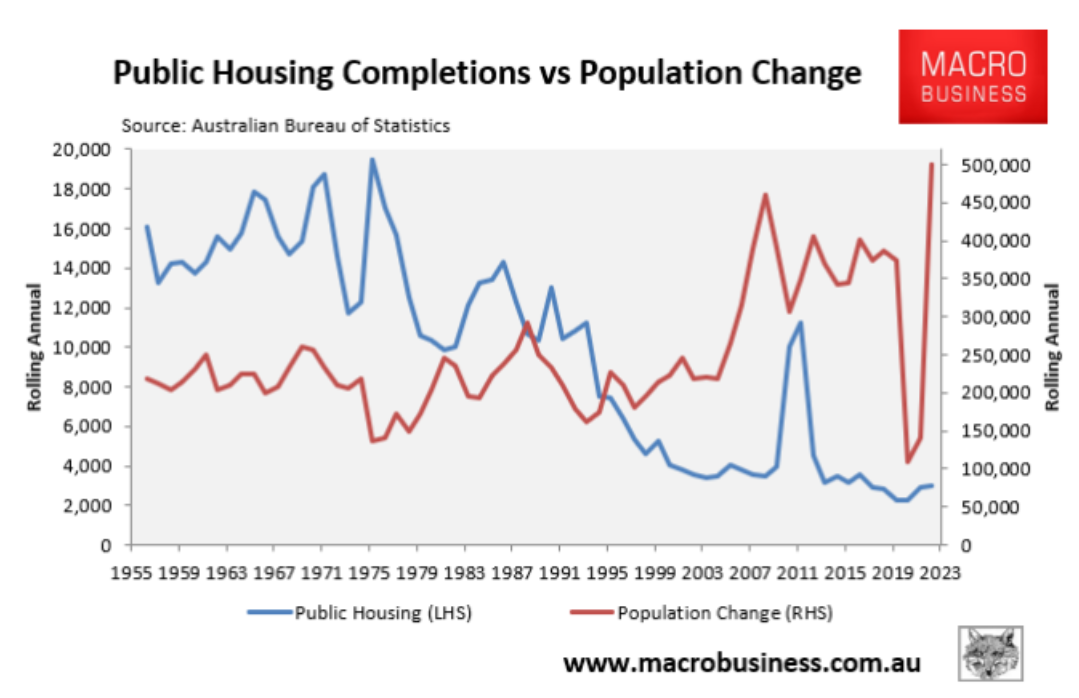

Source: Macrobusiness

The graph underscores the notable increase in population, particularly in the 2022-23 period. While there’s a lag in the real estate market’s response to economic changes, the anticipation is that more houses will be built in the coming years, gradually easing the current housing crisis.

However, merely increasing the number of houses may not be the sole solution. A report by the Daily Telegraph emphasises the accumulated shortfall in essential infrastructure, including roads, public transport, hospitals, and schools, demanding attention and improvement.

Barriers to new construction

Constructing new homes faces hurdles such as escalating construction costs and completion uncertainties. Addressing these challenges, the Migration Policy 2024 aligns with the role of migrants in providing crucial skills and labour, as evidenced by the inclusion of the “Skills in Demand” visa in the 2023-24 permanent Migration Program, aimed at mitigating the shortage of laborers.

The challenge of constructing new properties is intensified by the scarcity of available land, especially in popular urban areas where land prices are skyrocketing. This scarcity forces developers into a tough position, needing to strike a balance between making homes affordable for buyers or renters while still ensuring profitability.

The limited land availability, coupled with high demand, contributes to the ongoing rise in property prices. As developers navigate these dual challenges, the real estate market experiences an upward trend in property values, creating a more intricate landscape.

“Priority Growth Areas and Precincts” in NSW

In response to housing challenges, the New South Wales (NSW) government introduces “Priority Growth Areas and Precincts” as a strategic initiative. This approach focuses on revitalizing specific Sydney areas, including Greater Parramatta, Macquarie Park, Glenfield, Leppington, among others.

Emphasising strategic planning, this initiative is poised to surmount financial obstacles and uncertainties, fostering the development of large-scale residential projects in designated growth areas.

Overseas investors

China Remains a Dominant Force in Australian Real Estate Investment

China has maintained its position as the primary source of investment in residential real estate proposals. The growing interest is linked to China’s strict COVID-19 regulations and President Xi Jinping’s focus on achieving “common prosperity.”

Australia limits foreign buyers to acquiring new or off-the-plan residential properties, which has the potential to boost the appeal of new projects in emerging areas nationwide. These restrictions, coupled with China’s affluent individuals seeking more hospitable environments, contribute to the rising popularity of destinations like Singapore and Australia.

Conclusion

In summary, the Reserve Bank’s choice to keep interest rates at 4.35% brings a short-term relief for homeowners and potential buyers. The lowering inflation suggests the chance of future interest rate cuts, making payments more manageable and offering growth potential for property portfolios.

However, tighter migration policies, especially for skilled migrants, may alter the housing market dynamics. The expected decrease in overseas migration could ease pressure on smaller, more affordable housing options.

While this could benefit homeowners, it’s crucial to note that skilled professionals with higher purchasing capacity might influence demand for larger properties in sophisticated areas.

The government’s plans for ambitious housing construction aim to address population surges but face challenges like infrastructure deficits and limited land availability. Initiatives like “Priority Growth Areas and Precincts” in NSW focus on strategic planning to overcome these hurdles.

The RBA’s decision provides a brief stability, but the interplay of inflation, migration policies, and overseas investments creates a dynamic outlook for Australia’s property market. Success in this environment requires adaptability and a clear understanding of evolving economic factors shaping the future of real estate in the country.

Contact us today to make informed property decisions.