As spring begins, the market is gaining momentum. While inquiry levels may be lower than usual, the number of potential buyers is on the rise. For potential buyers, now is the ideal time to explore your options.

Take a closer look at our Property Market Update October 2023:

Table of Contents

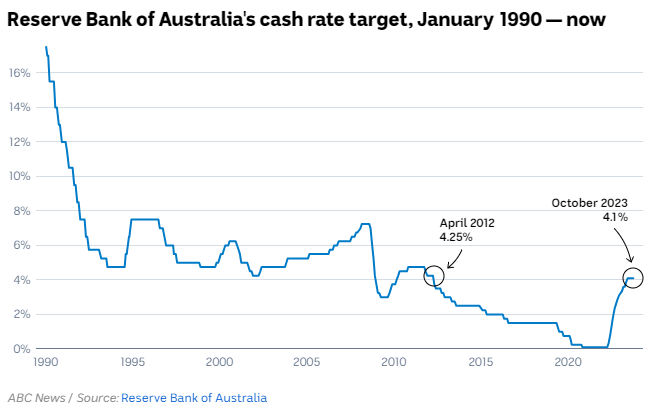

RBA Cash Rate Updates: Remains Steady at 4.1% For the 4th Month

In the latest Property Market Update October 2023, there’s positive news for property buyers. The Reserve Bank of Australia has kept the cash rate on hold for the fourth straight month. The first decision to keep the cash rate at 4.1% is made with the new governor of the RBA, Michele Bullock, in charge.

The RBA’s choice aligns with the expectations of financial markets and economists despite a slight uptick in August’s inflation rate to 5.2% from 4.9% in July.

This increase in inflation, driven by surging fuel prices and higher transportation costs, along with elevated housing, food, and insurance prices, was the first monthly rise since April. However, the underlying inflation rate showed a decline.

This increase in inflation, driven by surging fuel prices and higher transportation costs, along with elevated housing, food, and insurance prices, was the first monthly rise since April. However, the underlying inflation rate showed a decline.

Michele Bullock mentioned the RBA’s anticipation of inflation returning to its target range of 2-3% by late 2025, but she acknowledged potential challenges posed by higher fuel costs and rents.

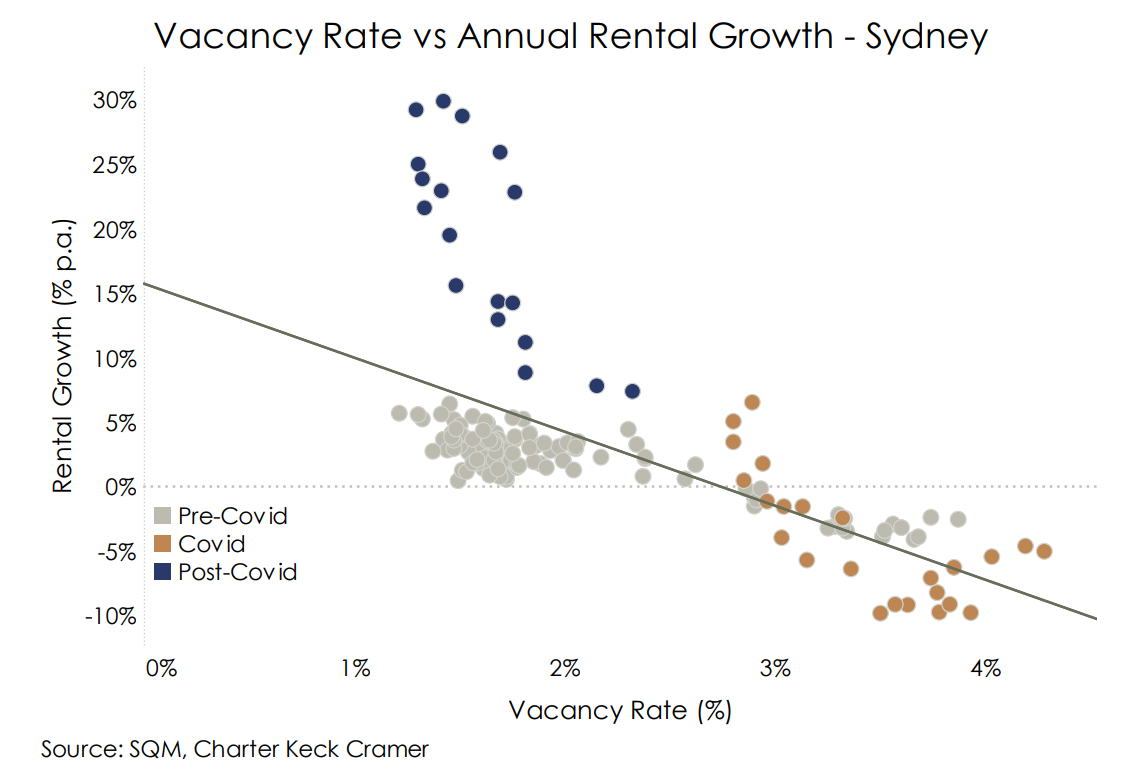

The RBA is also closely monitoring the housing sector, where rental pressures are evident in inflation figures. However, CoreLogic’s annual measure of market rents has been slowing since October of the previous year. This suggests that CPI rental growth may be nearing its peak.

Australian House Prices Nearing Record High: Insights from Property Market Update October 2023 Data

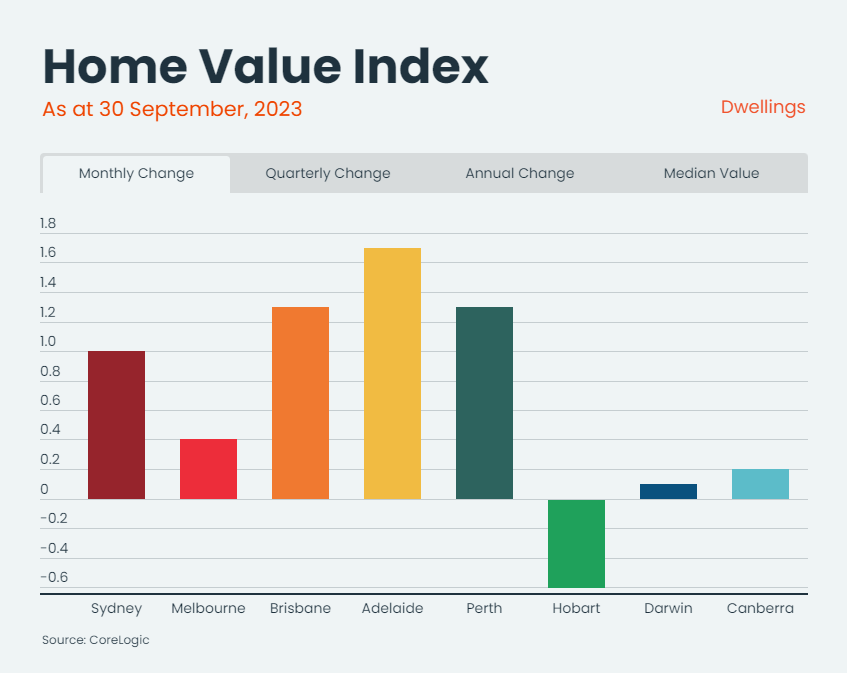

According to the latest data by CoreLogic, following a 0.7% increase in August, the quarterly growth rate for national home values has reached 2.2%.

CoreLogic’s research director, Tim Lawless, points out that the housing market performance in each city is influenced by its supply dynamics. “The cities with the highest capital gains have advertised supply levels that are approximately 40% below their five-year average.”

Sydney’s housing market has seen an impressive 11% recovery since reaching its lowest point in January. It appears to be on a trajectory to reach new record highs by early next year as the market upswing continues to expand. Tim Lawless predicts that the national Housing Value Index (HVI) will likely reach a new nominal high by the end of November at the current growth rate.

“We have already seen dwelling values reach new record highs in Perth and Adelaide. Brisbane looks set to reach a new record high in October, with home values currently only 0.6% below their previous peak. Hobart and Canberra have the furthest to go before staging a nominal recovery, with dwelling values remaining 12.4% and 7.0% below their cyclical highs from last year.”

Moreover, “the estimated volume of home sales across the combined capital cities was 1.9% higher than a year ago and 6.3% above the five-year average.” Mr Lawless said.

Sydney Real Estate Market’s New Cycle Has Begun

According to the State of the Market Report H1 2023 by Charter Keck Cramer supports the view that the next market cycle in Sydney has already commenced. Stand-alone median dwelling prices are now up 4.4% annually and 10.6% since January 2023 (albeit remaining below the previous April 2022 peak), and we consider the RBA is at or near the top of the rate tightening cycle, particularly as rates have held steady for the last three months.

Whilst there have been challenges in various apartment sub-markets and locations throughout Sydney, boutique prestige projects continue to perform strongly. This is highlighted by the strong takeup of new release projects and continued excellent demand (and prices) for development sites in premium locations.

In relation to the broader market, once there is greater market certainty that we’re nearing the top of the rate tightening cycle (which may have already occurred), overall market sentiment is expected to improve.

Sydney Apartment Market “Jumping A Full Cycle”

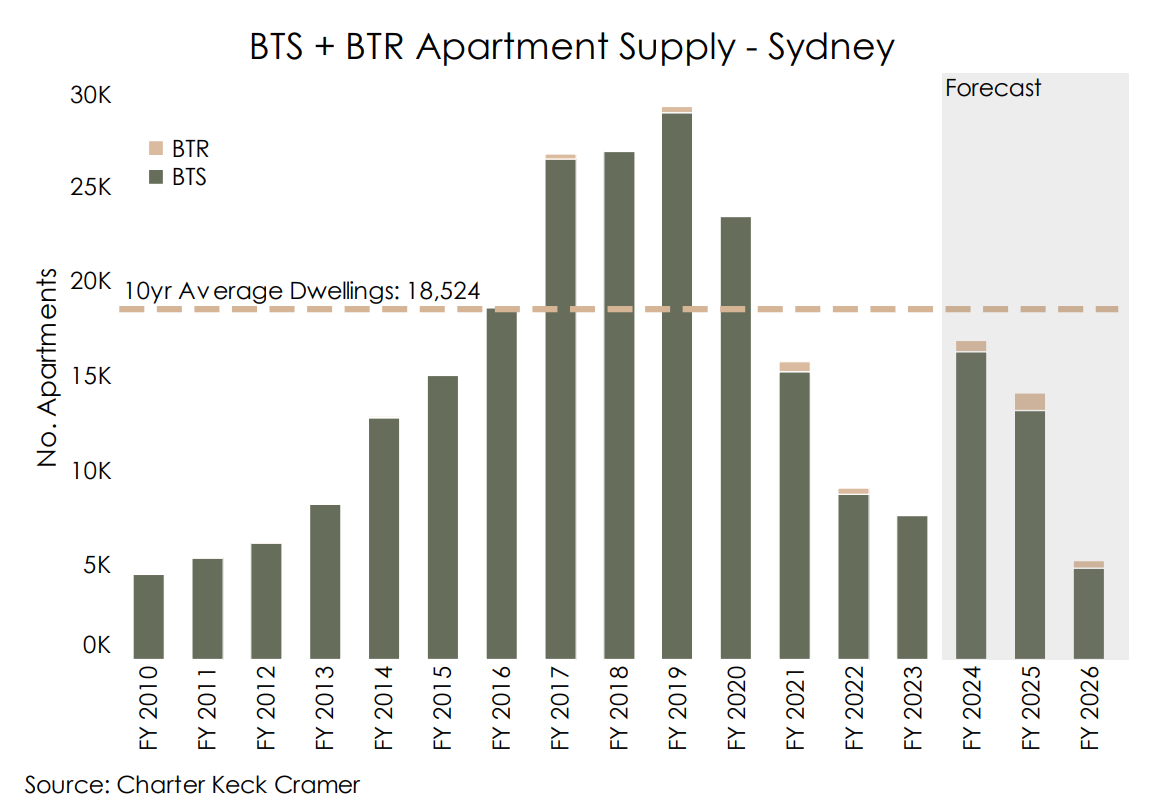

The Property Market Update October 2023 highlights insights from Charter Keck Cramer, indicating that the Sydney off-the-plan apartment market is in the process of recalibrating and leaping ahead by a full market cycle.

In this upcoming cycle, it’s expected that the Build-to-Sell (BTS) and Build-to-Rent (BTR) apartment markets will be the primary beneficiaries. This is due to significant affordability challenges in Sydney and shifting preferences in how people want to live.

The supply-demand imbalance, previously noted in February 2023, has become even more severe. The supply of BTS and BTR apartments remains historically low, while not enough new properties are being developed to accommodate Sydney’s growing population.

Charter Keck Cramer’s analysis suggests that there’s a demand for 22,000 to 25,000 BTS and BTR apartments annually to house the growing population. This could lead to price increases, especially as market sentiment improves and interest rates begin to decrease.

In recent months, certain sub-markets have already seen median apartment price growth, partly due to the Reserve Bank of Australia keeping cash rates stable and rapid rental price increases. This has led to increased buyer activity as more purchasers return to the market.

Furthermore, the report anticipates continued growth in the rental market over the next 3 to 4 years due to the current supply-demand imbalance. Investors in BTR properties can expect higher rental revenue escalations to reflect these market conditions better. BTS investors may also find the market more enticing as yields improve.

Looking Ahead

In summary, with rapid immigration driving population growth, demand for dwellings continues to grow.

In our Property Market Update October 2023, there’s encouraging news for the apartment sector. Sydney’s apartment market is expected to remain undersupplied despite the projected increase in construction volumes as high levels of Net Overseas Migration absorb new stock.

From a market perspective, the lack of new supply over the last 3 – 4 years should result in greater demand for apartment stock, being the most affordable dwelling typology. This will likely continue the upward pressure on pricing, particularly when market sentiment improves. And interest rates start to cycle downward.

It is reasonable for the industry to expect that over the next two years, weekly rents will continue to increase at above-average levels of growth and prices of new BTS apartments will adjust upwards across most markets. Once the market finds a new equilibrium, it is anticipated that both rent and price changes will revert to longer-term trends.

Why Off-the-Plan Apartments Are a Smart Choice for Today’s Property Buyers and Investors

The Property Market Update October 2023 uncovers the growing appeal of off-the-plan apartments as a smart investment option, driven by several compelling factors.

1. Rental Growth: Rental market dynamics favour investors, with a continued imbalance in supply and demand. This suggests that the rental market will likely experience sustained growth over the next 3 to 4 years. Investors in Build-to-Rent (BTR) properties can anticipate higher rental revenue escalations, reflecting these market distortions.

2. Limited Supply: The supply of both Build-to-Sell (BTS) and BTR apartments remains historically low, failing to meet the housing needs of Sydney’s growing population. Charter Keck Cramer’s analysis reveals a substantial demand for BTS and BTR apartments. This pent-up demand could exert upward pressure on pricing, particularly as market sentiment improves and interest rates potentially decrease.

3. Affordability: As the median house price in Sydney rises, reaching $1.3 million in June 2023, the affordability gap between houses and units widens. In fact, the current price gap stands at 64%, reflecting the increasing affordability challenge for buyers. With rising interest rates and reduced purchasing power, more buyers are expected to shift their focus to the unit market. This trend is poised to support price growth and overall apartment price recalibration, making off-the-plan units an attractive option.

In summary, off-the-plan apartments, especially in the BTS and BTR segments, offer a promising investment opportunity in light of ongoing rental growth, limited supply, and the shifting affordability landscape compared to traditional houses.

Contact our team today to leverage the current advantages of investing in units. Stay ahead of the property trends and seize the opportunity to enter the market.