Table of Contents

Introduction to the First Home Guarantee

In today’s dynamic real estate market, the dream of homeownership seems increasingly out of reach for many. However, the First Home Guarantee Scheme offers a beacon of hope. This initiative, launched by the Australian Government, is designed to support eligible buyers on their journey to purchasing their first home.

Saving up to buy your first home can be a challenging task, especially in today’s real estate market. That’s where The First Home Guarantee Scheme steps in to assist eligible homebuyers in achieving their homeownership dreams sooner.

Data from CoreLogic’s national Home Value Index indicates that Sydney home values increased another 1.7% in June, which means that Sydney’s median housing values are rising by roughly $4,262 a week.

So it is no surprise that the biggest challenge for many first-home buyers is being able to afford the deposit. With the rising property prices, even just 20% can be quite a difficult goal to reach, especially so if you’re using the majority of your weekly savings for rent. But there is a way to purchase your first home sooner.

Previously known as the First Home Deposit Scheme, the First Home Guarantee Scheme, initiated by the Australian Government, allows first home buyers to overcome the barrier of the deposit and purchase their first home.

Let’s find out more.

What is the First Home Guarantee Scheme?

Understanding the First Home Guarantee Scheme

The First Home Guarantee Scheme, previously known as the First Home Deposit Scheme, is a pivotal program aimed at assisting first-home buyers in Australia. Through this scheme, participants can purchase a residential property with as little as a 5% minimum deposit, circumventing the need for Lenders Mortgage Insurance (LMI), thus making the dream of owning a home more accessible than ever before.

How to know if the First Home Guarantee Scheme is for you?

Eligibility for the First Home Guarantee Scheme

Eligibility for the scheme is broad, encompassing not only first-time buyers but also those who have not owned property in Australia in the last decade. This inclusivity ensures that the First Home Guarantee Scheme’s eligibility criteria cater to a wide demographic, promoting homeownership across the country.

Before applying for the First Home Guarantee Scheme, there is a certain eligibility criteria that home buyers must fulfil (as of 1 July 2023).

- Applying as an individual or 2 joint applicants.

- An Australian citizen(s) or permanent resident(s) at the time they enter the loan.

- At least 18 years of age.

- Earning up to $125,000 for individuals or $200,000 for joint applicants, as shown on the Notice of Assessment that is issued by the Australian Taxation Office.

- Intending for the property to be owner-occupied (Investment properties cannot be bought with this home buyer guarantee scheme).

- First-home buyers or previous homeowners who haven’t owned a property in Australia in the past ten years.

As of 1 July 2023, the Australian Government has also opened up the eligibility criteria for the Scheme to permanent residents and previous homeowners and also lets home buyers apply for the scheme with friends or family members.

Key Features of the First Home Buyer Guarantee Scheme

One of the scheme’s standout features is its flexibility regarding the types of properties eligible for purchase. Whether it’s a new home through the New Home Guarantee, an existing dwelling, or a house and land package, the scheme offers something for everyone, embodying the essence of the First Home Buyer Guarantee.

Dwelling types for the First Home Guarantee Scheme

Under the First Home Guarantee Scheme, first-home buyers can purchase:

- An off-the-plan apartment or townhouse

- A house and land package

- An existing house, townhouse or apartment

- Land and a separate contract to build a home

Property price threshold for the First Home Guarantee Scheme

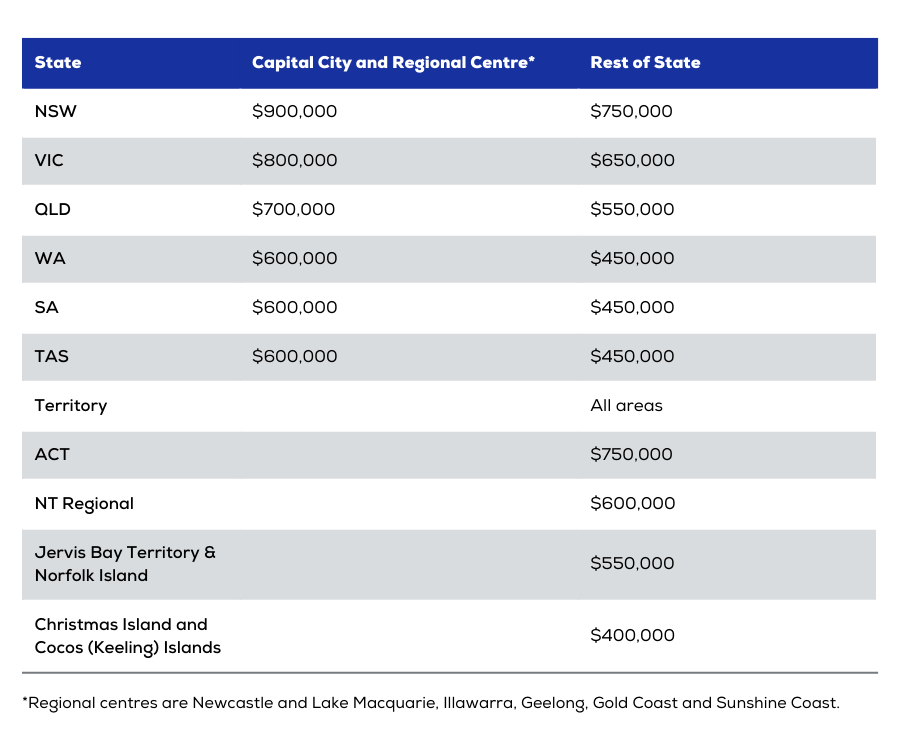

Below is a table of property price caps for the First Home Buyer Guarantee Scheme, which will help home buyers purchase homes that can be covered by the First Home Buyer Guarantee Scheme.

Participating lenders

There are 32 total lenders participating in this home loan deposit scheme:

- two major bank lenders (National Australia Bank and Commonwealth Bank of Australia), and

- 30 non-major lenders such as Bendigo Bank, Indigenous Business Australia, People’s Choice Credit Union, Regional Australian Bank and Teachers Mutual Bank Limited (including Firefighters Mutual Bank, Health Professionals Bank, Teachers Mutual Bank and UniBank).

First Home Guarantee QLD: Regional Opportunities

Notably, the scheme extends its reach to regional areas, with the Regional First Home Buyer Guarantee offering targeted support to those looking to buy outside metropolitan hubs. This initiative is particularly appealing for prospective buyers in Queensland, spotlighted through the First Home Guarantee Scheme QLD, illustrating the government’s commitment to ensuring homeownership is accessible across the entire nation.

Is this scheme for you?

As an eligible home buyer for the First Home Guarantee Scheme, it’s important to weigh out the pros and cons of the Scheme before you apply. Here is a quick comparison to easily help home buyers identify if this home guarantee is exactly what they need

Pros and Cons of the First Home Guarantee Scheme

When considering the First Home Guarantee, it’s crucial to weigh its advantages and limitations. The scheme accelerates access to the property market, effectively lowering the entry barrier for first-time buyers. However, prospective participants should carefully evaluate the pros and cons of the First Home Guarantee Scheme, considering factors such as the long-term implications of a smaller deposit on interest payments and the overall loan lifespan.

Pros

1. YOU AVOID PAYING LENDERS MORTGAGE INSURANCE (LMI)

Something many first-home buyers do not know is that, even once you’ve saved a deposit, there are fees and charges that you need to pay before it can go into the mortgage to purchase a home. One of the biggest charges is Lenders Mortgage Insurance, which can sometimes cost tens of thousands of dollars. This First Home Guarantee Scheme aims at eliminating this cost for eligible first-home buyers, which lets them buy a home sooner and pay lower fees over the life of their home loan.

2. YOU CAN BE A FIRST-TIME HOME BUYER SOONER

One of the best benefits of this First Home Guarantee Scheme is that it gives you quick access to the property market by allowing home buyers to purchase a property with a lower deposit (and also by not paying Lenders Mortgage Insurance).

This is incredibly helpful, as a majority of first-home buyers find themselves caught in the endless cycle of saving up for the 20% deposit, only to learn that the original price has gone up and that they have to return to saving up for the new 20% goal.

3. IT IS AVAILABLE FOR A VARIETY OF PROPERTIES

Unlike the First Home Owner’s Grant, which only applies to newly built homes, this home guarantee scheme can be used to purchase existing homes, an off-the-plan home, vacant land, or a house and land package.

Based on the scheme’s current property price cap list, CoreLogic estimates that around 35.4% of Australian properties qualify for the scheme. If prices decline, this could mean that more properties would be available for applicants.

Cons

1. YOU HAVE TO USE ALL YOUR SAVINGS ON YOUR 5% MINIMUM DEPOSIT

There is one main issue with the first home buyer guarantee scheme, and it’s that you have to use all of your savings on the 5% deposit. This is to prevent people from taking advantage of this home guarantee scheme.

2. YOU WILL BE PAYING MORE IN INTEREST

Purchasing a property with a smaller deposit means that you will be paying more in interest over the life of your home loan because you’re paying interest on a 95% loan instead of typically saving for a deposit of 20% and taking out a home loan for the remaining 80%.

3. THERE ARE RISKS INVOLVED

Buying a property with a larger loan also comes with risks. An increase in interest rates could affect the cost of a monthly repayment, and a higher Loan to Value Ratio (LVR) could also limit the lenders that are available to you in the future.

So is it worth it to sign up?

Ultimately, it all depends on your personal circumstances, the urgency of your need to purchase a home, and the state of the housing market in your chosen area.

For someone who is not confident in their finances, a 95% loan might be too expensive and stressful to manage in comparison to a mortgage with a bigger deposit. But if you are confident in your income and feel ready to purchase a home now that you know how to bypass the deposit hurdle, then this home guarantee scheme might be the right choice for you.

Still unsure? Want to speak to a home lending specialist and get personalised advice for your concerns?

Speak to our St Trinity Team at (02) 9099 3412 or enquire below.

FAQs

1. How do I apply for the First Home Guarantee Scheme?

To enroll in the First Home Guarantee Scheme, you should submit your application either directly to one of the scheme’s authorized lenders or through a mortgage broker.

We recommend that potential homebuyers, together with their advisors, collaborate with a Participating Lender and consider consulting independent financial and legal experts. This will help them evaluate how well a particular home loan or property aligns with their distinct financial situations and objectives.

Before formalizing a home loan agreement, it is prudent for homebuyers to have conversations with their lender or broker regarding how fluctuations in interest rates or property values might affect their unique circumstances.

2. How many places are available in the First Home Guarantee Scheme?

50,000 new places are now available for the 2023-24 financial year across the three guarantees:

- 35,000 places for the First Home Guarantee Scheme (FHBG);

- 10,000 places for the Regional First Home Buyer Guarantee (RFHBG); and

- 5,000 places for the Family Home Guarantee (FHG).

3. What deposit do I need for the First Home Guarantee Scheme?

Eligible buyers have the opportunity to acquire or construct a new home with a deposit as low as 5%. For eligible single parents, this deposit requirement can be as minimal as 2%, all without the necessity of lenders’ mortgage insurance.