The November 2023 Property Market Update offers a comprehensive overview of the real estate landscape, encompassing both promising and challenging news. This article delves into the essential trends, providing valuable insights for you to stay on top of the market trends.

Table of Contents

Key Takeaways

The property market update for November 2023 reveals a mixed landscape.

- The Australian housing market is experiencing a remarkable recovery, with strong property value growth. Despite challenges like the RBA’s cash rate increase and tight affordability, the housing market is on an upward trajectory.

- Migration trends, particularly the movement from capital cities to regional areas, are impacting housing demand.

- Smaller capital cities are struggling to regain their footing, while major cities like Sydney and Melbourne are benefiting from international and interstate migration.

- Investor finance jumped by a solid 16.0% since February, showing that investors are feeling more confident due to the increase in inner-city housing prices.

RBA Cash Rate Update: Reserve Bank Raised Cash Rate to 4.35%

The RBA board made a significant decision on Tuesday, raising the cash rate by 25 basis points to 4.35%, marking a 12-year high. This move was broadly expected by economists and represents the 13th rate increase since May 2022.

RBA Governor Michele Bullock emphasized that while inflation in Australia has passed its peak, it remains unacceptably high and more persistent than previously anticipated.

This was evident in the latest CPI inflation readings, which revealed that while goods price inflation had moderated, many service prices were still rising significantly.

The decision to increase interest rates was driven by the board’s desire to have greater confidence that inflation would return to the target range within a reasonable timeframe. The RBA’s new projection is for inflation to reach 3.5% on an annual basis by the end of 2024, with the target set to be achieved by the end of 2025.

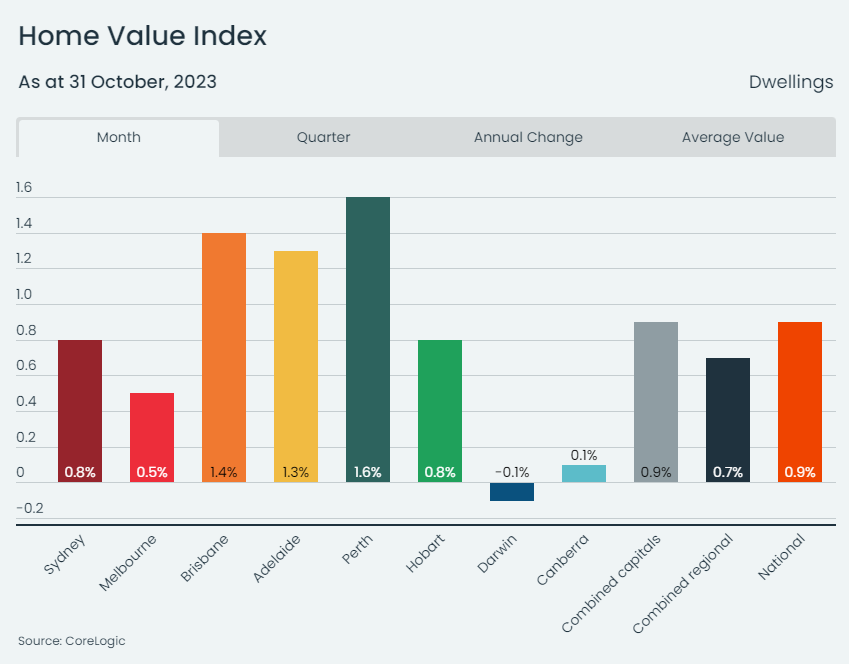

National Home Value Index Surge by 0.9% this month

Starting in January, the national Housing Value Index (HVI) has experienced a 7.6% increase, bringing it within half a percentage point of the all-time high recorded in April of the previous year.

Tim Lawless, the research director at CoreLogic, anticipates that a full recovery in the national index is on the horizon.

He stated, “At this rate of growth, we will see the national HVI reach a new record high mid-way through November, recovering from the -7.5% drop in values recorded over the recent downturn between May 2022 and January 2023.”

Though home values are steadily going up in major cities, there’s a visible slowdown in the growth rate. In the three months ending June 2023, capital city home values rose by 3.7%, but then the growth eased to 2.6% in the following three months leading up to October.

“The slower rate of appreciation can probably be attributed to a combination of higher advertised stock levels alongside stretched affordability,” Mr Lawless said.

“With an acceleration in the flow of new listings coming onto the market, it’s unlikely buyer demand will be able to keep pace as we move through spring amid high-interest rates and low sentiment.”

During the month, dwelling values increased in all capital cities except for Darwin, which saw a slight decrease of -0.1%. Perth, Brisbane, and Adelaide stood out with robust performance, posting respective gains of 1.6%, 1.4%, and 1.3%.

Over the first ten months of the year, three capital cities have witnessed dwelling values surge by more than 10%. Leading the pack are Sydney with a 10.9% increase, followed closely by Perth at 10.8% and Brisbane at 10.2%.

Will There Be a New Property Market Record in 2023?

Australia’s property market is making a remarkable comeback after the 2022 downturn.

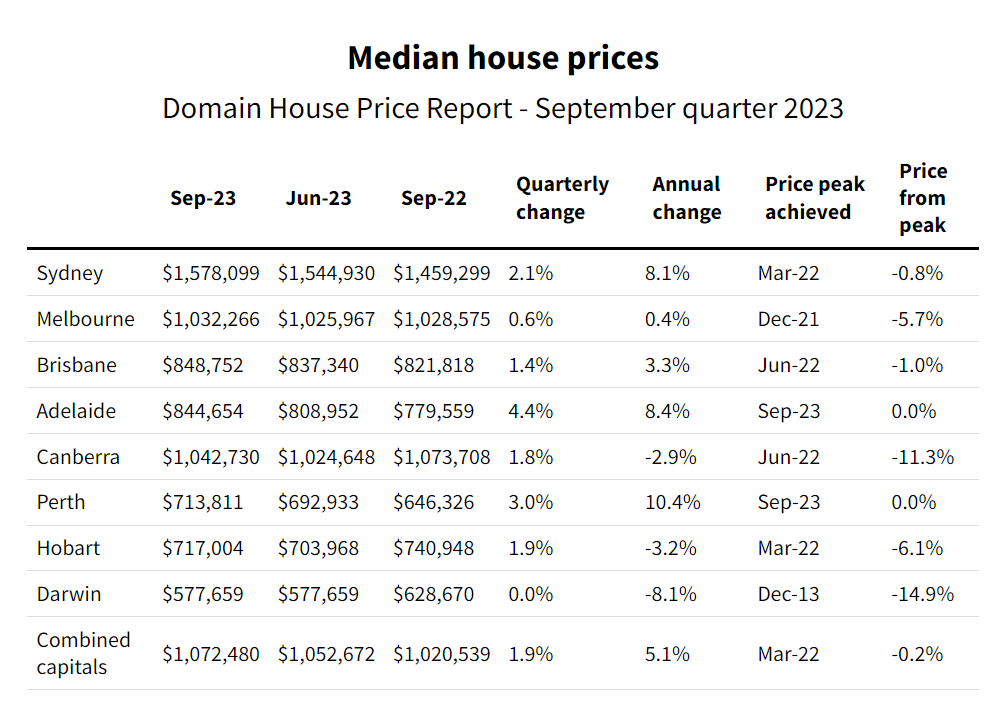

Domain’s House Price Report, released recently, highlights a national median house price that’s just $2,000 short of returning to the peak levels witnessed during the pandemic boom. This represents a remarkable turnaround from the sharp decline in housing prices experienced last year.

In the September quarter, every capital city has either witnessed an increase in property prices or achieved stabilization, indicating a broader recovery trend.

However, when we examine the property market over the past 12 months, a significant gap becomes apparent. Hobart, Darwin, and Canberra, among Australia’s smaller capitals, are experiencing a decline in property prices, in stark contrast to the positive growth seen in Sydney, Melbourne, Brisbane, Adelaide, and Perth.

Sydney, in particular, has seen a robust 8.1% increase in house prices over the past year, with other major cities also enjoying growth, albeit to varying degrees.

Source: Domain

Shane Oliver, Chief Economist at AMP Capital, attributes these discrepancies to external factors affecting these smaller cities.

“At the moment, Sydney and Melbourne are benefitting from the return of international migration,” he says.

“The smaller cities benefitted a lot during the COVID period when people were less keen on the big cities and it also had more affordable housing available, so it was a big push in migration … but it seems that demand has rescinded and the market has waned.”

Property prices in a city can be significantly influenced by both overseas and interstate migration, especially when supply struggles to meet population growth. The resulting dynamics have varying impacts on different cities across Australia’s property landscape.

Migration Trends and Their Impact on the Property Market

Overseas Migration Surges to Record Levels, Highest Since 2008

Australia implemented strict border controls in late March 2020, barring entry to all non-citizens and non-residents. The country fully reopened to both vaccinated and non-vaccinated travellers in July 2022. By March 2023, Australia’s annual population growth had reached 2.17%, marking the highest growth rate since 2008.

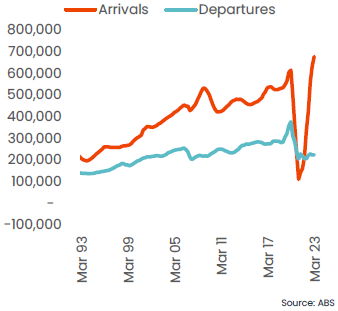

Notably, net overseas migration, calculated as the difference between overseas arrivals and departures, has surged to a record high, contributing 454,000 people to the population over the past 12 months. This figure stands in stark contrast to the pre-COVID decade’s average annual net overseas migration of 217,000.

Overseas arrivals and departures, rolling annual, Australia

While implementing a temporary cap on migration may provide some relief to housing demand in the short term, the COVID-19 pandemic has underscored the longer-term challenges associated with such measures.

Housing demand, which represents the movement of people, is generally more flexible or “liquid” compared to housing supply, which involves the construction or acquisition of new housing units. When international borders reopened, it created a sudden surge in rental demand, causing a shock effect that promptly drove up rents and exacerbated the already tight rental market.

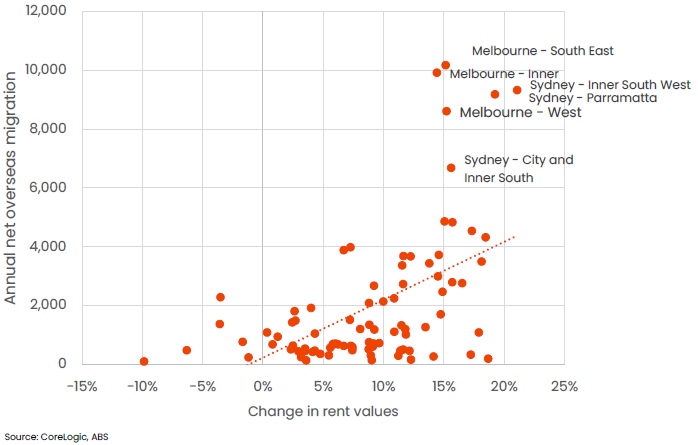

In the past, Melbourne’s South East and Inner SA4, along with Sydney’s Inner South West and Paramatta, attracted the highest volume of net overseas migration. From July 2022 (when international travel restrictions eased) to October this year, these areas experienced some of the highest increases in rent values, averaging a solid 18% growth.

This highlights a clear connection between the growth in rent values since July 2022 and the historical volumes of net overseas migration in the SA4 regions. This means that overseas migration has been a driving force behind the short-term increase in rents.

Change in rents since COVID travel restrictions eased in July 2022

Capital to Regional Migration: Accounting for 11% of All Relocations

According to the Regional Movers Index (RMI) for the September 2023 quarter, regional New South Wales (NSW) has emerged as the primary migration destination, surpassing regional Queensland in popularity.

The RMI data indicates that during the 12 months leading to September 2023, nearly 39% of individuals moving from cities opted for regional NSW, a notable increase from the previous period’s 26%. Meanwhile, regional Queensland was the second most favoured location at 33%, though it experienced a slight decline from the previous year’s 37%. Victoria secured the third spot with 21% of all outflows from capital cities.

The increased migration from capital cities to regional areas, particularly regional NSW, suggests a growing demand for housing in these regions.

Source: Regional Movers Index (RMI)

When we look at the bigger picture, the regional housing market saw a 0.7% increase in October, slightly trailing the 0.9% rise observed in the combined capital cities.

“This pattern of greater growth in the capital cities was consistent across all states,” Mr. Lawless explained. “Similar to the trend in the capitals, regional Queensland, WA and SA are showing stronger conditions with each of these rest of state regions at record highs in October.”

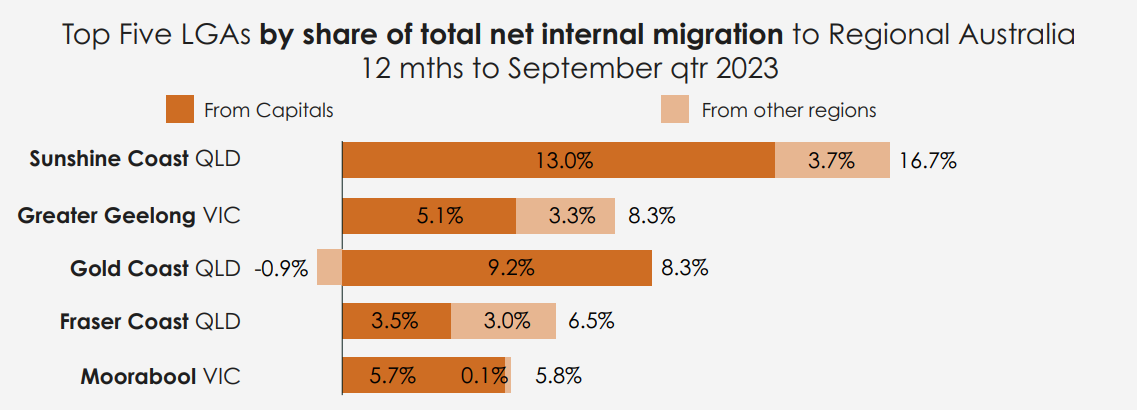

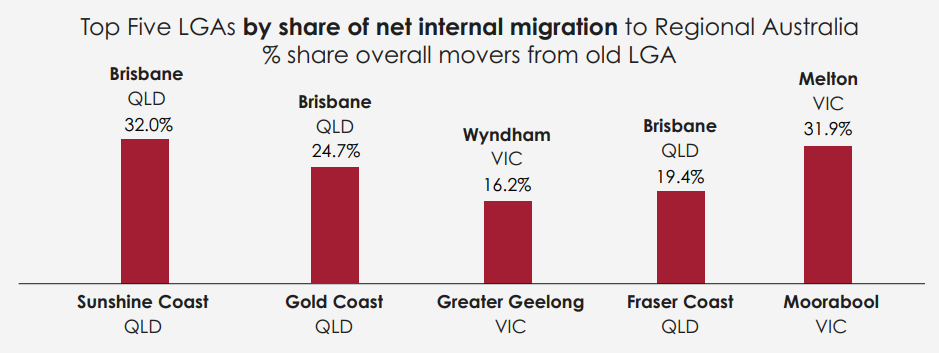

Taking a closer look at the Top Five Local Government Areas (LGAs) based on the share of net internal migration, it’s clear that people making the move are more likely to come from nearby cities.

For example, in the case of Brisbane, 32% of those who relocated went to the Sunshine Coast, 24.7% to the Gold Coast, and 19.4% to the Fraser Coast. Moreton Bay, Logan, and Ipswich also played a significant role in contributing to this migration trend.

Source: Regional Movers Index (RMI)

This migration trend could be one of the contributing factors that led to the nominal rebound in Brisbane’s housing values in October, reversing the previous -8.9% decline and setting a new record high. It aligns with the overarching trend seen in capital cities, with regional Queensland, Western Australia, and South Australia also experiencing strong market conditions, all reaching record highs in October.

This migration trend could be one of the contributing factors that led to the nominal rebound in Brisbane’s housing values in October, reversing the previous -8.9% decline and setting a new record high. It aligns with the overarching trend seen in capital cities, with regional Queensland, Western Australia, and South Australia also experiencing strong market conditions, all reaching record highs in October.

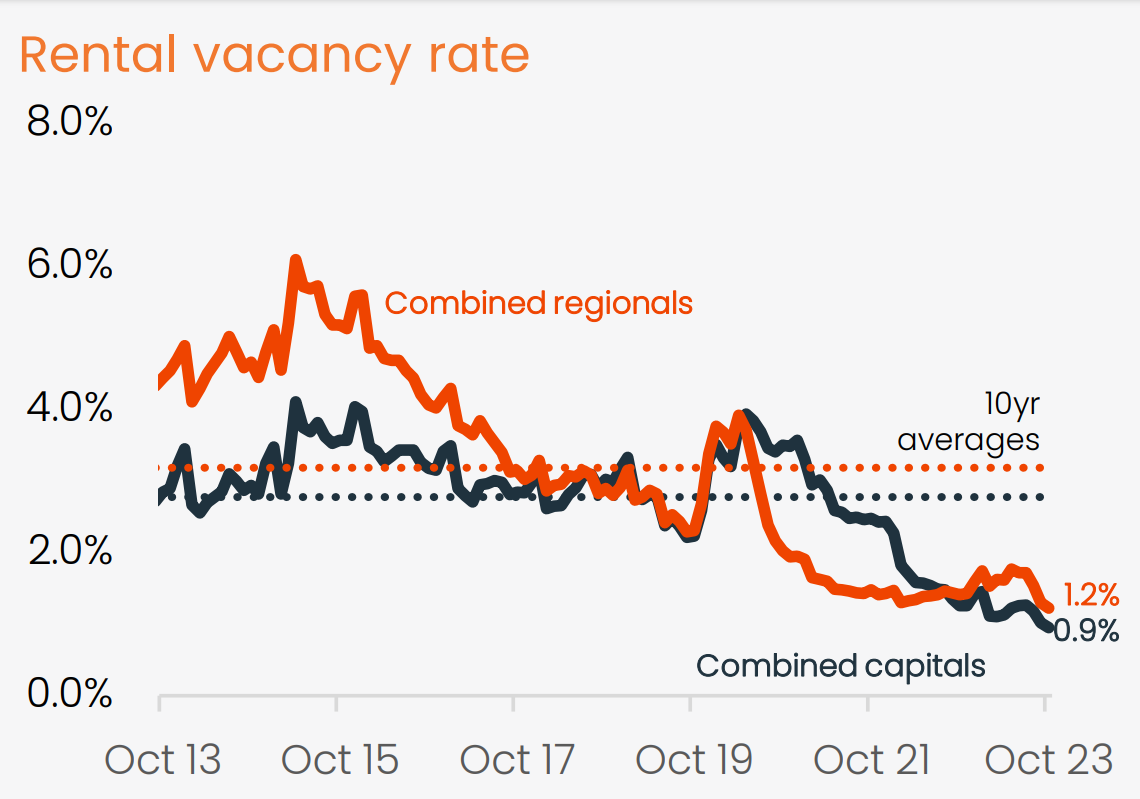

Record Low Rental Vacancies in October

Source: CoreLogic

In October, rental vacancies hit a historic low, plummeting to 0.9% in the combined capital cities and 1.2% in the combined regional markets. Nationally, rental listings were down by 35.5% compared to the previous five-year average over the four weeks ending October 29th and were 16.1% lower than the previous year.

“We aren’t seeing any signs of a supply response in rental markets just yet,” Mr Lawless said. “Rental listings are consistently trending lower while rents have been rising every month for the past 39 months.

While the rental market remains tight, the pace of rent growth in capital city markets has lost some momentum and become more diverse. The rolling quarterly rate of rental growth in the combined capitals has decreased from 3.1% over the three months ending May to 1.8% over the most recent three months.

Perth stands out with the highest annual rental growth, seeing a 12.7% increase in house rents and a 16.6% rise in unit rents over the past year. In contrast, Hobart and Canberra have vacancy rates closer to average levels, and rents are falling annually.

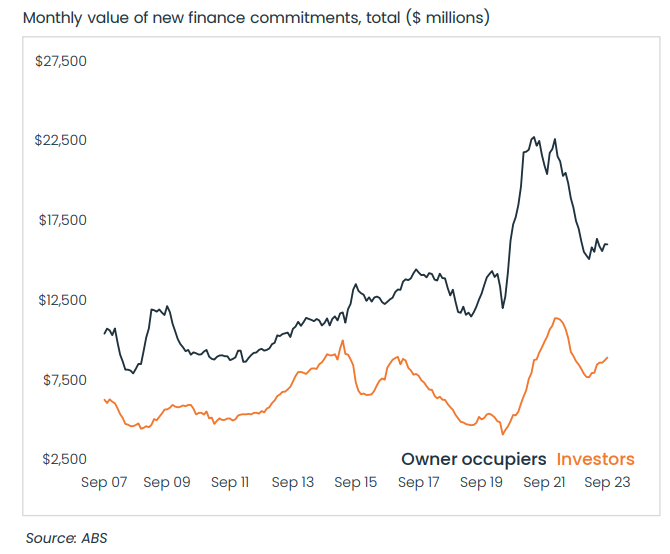

The Rise of Rentvesting and Growing Investor Confidence

In September, the value of newly secured housing finance saw a 0.6% increase, following a substantial 2.4% surge in August. This upward trajectory has led to a 9.5% overall growth in new housing lending since its recent low in February 2023. Notably, investor finance has experienced a remarkable 16.0% increase since February, surpassing the 6.1% growth observed in owner-occupier lending.

On a national scale, investor finance constituted 35.8% of new mortgage lending in September, with the highest share observed in NSW at 40.2%, surpassing the historical average.

A significant trend in investor behaviour is highlighted in a recent property sentiment report, where 5% of our audience identifies as ‘rentvestors.’ This innovative strategy entails investors renting in their preferred suburb while acquiring more affordable properties on suburban outskirts or in regional areas. Some are opting to purchase and lease out cost-effective apartments. The survey indicates that approximately one in 12 respondents now identifies as a rentvestor.

In the face of escalating inner-city housing prices, rentvesting is increasingly becoming a favoured lifestyle and investment choice, with expectations that this trend will continue to gain momentum over time.

Property Market Update Q3 2023 By State

NSW Market Update: Popular Property Types Maintain Strong Presence

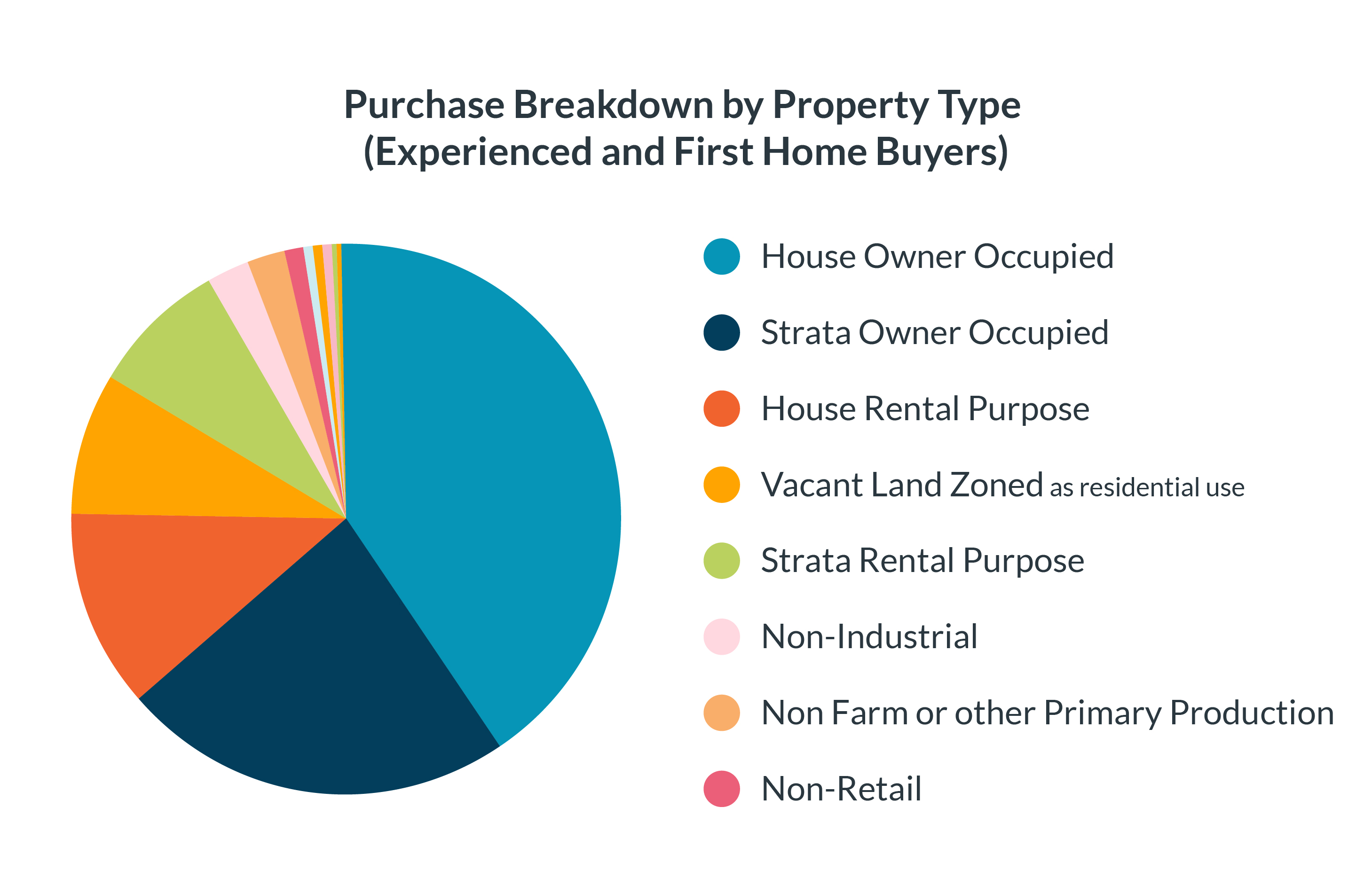

In the Q3 2023 Property Market Update for New South Wales, it’s evident that the most popular property types in the region have maintained their market presence.

Houses and strata owner-occupied dwellings continue to dominate, with houses accounting for 44% of the market share, while strata owner-occupied dwellings saw a slight increase from 20% in Q2 to 21% in Q3.

Source: InfoTrack

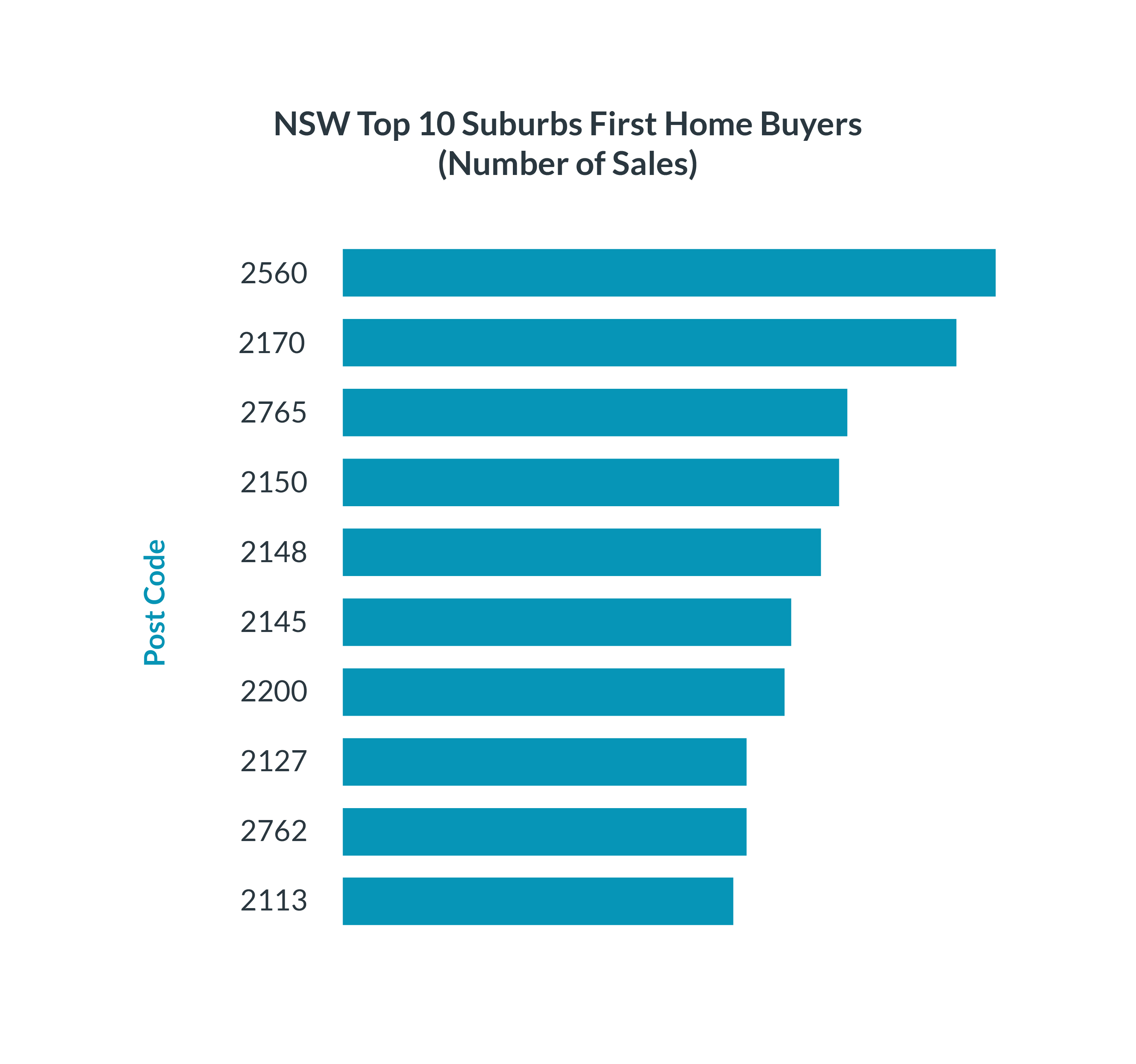

Notably, first-time home buyers are making their mark in Greater Western Sydney with shifts in preferences. The north-western postcode of 2765 (Richmond, NSW), which held the top position in the previous quarter, now stands at the third spot, consistent with its Q1 performance.

Source: InfoTrack

On the other hand, the greater western Sydney postcode 2560, encompassing areas like Campbelltown and Leumeah, has surged from 7th place in the last quarter to secure the top position.

In terms of property values, the $700-$800k range of regional housing values proved to be the most sought-after, representing 28% of total property sales in the 2560 area. Additionally, the top 10 list welcomes three new entrants: 2200, 2127, and 2113, adding further diversity to the property market landscape.

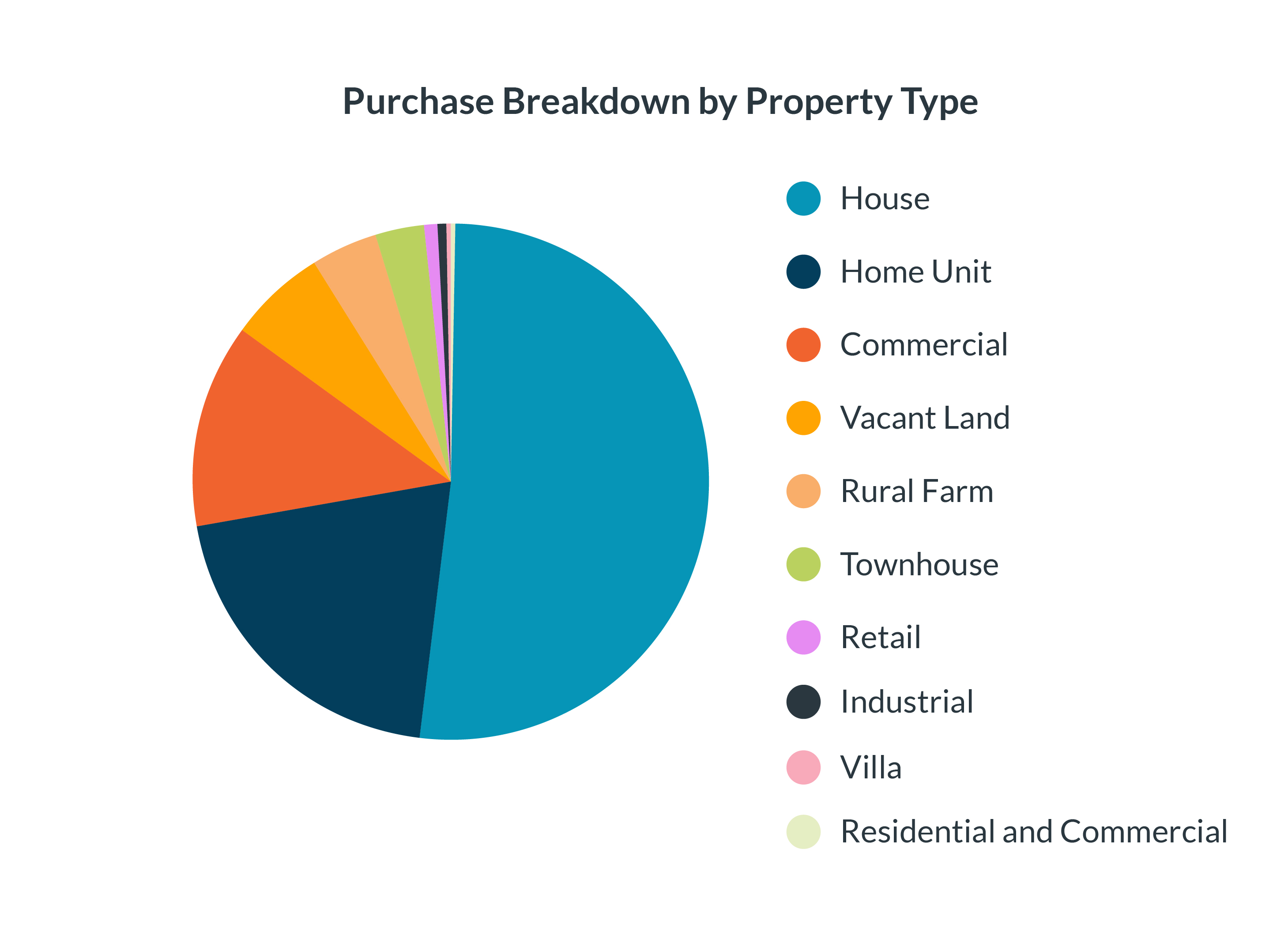

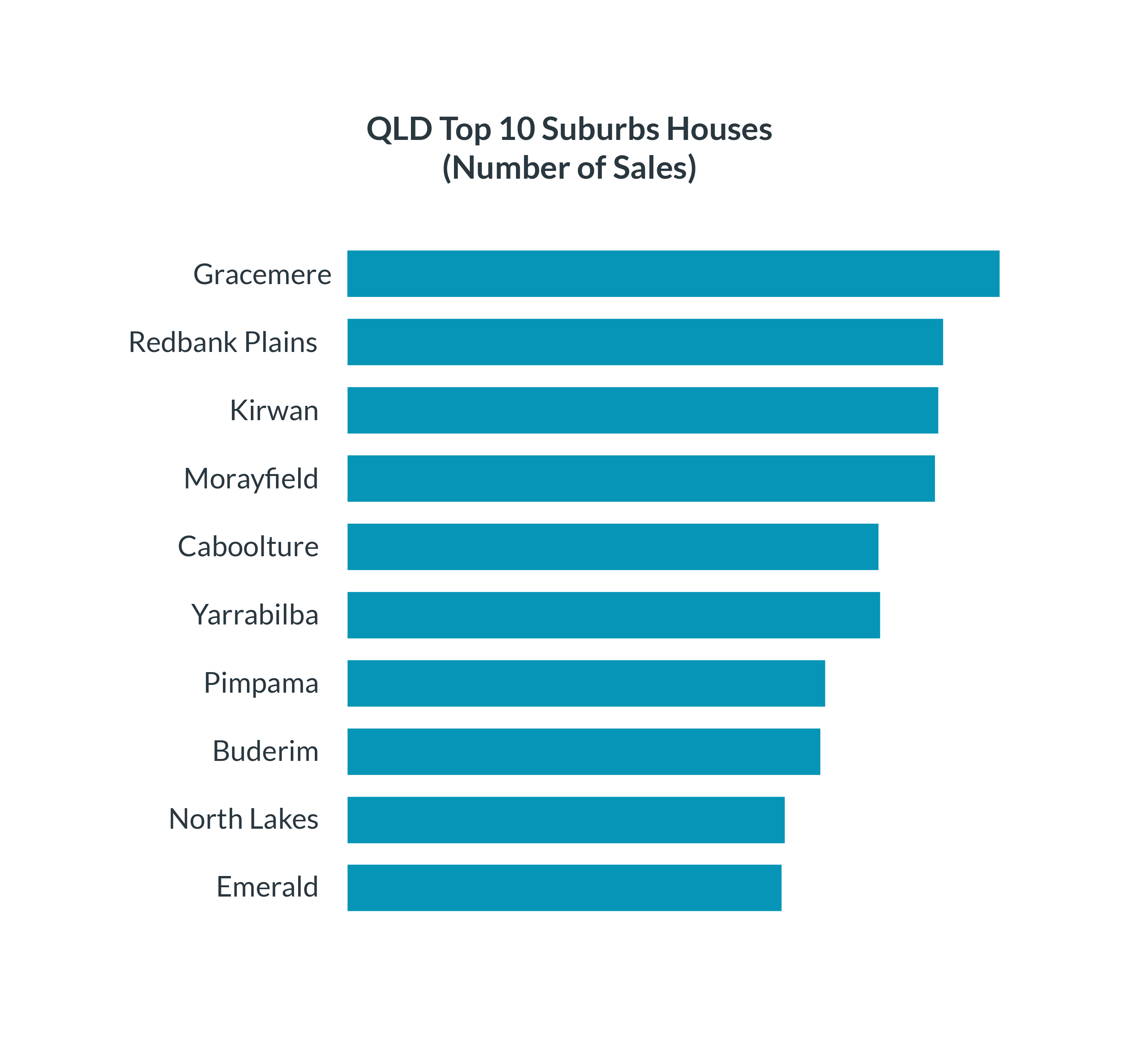

QLD Market Update: Surging Demand for Houses in Queensland

In Queensland’s property market, houses have once again proven to be the preferred choice property investors, maintaining their dominance with a substantial 53% share for the third consecutive quarter.

Meanwhile, home units have seen a noteworthy increase in Q3, capturing a 21% share, marking a 3% growth compared to the previous quarter. This trend reflects the enduring appeal of houses for Queensland residents.

Source: InfoTrack

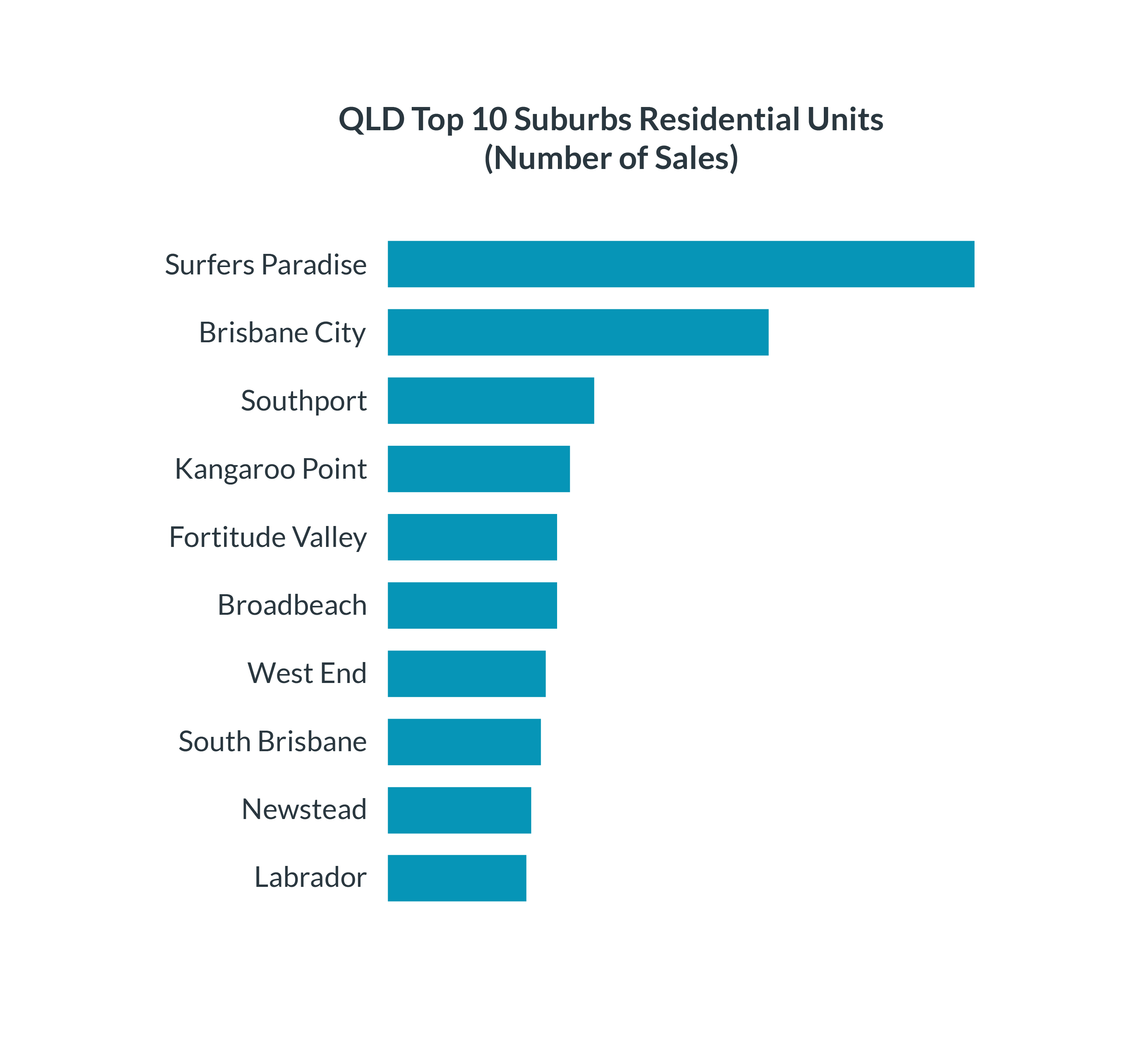

Furthermore, the residential property market landscape in Brisbane has shown interesting dynamics this quarter, as central Brisbane areas, including Brisbane City, Kangaroo Point, Fortitude Valley, West End, South Brisbane, and Newstead, have surged into the top 10 list of suburb residential units. This shift signals a gradual move away from the beachside locations that were previously in favour, although Surfers Paradise remains a strong contender, holding onto its top position.

Source: InfoTrack

Regarding Top 10 suburbs houses, in North Queensland, Rockhampton’s suburb, Gracemere, has emerged as the leader in Q3, a remarkable climb from its 6th place position in Q2. This victory underscores the growing popularity of North Queensland locations. Notably, Kirwan in Townsville and Emerald have also maintained their top 10 positions consistently. Meanwhile, Pimpama, situated in the northern end of the Gold Coast, is a newcomer to the list, marking its debut appearance in the top 10, reflecting the evolving preferences of property buyers in the region.

Source: InfoTrack

Source: InfoTrack

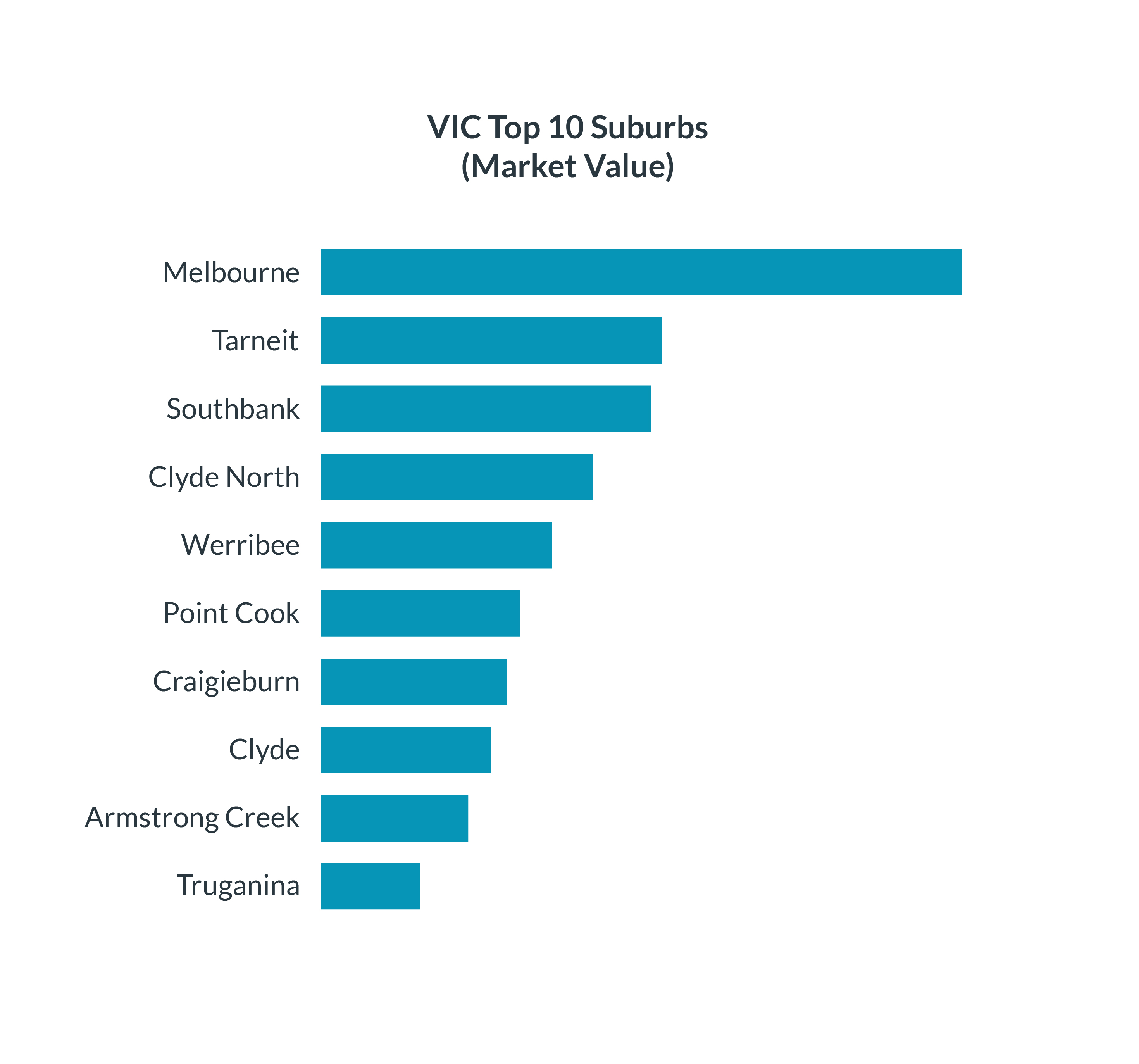

VIC Market Update: Melbourne’s Expanding Urban Growth

Melbourne City remains the frontrunner in property markets, consistently securing the top spot in Q1 and Q2 of 2023. The city’s top three suburbs, Tarneit and Southbank, have also maintained their positions throughout the quarters. Notably, five new entrants – Point Cook, Craigieburn, Clyde North, Armstrong Creek, and Cranbourne East – have joined the list. This reflects a growing trend of buyers seeking property options outside the central Melbourne district.

Source: InfoTrack

Source: InfoTrack

Property Market Update November 2023 – Summary

In summary, the property market landscape in Australia during October has been marked by several significant trends and changes.

The national Housing Value Index (HVI) displayed a strong surge of 0.9% for the month, contributing to a cumulative increase of 7.6% since January. This upward trajectory, as observed by Tim Lawless, CoreLogic’s research director, suggests a potential full recovery in the national index by mid-November 2023.

While property values continue to rise in most major cities, there has been a noticeable low vacancy rate. Rental vacancies reached historic lows in October, with a mere 0.9% in the combined capital cities and 1.2% in the combined regional markets, leading to a 35.5% decrease in rental listings compared to the previous five-year average. However, this tightening supply has not yet triggered a supply response in the rental housing markets.

The pace of rent growth has also shown some changes, with a shift towards more diverse trends. House rents are rising faster than unit rents in Sydney and Melbourne, potentially related to the seasonality of university semesters and foreign student arrivals. Perth stands out with the highest annual rental growth, while Hobart and Canberra have vacancy rates closer to average levels, with rents declining.

Navigating The Property Market: Is Rentvesting the Right Move for You?

In the current climate marked by a surge in property prices and rental growth, it presents an opportune time for property investors to explore the benefits of rentvesting. Rentvesting offers several advantages in this market scenario:

- Rentvesting allows you to own a property faster.

- Purchasing an investment property provides tax benefits.

- Making wise decisions when buying a property is more likely.

So, is rentvesting a good idea? The choice between rentvesting and other options depends on your goals and willingness to make sacrifices for future gains. If living close to the city and enjoying a rich lifestyle are crucial, rentvesting can be a path to homeownership without compromising your quality of life.

On the other hand, if building wealth quickly is the priority, buying a property in an affordable area may offer a faster route, potentially avoiding capital gains tax implications.

Now is the time to seize the opportunities presented by rentvesting. Explore properties in areas with growth potential, aligning with your investment strategy and lifestyle preferences. Consult with real estate professionals, conduct thorough market research, and take advantage of this moment to strategically position yourself in the evolving property landscape.

Are you ready to leverage capital growth in the dynamic property market? Contact us today to stay ahead in the real estate game and seize the opportunity to invest in property.