Over the last few years, the Australian real estate market has witnessed an increasing price gap between houses and apartments. This has led to a significant price gap, raising questions about what’s causing it and what it means for people looking to buy a home.

Table of Contents

Price Gap Between Houses and Apartments Widens

Australia’s housing market is bouncing back after the pandemic, and prices are increasing fast. New data from CoreLogic says the gap between house and apartment prices has grown by 45% in the past four years.

Between March 2020 and January 2024, house prices in capital cities went up by 33.9%, approximately $239,000. On the other hand, apartments only grew in value by 11.2%, approximately $65,235 more. Just in the last year alone, house prices increased by a staggering 11% ($93,552), while apartment values grew by 6.9% ($41,789).

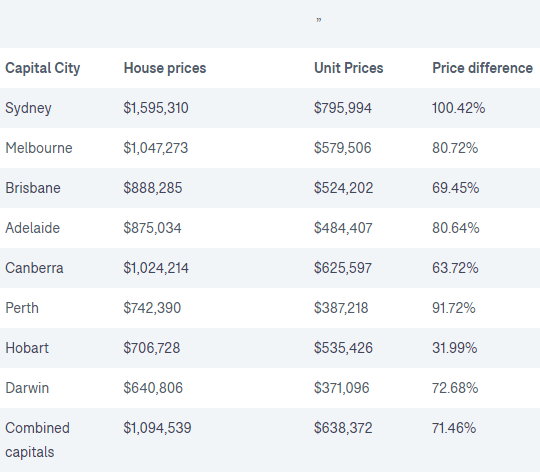

Moreover, Domain’s latest house price report states that the cost of a house is almost double that of an apartment in Sydney & Perth, with median house prices standing at 100.4% and 91.7% higher respectively. Meanwhile, Hobart has the smallest difference, with houses being only 31.9% more expensive than units.

So, if you’re thinking about buying property, now might be a good time to consider getting an apartment. They’re still going up in price, but offer an affordable entry point or investment into the market.

Are house prices dropping?

This question looms large over the Australian real estate market as we’ve witnessed an increasing price gap between houses and apartments, raising significant concerns about property predictions in 2024, the property market trends and the 2024 housing market predictions.

7 Factors Behind the Price Gap Between Houses and Apartments In Australia

While a price gap between houses and apartments is expected, the current difference is unprecedented. The two possibilities driving the change are either; an overvaluation of houses or an undervaluation of units.

Let’s take a look at some factors contributing to this trend:

1. Changing Buyer Preferences

Since the onset of the pandemic, there has been a notable shift in buyer preferences towards properties with larger living spaces and outdoor areas. Remote work trends have intensified this desire, leading to a high demand for detached houses over apartments.

With many companies now mandating employees back into the office at least on a part-time basis, the market preferences may shift again.

2. Supply and Demand Dynamics

The oversupply of units in inner-city suburbs, coupled with reduced demand due to pandemic-related factors has contributed to slower unit price growth compared to houses.

Additionally, record-low interest rates and government incentives targeted towards houses have also fuelled demand in this segment of the market.

3. Economic Factors

The scarcity of land in desirable areas, particularly in capital cities like Sydney, has led to higher house prices compared to units.

This scarcity, combined with changing lifestyle preferences, has driven up the value of houses, widening the price gap. Affordability challenges also persist for first-time homebuyers, particularly in capital cities with limited land availability.

4. Regional Variations

Regional variations also play a role in differing prices, with cities experiencing varying degrees of growth.

While some regions have seen surges in demand balanced across both houses and units, others have seen a larger demand for houses, only pushing the price gap between houses and apartments further apart.

5. Market Trends

Unit prices have generally been more affordable compared to houses as they have been less affected by market shifts. However, the current market dynamics have brought significant challenges to unit prices.

Factors such as oversupply and decreased demand from international buyers are contributing to this impact.

6. Historical Trends and Data Analysis

Analysis of historical data reveals a consistent trend of house prices outpacing unit prices, particularly since the pandemic began. This trend underscores the enduring appeal of detached houses and the challenges faced by the apartment market.

7. Social and Economic Implications

The widening price gap poses affordability challenges for first-time home buyers and households with lower incomes. The change in people’s housing preferences also raises questions about urban planning for housing and development in cities.

Future Outlook and Predictions

Projections suggest that the gap will keep growing in the short term due to ongoing economic and social factors. However, government policies and changes in the market could impact this trend over the long term.

Historical data records of median prices, affordability indices and transaction volumes suggest that fluctuations in the property market are not extraordinary.

The latest CoreLogic Home Value Index (HVI) as of June 2023 indicates that the prices of houses and units continue to fluctuate across the country due to the previously mentioned factors.

The current high price for houses in the market is largely due to supply constraints. With Australian cities gaining more population, there is a continued high demand for accommodation which may lead to a surge in the purchase of new apartments.

As the shift for many Australians back to the office continues in 2024, demand and preferences in the property market may shift too. With the pandemic leaving people wanting space, the shift back to the office at least on a part-time basis, may shift consumers back to wanting an easily maintained home. Driving demand back into the unit sector, bringing house and unit values closer together.

Source: CoreLogic

Should You Buy Property Now or Wait Until Later?

Australia’s housing market is recovering from the 2022 downturn, reaching a new record for combined capital house and unit prices in 2023, surpassing previous records that were set in March 2022 for houses and December 2021 for units.

The recovery has been steady for house prices and relatively swift for units. Notably, Sydney and Melbourne are witnessing a strong rebound in unit prices, with Sydney expected to hit a new record at the end of the first quarter of 2024.

While there are growth opportunities, particularly in the housing market, potential buyers should carefully assess their circumstances and risk tolerance before making a decision. However, it’s essential to conduct thorough research, consider market conditions, and consult with financial experts before making any significant investment decisions.

As we delve into the 2024 house price predictions and property predictions, it’s clear that the Australian real estate market presents a complex landscape for prospective buyers and investors. The anticipation of shifts within the market underscores the need for a detailed analysis and a strategic approach towards property investments in 2024 in the real estate sector.

Conclusion

In conclusion, the growing price gap between house and unit prices in Australia reflects a complex interplay of economic, social, and demographic factors.

However, as the saying always goes, the best time to buy property was 20 years ago. The next best time to buy property is today.

While prices in the apartment sector of residential housing are still offering affordable options with good rental returns, now could be the time to jump into the market or add to your property portfolio.

Homeowners and property investors should carefully consider current market conditions and their long-term financial goals for maximum returns on their investments.

The 2024 housing market predictions paint a picture of regional disparity and diverse opportunities within the property market.

On one hand, certain locales might witness a stabilization or even a decrease in house prices, offering a potential respite for buyers. On the other hand, some regions are expected to see continued or accelerated growth, highlighting the critical need for region-specific insights when navigating the 2024 house price predictions.

This intricate market behavior signals a period of adjustment and opportunity, making informed decisions more crucial than ever for those looking to enter or expand within the real estate market.

Contact us below for expert guidance on the property market and your next steps to property ownership.

Frequently Asked Questions

1. What caused the price gap between houses and apartments to widen?

The widening price gap between houses and apartments can be attributed to several factors including changing buyer preferences, supply and demand dynamics, economic factors such as land scarcity in desirable areas, regional variations, and market trends favouring houses over apartments.

2. How much have house and apartment prices changed since March 2020?

Since March 2020, house prices in capital cities have increased by approximately 33.9%, amounting to around $239,000, while apartment prices have risen by about 11.2%, which translates to roughly $65,235.

3. Why are house prices rising faster than apartment prices?

House prices are rising faster than apartment prices due to several reasons, including changing buyer preferences for properties with larger living spaces and outdoor areas, tied in with reduced demand for apartments due to pandemic-related factors.

Also, there is an oversupply of apartments in inner-city suburbs, record-low interest rates, and government incentives targeting houses – all of these weigh in to create higher volatility in house prices over apartments.

4. What is the future for apartment prices?

The future of apartment prices is subject to various factors such as market demand, economic conditions, government policies, and regional variations.

Projections suggest that apartment prices may continue to face challenges due to factors like oversupply and decreased demand from international buyers.

However, as cities gain more population and the demand for accommodation rises, there could be a surge in the purchase of new apartments.

5. Are there any predictions for house prices in 2024?

Predictions for house prices in 2024 are influenced by ongoing economic and social factors, government policies, and market trends.

While historical data indicates fluctuations in the property market, projections suggest that the gap between house and apartment prices may continue to grow in the short term.

However, shifts in buyer preferences and market dynamics could impact this trend over the long term.